Ohio it 3 2022

What is the Ohio IT-3?

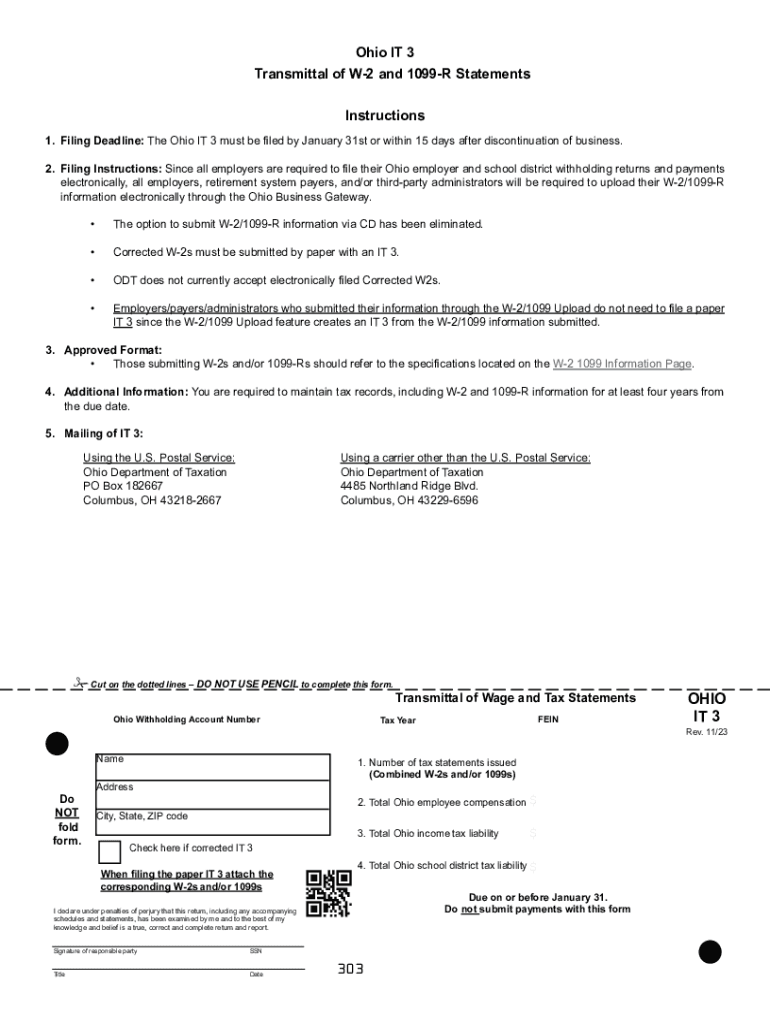

The Ohio IT-3 is a tax form used by employers in Ohio to report the income tax withheld from employee wages. This form is essential for ensuring that employees fulfill their state tax obligations. It provides a summary of the total wages paid and the amount of state income tax withheld throughout the year. Employers are required to submit this form to the Ohio Department of Taxation, which helps maintain accurate tax records for both the state and the employees.

How to Use the Ohio IT-3

Using the Ohio IT-3 involves several steps. First, employers must gather all necessary payroll information, including total wages paid and the amount of state tax withheld for each employee. Once this information is compiled, employers can fill out the form, ensuring all sections are completed accurately. After completing the form, it should be submitted to the Ohio Department of Taxation, either electronically or via mail, depending on the employer's preference. It is crucial to retain copies of the submitted form for record-keeping purposes.

Steps to Complete the Ohio IT-3

Completing the Ohio IT-3 requires careful attention to detail. Here are the steps to follow:

- Gather all payroll records for the tax year, including employee wages and tax withholdings.

- Fill out the employer information section, including the employer's name, address, and identification number.

- List each employee's total wages and the corresponding amount of state income tax withheld.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the completed form to the Ohio Department of Taxation by the specified deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Ohio IT-3 to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. It is essential to submit the form on time to ensure compliance with state tax regulations. Additionally, employers should keep track of any changes to deadlines that may occur due to state policy updates or special circumstances.

Required Documents

To complete the Ohio IT-3, employers need specific documents. These include:

- Payroll records for the entire tax year, detailing employee wages and tax withholdings.

- Employer identification number (EIN) for accurate reporting.

- Any previous tax forms that may provide context or additional information needed for the current filing.

Form Submission Methods

The Ohio IT-3 can be submitted through various methods. Employers have the option to file electronically, which is often the preferred method due to its efficiency and speed. Alternatively, the form can be mailed to the Ohio Department of Taxation. Employers should ensure that they choose a submission method that aligns with their operational capabilities and preferences, while also considering any potential processing times associated with each method.

Quick guide on how to complete ohio it 3

Effortlessly complete Ohio It 3 on any device

Digital document handling has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Ohio It 3 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to edit and electronically sign Ohio It 3 with minimal effort

- Find Ohio It 3 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or censor sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign Ohio It 3 and maintain effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 3

Create this form in 5 minutes!

How to create an eSignature for the ohio it 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ohio Form 3 and how can airSlate SignNow help?

Ohio Form 3 is a crucial document used for various official processes in the state. airSlate SignNow streamlines the signing and submission of Ohio Form 3, making it easy for users to eSign the document quickly and securely. Our platform ensures compliance and offers a user-friendly interface that simplifies the entire process.

-

Does airSlate SignNow support electronic signatures for Ohio Form 3?

Yes, airSlate SignNow fully supports electronic signatures for Ohio Form 3. This means you can sign your documents remotely, eliminating the need for in-person meetings. The electronic signatures provided by our platform are legally binding and compliant with state regulations.

-

What features does airSlate SignNow offer for managing Ohio Form 3?

airSlate SignNow offers a variety of features to manage Ohio Form 3 effectively. Users can utilize templates, set up reminders, and track document status in real-time. Our platform also allows for collaboration, enabling multiple users to work on Ohio Form 3 seamlessly.

-

Is there a cost associated with using airSlate SignNow for Ohio Form 3?

Yes, airSlate SignNow offers several pricing plans, making it a cost-effective solution for handling Ohio Form 3. Pricing is based on the number of users and features you need. We provide flexible options, ensuring businesses of all sizes can find a suitable plan.

-

Can I integrate airSlate SignNow with other applications when working on Ohio Form 3?

Absolutely! airSlate SignNow integrates with numerous applications, making it easy to manage Ohio Form 3 alongside your existing tools. Popular integrations include Google Workspace, Dropbox, and more, enhancing your workflow and document management capabilities.

-

What are the benefits of using airSlate SignNow for Ohio Form 3?

Using airSlate SignNow for Ohio Form 3 provides numerous benefits, including faster turnaround times and enhanced security. Our platform minimizes paperwork and reduces processing delays while ensuring that your documents are safely stored and accessed. Additionally, the intuitive design makes it accessible for all users.

-

How secure is the electronic signing process for Ohio Form 3 with airSlate SignNow?

The electronic signing process for Ohio Form 3 using airSlate SignNow is highly secure. We use advanced encryption and comply with industry security standards to protect your data. You can rest assured that your documents are safe and secure during the signing process.

Get more for Ohio It 3

Find out other Ohio It 3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors