NOTE If Married Out of Community of Property and Only Wife Applies, We Also Need the Form

Understanding the NOTE If Married Out Of Community Of Property And Only Wife Applies

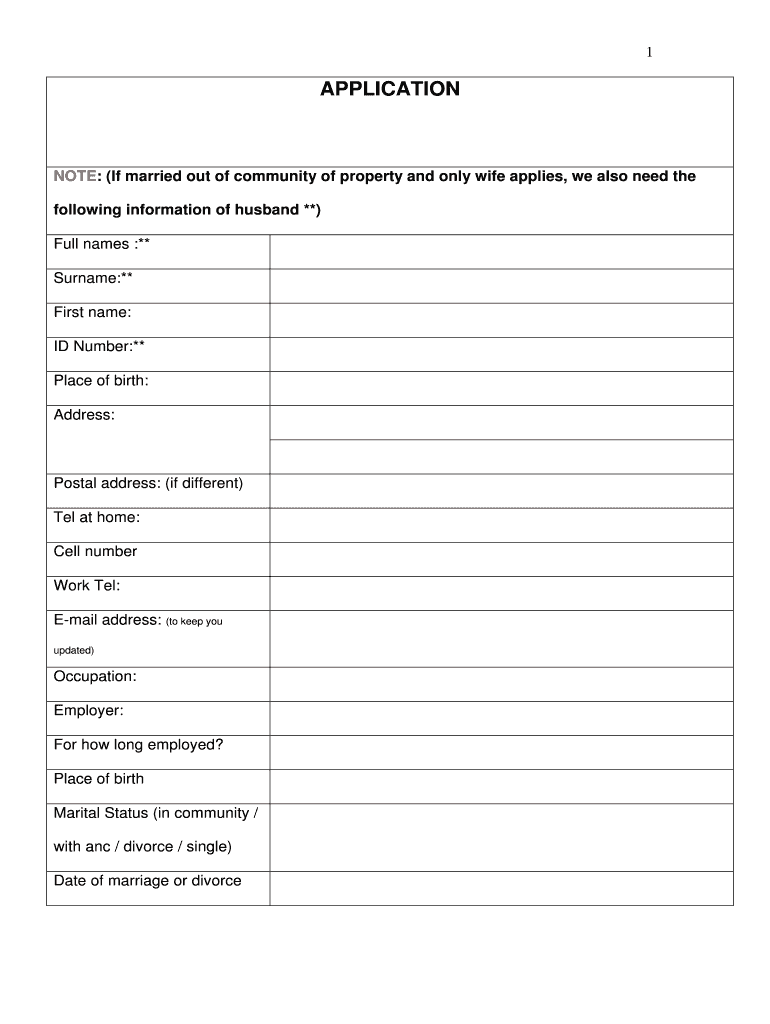

The form titled "NOTE If Married Out Of Community Of Property And Only Wife Applies" is a specific legal document that addresses the circumstances under which a married woman, who is married out of community of property, can apply for certain legal or financial benefits. This type of marital arrangement typically means that each spouse retains ownership of their individual assets and liabilities, rather than sharing them. Understanding this form is essential for ensuring compliance with legal requirements and protecting individual rights.

Steps to Complete the NOTE If Married Out Of Community Of Property And Only Wife Applies

Completing this form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including identification and marital status documentation. Next, clearly indicate the specific purpose of the application, as this will guide the information required. Fill out the form meticulously, ensuring that all sections are completed as per the instructions provided. Finally, review the form for any errors before submission to avoid delays or complications.

Required Documents for the NOTE If Married Out Of Community Of Property And Only Wife Applies

When applying with the "NOTE If Married Out Of Community Of Property And Only Wife Applies," certain documents are essential. These typically include:

- Proof of identity, such as a government-issued ID or passport.

- Marriage certificate to establish marital status.

- Any prior legal documents that may support the application, such as prenuptial agreements.

Having these documents ready will facilitate a smoother application process.

Legal Use of the NOTE If Married Out Of Community Of Property And Only Wife Applies

This form serves a significant legal purpose, particularly in matters related to property rights and financial claims. It is crucial in jurisdictions where community property laws apply differently to married couples. By submitting this form, the wife can assert her rights to specific benefits or claims that may not automatically be granted under community property laws. Legal advice may be beneficial to navigate the implications of this form effectively.

State-Specific Rules for the NOTE If Married Out Of Community Of Property And Only Wife Applies

Each state may have unique regulations governing the use and submission of the "NOTE If Married Out Of Community Of Property And Only Wife Applies." It is important to familiarize oneself with these rules, as they can affect the validity of the form and the rights of the parties involved. Consulting with a legal professional who understands state-specific laws can provide clarity and ensure compliance.

Examples of Using the NOTE If Married Out Of Community Of Property And Only Wife Applies

Practical examples of utilizing this form include scenarios where a wife seeks to apply for a loan, claim insurance benefits, or assert her rights in a legal proceeding. In each case, the form serves to clarify her status and rights under the law, particularly in situations where property ownership is contested or where financial claims are involved. Understanding these examples can help in preparing the necessary documentation and arguments.

Quick guide on how to complete note if married out of community of property and only wife applies we also need the

Effortlessly prepare [SKS] on any device

Managing documents online has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The

Create this form in 5 minutes!

How to create an eSignature for the note if married out of community of property and only wife applies we also need the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What documents are required if married out of community of property and only the wife applies?

NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The relevant documentation that verifies the marital status and any agreements made. This typically includes a marriage certificate and any prenuptial agreements. Ensuring you have these documents ready will streamline the eSigning process.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced encryption and security protocols to protect your documents. Our platform is designed to keep your information safe while you eSign and send documents. You can trust that your data is secure, especially when handling sensitive information like 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The.'

-

What are the pricing options for airSlate SignNow?

We offer flexible pricing plans tailored to meet the needs of different users. Whether you're an individual or a business, you can choose a plan that fits your budget. For specific queries like 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The,' our customer support can assist you in selecting the best option.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow. You can connect with popular tools like Google Drive, Salesforce, and more. This is particularly useful for managing documents related to 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The.'

-

What features does airSlate SignNow provide for document management?

Our platform includes features such as customizable templates, real-time tracking, and automated reminders. These tools help you manage your documents efficiently, especially when dealing with specific cases like 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The.'

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows you to eSign and manage documents on the go. This flexibility ensures that you can handle important tasks, including those related to 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The,' from anywhere.

-

How can I get support if I have questions about my documents?

Our customer support team is available to assist you with any questions or concerns. You can signNow out via chat, email, or phone for immediate assistance. If your inquiry involves 'NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The,' we can provide specialized guidance.

Get more for NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The

- Pilots manual form

- 6 k 1 gol20070423 6k form

- 0429 minutes of the extraordinary shareholders cyrela form

- Course dates and fees for geos qce gc form

- Page 1 visa emergency medical indemnified services form

- Texas secured promissory note form

- Membership application black forest fire rescue form

- Dependant termination form

Find out other NOTE If Married Out Of Community Of Property And Only Wife Applies, We Also Need The

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple