Mrt 441 Form

What is the Vermont 441 Form?

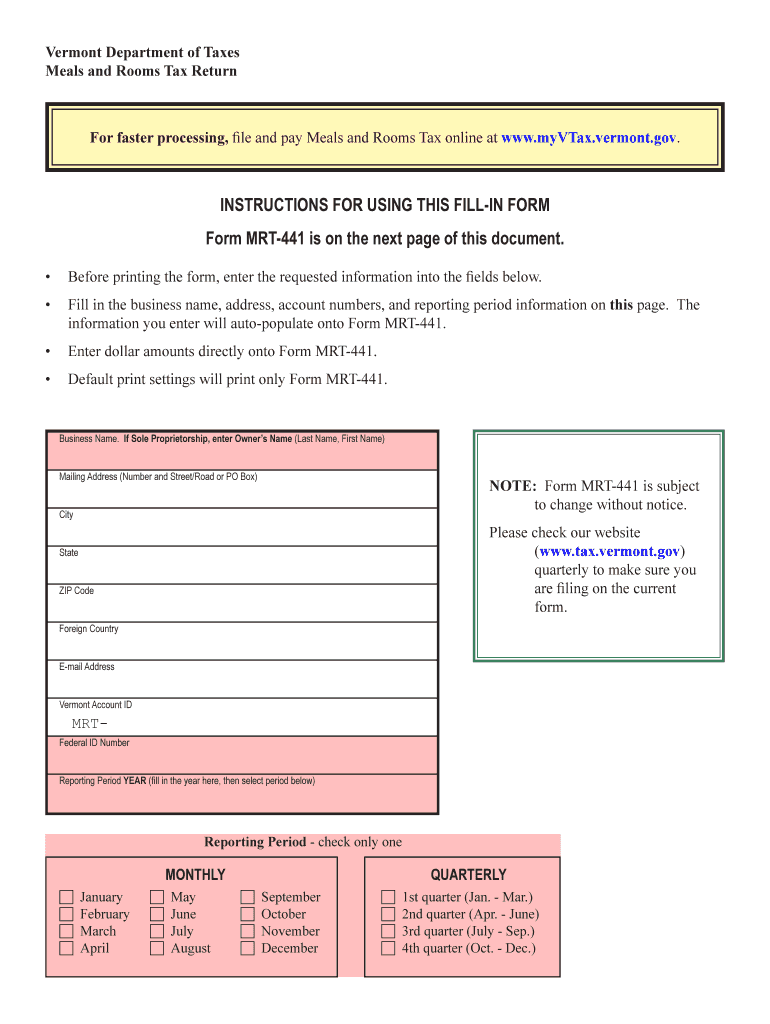

The Vermont 441 form, also known as the MRT 441 form, is a tax document used by businesses in Vermont to report and pay the rooms and meals tax. This tax applies to the rental of rooms and the sale of prepared food and beverages. Understanding the purpose of this form is essential for compliance with state tax laws.

How to Use the Vermont 441 Form

Using the Vermont 441 form involves several steps to ensure accurate reporting and payment of the rooms and meals tax. Businesses must first determine their tax liability based on their sales and rental income. Once the necessary calculations are made, the form can be filled out with the relevant information. This includes reporting total sales, taxable sales, and the amount of tax due. Accurate completion of the form is crucial for avoiding penalties.

Steps to Complete the Vermont 441 Form

Completing the Vermont 441 form requires careful attention to detail. Follow these steps for proper completion:

- Gather all sales records related to room rentals and prepared food sales.

- Calculate total sales and determine the taxable amount.

- Fill in the required fields on the form, including your business information and tax calculations.

- Review the form for accuracy before submission.

- Submit the completed form along with the payment by the due date.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Vermont 441 form is vital for compliance. Typically, the form is due on a quarterly basis, with specific deadlines for each quarter. Businesses should mark their calendars to ensure timely submission to avoid late fees and penalties. It is advisable to check with the Vermont Department of Taxes for the most current deadlines and any changes to the filing schedule.

Legal Use of the Vermont 441 Form

The Vermont 441 form must be used in accordance with state tax laws. Electronic filing is permitted and often encouraged for efficiency. Compliance with the legal requirements surrounding the form ensures that businesses fulfill their tax obligations and avoid potential legal issues. It is important to maintain accurate records and documentation to support the information reported on the form.

Key Elements of the Vermont 441 Form

Key elements of the Vermont 441 form include:

- Business identification information, such as name and address.

- Details of total sales and taxable sales.

- Calculation of the rooms and meals tax due.

- Signature of the person responsible for tax reporting.

Each of these elements plays a critical role in ensuring the form is completed accurately and in compliance with Vermont tax regulations.

Quick guide on how to complete meals and rooms taxfrequently asked questionsdepartment of

Complete Mrt 441 effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Mrt 441 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign Mrt 441 without hassle

- Obtain Mrt 441 and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mrt 441 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the meals and rooms taxfrequently asked questionsdepartment of

How to make an electronic signature for your Meals And Rooms Taxfrequently Asked Questionsdepartment Of online

How to generate an eSignature for your Meals And Rooms Taxfrequently Asked Questionsdepartment Of in Google Chrome

How to make an electronic signature for putting it on the Meals And Rooms Taxfrequently Asked Questionsdepartment Of in Gmail

How to make an eSignature for the Meals And Rooms Taxfrequently Asked Questionsdepartment Of from your mobile device

How to make an electronic signature for the Meals And Rooms Taxfrequently Asked Questionsdepartment Of on iOS

How to create an electronic signature for the Meals And Rooms Taxfrequently Asked Questionsdepartment Of on Android OS

People also ask

-

What is the Vermont 441 form?

The Vermont 441 form is a tax form used to report income and other financial information to the state of Vermont. It is essential for businesses and individuals to complete this form accurately to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit the Vermont 441 form securely and efficiently.

-

How can airSlate SignNow help with the Vermont 441 form?

airSlate SignNow streamlines the eSigning process for the Vermont 441 form, allowing you to fill out, sign, and submit documents from anywhere. Our user-friendly platform simplifies the entire workflow, making it easy to manage your tax forms and avoid errors. You can also track the status of your submissions in real time.

-

Is there a cost associated with using airSlate SignNow for the Vermont 441 form?

Yes, airSlate SignNow offers various pricing plans to fit your business needs, including options for individuals and teams. The pricing is competitive and provides excellent value for features like document templates, automated workflows, and secure eSigning. You can choose the plan that best suits your requirements while preparing the Vermont 441 form.

-

What features does airSlate SignNow offer for the Vermont 441 form?

airSlate SignNow includes features such as drag-and-drop document uploads, easy eSign functionality, and customizable templates specifically for the Vermont 441 form. Our platform also provides secure storage and sharing options, so you can keep your tax documents organized and accessible when needed. These features ensure a seamless filing experience.

-

Can I integrate airSlate SignNow with other tools while handling the Vermont 441 form?

Absolutely! airSlate SignNow offers integration with various tools and applications, allowing you to connect seamlessly with your existing software. This means you can easily import data to complete the Vermont 441 form and automate workflows to boost your productivity. Our integrations enhance your overall document management experience.

-

What are the benefits of using airSlate SignNow for the Vermont 441 form?

Using airSlate SignNow for the Vermont 441 form provides numerous benefits, including efficiency, enhanced security, and a user-friendly experience. You can save time and reduce stress by avoiding manual paperwork, while our digital platform ensures your documents are securely stored and compliant. Additionally, you will have access to customer support when needed.

-

Is airSlate SignNow compliant with Vermont state regulations for the 441 form?

Yes, airSlate SignNow is compliant with Vermont state regulations, making it a reliable choice for submitting the Vermont 441 form. Our platform adheres to eSignature laws, ensuring that your signed documents are legally valid and accepted by state authorities. You can be confident in using our solution for your tax filing needs.

Get more for Mrt 441

- Maui behavioral health resources p aloha house form

- Client list form

- Poronol form

- Kauai veterans memorial hospital samuel mahelona memorial hospital form

- Medical expense flex hra reimbursement request f form

- Requests must be received 14 days in advance form

- Tantre farm job application form

- Application for employment century foods international form

Find out other Mrt 441

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter