Nj 1040x Form

What is the NJ 1040X Form

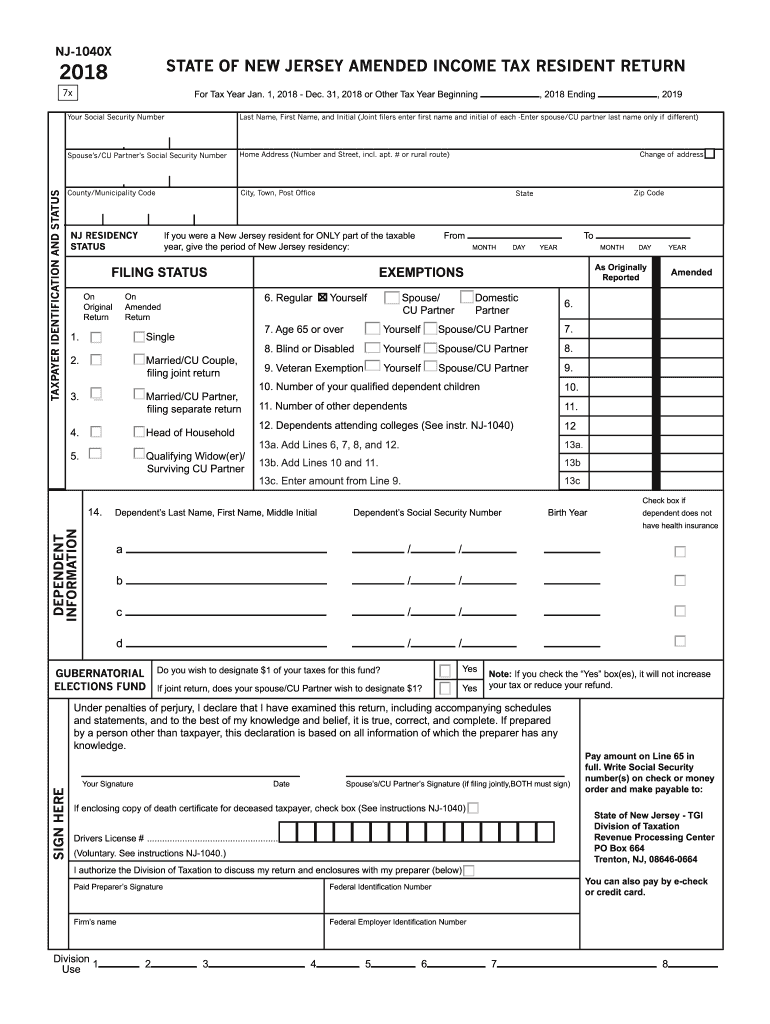

The NJ 1040X form is an amended tax return used by New Jersey residents to correct errors or make changes to their original NJ 1040 income tax return. This form allows taxpayers to adjust their income, deductions, or credits after they have filed their initial return. It is essential for ensuring that the tax information reported to the state is accurate and up-to-date. The NJ 1040X can be used to claim additional deductions, report additional income, or correct filing status, among other adjustments.

How to use the NJ 1040X Form

Using the NJ 1040X form involves several key steps. First, you must obtain the form, which can be downloaded from the New Jersey Division of Taxation website or accessed through tax preparation software. Next, fill out the form by providing your personal information and detailing the changes you are making compared to your original NJ 1040 return. It is important to include explanations for each change and to attach any necessary documentation that supports your amendments. Finally, submit the completed NJ 1040X form to the New Jersey Division of Taxation by mail, ensuring that you keep a copy for your records.

Steps to complete the NJ 1040X Form

Completing the NJ 1040X form requires careful attention to detail. Follow these steps:

- Download the NJ 1040X form from the New Jersey Division of Taxation website.

- Fill in your name, address, and Social Security number at the top of the form.

- Indicate the tax year you are amending.

- Provide the original amounts from your NJ 1040 return in the appropriate sections.

- Enter the corrected amounts and explain the reasons for each change in the designated area.

- Attach any relevant documentation that supports your amendments.

- Sign and date the form before submitting it to the appropriate address.

Legal use of the NJ 1040X Form

The NJ 1040X form is legally recognized as a valid method for amending a tax return in New Jersey. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame. According to New Jersey tax law, taxpayers have three years from the original due date of the return to file an amended return. Compliance with this timeframe is crucial to avoid penalties and ensure that any refunds or adjustments are processed correctly.

Filing Deadlines / Important Dates

When filing the NJ 1040X form, it is important to be aware of key deadlines. Taxpayers must submit the amended return within three years of the original filing date to be eligible for any refunds. Additionally, if you are amending your return to report additional tax owed, it is advisable to file as soon as possible to avoid accruing interest and penalties on the unpaid amount. Always check the New Jersey Division of Taxation's website for the most current filing deadlines and important dates related to tax amendments.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040X form can be submitted through various methods. Currently, New Jersey does not allow electronic filing for amended returns, so the form must be mailed to the New Jersey Division of Taxation. Ensure that you send the form to the correct address as specified in the instructions. While in-person submissions are not typically available for amended returns, you can contact the Division of Taxation for assistance if needed. Always retain a copy of the submitted form and any supporting documents for your records.

Quick guide on how to complete nj 1040x amended resident return form

Effortlessly prepare Nj 1040x Form on any device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any delays. Manage Nj 1040x Form seamlessly on any device using airSlate SignNow's Android or iOS applications and enhance any document-related tasks today.

The easiest way to modify and electronically sign Nj 1040x Form with ease

- Locate Nj 1040x Form and click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click the Complete button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Nj 1040x Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1040x amended resident return form

How to generate an electronic signature for your Nj 1040x Amended Resident Return Form online

How to make an electronic signature for your Nj 1040x Amended Resident Return Form in Chrome

How to create an eSignature for putting it on the Nj 1040x Amended Resident Return Form in Gmail

How to create an electronic signature for the Nj 1040x Amended Resident Return Form right from your mobile device

How to generate an electronic signature for the Nj 1040x Amended Resident Return Form on iOS devices

How to create an eSignature for the Nj 1040x Amended Resident Return Form on Android

People also ask

-

What is the main benefit of using airSlate SignNow for my NJ 2018 return?

Using airSlate SignNow for your NJ 2018 return simplifies the eSigning process, making it quick and efficient. It allows you to securely sign and send documents without the hassle of printing or mailing, ensuring you meet deadlines reliably.

-

How much does it cost to use airSlate SignNow for my NJ 2018 return?

airSlate SignNow offers various pricing plans, catering to different needs and budgets. Depending on the features you require for your NJ 2018 return, you can choose a plan that is both cost-effective and scalable as your business grows.

-

Can I use airSlate SignNow to send documents related to my NJ 2018 return?

Yes, you can easily send any documents related to your NJ 2018 return using airSlate SignNow. The platform allows you to upload, sign, and send the documents securely, ensuring compliance with state regulations.

-

What features does airSlate SignNow offer for managing my NJ 2018 return?

airSlate SignNow provides a variety of features such as document templates, in-person signing options, and real-time notifications, all designed to streamline the process for your NJ 2018 return. These features help you stay organized and keep track of important documents.

-

Is airSlate SignNow compliant with NJ state regulations for 2018 returns?

Yes, airSlate SignNow complies with all state regulations concerning document signing and electronic records for NJ 2018 returns. This ensures that your signed documents will hold up under scrutiny and meet legal requirements.

-

Does airSlate SignNow integrate with other financial software for my NJ 2018 return?

airSlate SignNow seamlessly integrates with numerous financial and productivity software, making data management easier for your NJ 2018 return. These integrations allow for a smoother workflow and better organization of your financial documents.

-

How secure is airSlate SignNow for handling sensitive data related to my NJ 2018 return?

airSlate SignNow prioritizes security by utilizing advanced encryption and compliance with industry standards. Your data related to the NJ 2018 return is safeguarded, ensuring confidentiality and peace of mind while using the platform.

Get more for Nj 1040x Form

- Induction of emt by twist proteins basicmed med ncku edu form

- Estimated tax worksheet form

- City of cincinnati income tax fill out ampamp sign online form

- Instructions only no returns hio2022instructions f form

- Ohio dot releases wine mixed beverage tax return form

- Ohio it 3 form

- Heath individual return lck 23 form

- Organization contract template form

Find out other Nj 1040x Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors