Form 5471

What is the Form 5471

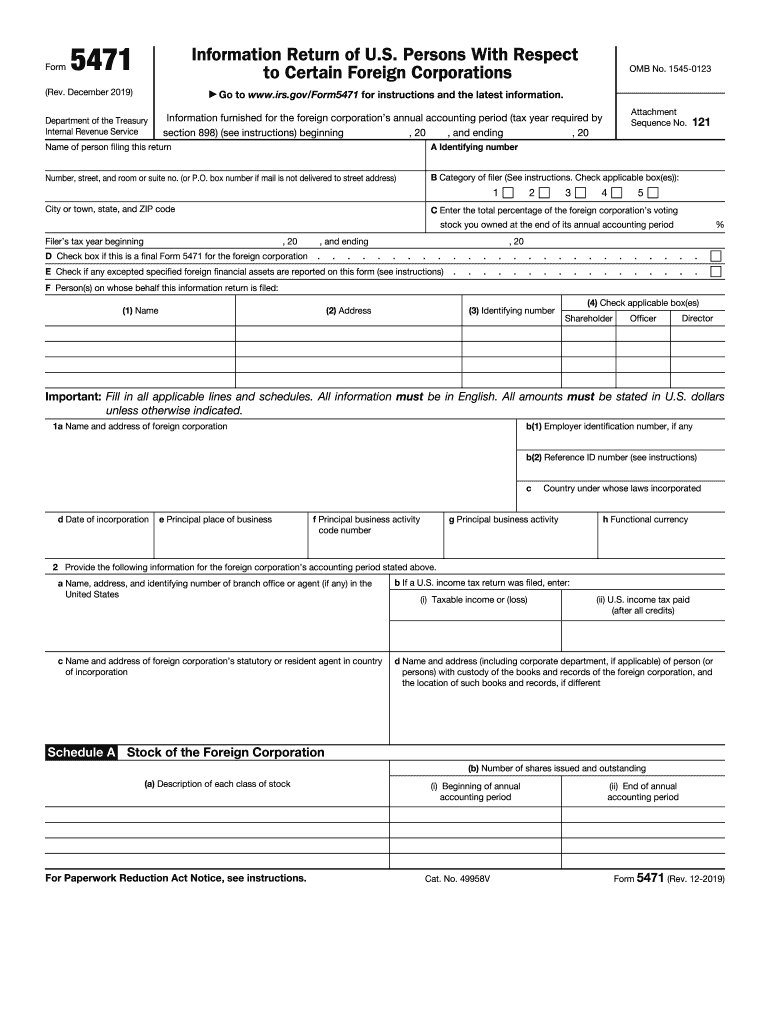

The Form 5471 is a U.S. Internal Revenue Service (IRS) tax form used by certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is essential for reporting information about foreign corporations and their activities, ensuring compliance with U.S. tax laws. The 5471 is particularly important for those who own at least ten percent of the foreign corporation's stock, as it helps the IRS track foreign income and assets.

How to use the Form 5471

Using the Form 5471 involves several steps, primarily focused on accurately reporting your ownership interests and the financial activities of the foreign corporation. The form requires detailed information about the corporation, including its income, expenses, and balance sheet. It is crucial to gather all necessary financial documents from the foreign corporation to ensure accurate reporting. The completed form must be attached to your annual tax return, providing the IRS with a comprehensive view of your foreign investments.

Steps to complete the Form 5471

Completing the Form 5471 requires careful attention to detail. Here are the key steps:

- Determine your filing requirement based on your ownership percentage in the foreign corporation.

- Gather financial statements and relevant documents from the foreign corporation.

- Fill out the required sections of the form, including information on income, expenses, and ownership structure.

- Review the form for accuracy and completeness before submission.

- Attach the completed form to your annual tax return.

Legal use of the Form 5471

The legal use of the Form 5471 is governed by IRS regulations. It is mandatory for U.S. taxpayers who meet specific criteria regarding foreign corporations. Failure to file the form when required can result in significant penalties. The form serves to maintain transparency in international business operations and ensures that U.S. taxpayers report their foreign income accurately. Understanding the legal implications of using the 5471 is crucial for compliance with U.S. tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5471 are aligned with your annual tax return due date. Typically, the form must be filed by the due date of your tax return, including extensions. For most taxpayers, this means the form is due on April 15 of the following year, with extensions available until October 15. It is essential to be aware of these deadlines to avoid penalties and ensure compliance.

Penalties for Non-Compliance

Non-compliance with the Form 5471 filing requirements can lead to substantial penalties. The IRS imposes a penalty of $10,000 for each failure to file the form, with additional penalties for continued failure after the IRS notifies the taxpayer. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form 5471 information return of us persons with respect to

Effortlessly prepare Form 5471 on any device

Digital document management is gaining traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct template and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage Form 5471 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 5471 effortlessly

- Find Form 5471 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 5471, ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5471 information return of us persons with respect to

How to generate an electronic signature for your Form 5471 Information Return Of Us Persons With Respect To in the online mode

How to create an electronic signature for the Form 5471 Information Return Of Us Persons With Respect To in Chrome

How to generate an electronic signature for signing the Form 5471 Information Return Of Us Persons With Respect To in Gmail

How to create an electronic signature for the Form 5471 Information Return Of Us Persons With Respect To right from your smart phone

How to create an electronic signature for the Form 5471 Information Return Of Us Persons With Respect To on iOS devices

How to create an electronic signature for the Form 5471 Information Return Of Us Persons With Respect To on Android

People also ask

-

What is the purpose of the 2019 5471 form?

The 2019 5471 form is used to report information about Foreign Corporations owned by U.S. citizens and residents. It provides the IRS with details on the operations and financials of overseas entities, ensuring compliance with tax obligations.

-

How can airSlate SignNow assist with the 2019 5471 filing process?

airSlate SignNow streamlines the process of preparing and sending the 2019 5471 form by providing an easy-to-use eSignature solution. With our platform, you can quickly obtain signatures and ensure that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the 2019 5471?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost depends on the features you select, but our plans are designed to be cost-effective while providing essential tools to assist with the 2019 5471 and other document needs.

-

What features does airSlate SignNow offer to help with IRS compliance for the 2019 5471?

airSlate SignNow provides advanced features such as document templates, real-time tracking, and secure sharing options. These tools help ensure that your 2019 5471 form is filled out correctly and submitted on time, maintaining IRS compliance.

-

Can I integrate airSlate SignNow with my current tax software for 2019 5471?

Absolutely! airSlate SignNow supports multiple integrations with popular tax software solutions. This allows for seamless data transfer and more efficient workflow management regarding the preparation of the 2019 5471 form.

-

How does airSlate SignNow ensure the security of my 2019 5471 documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption protocols and secure access features to protect your 2019 5471 documents and ensure that only authorized users can view or modify them.

-

What are the benefits of using airSlate SignNow for the 2019 5471 filings?

Using airSlate SignNow for your 2019 5471 filings provides faster processing times, improved accuracy, and enhanced organization. Our platform simplifies the signing process, making it easier for you to manage and submit your documents.

Get more for Form 5471

Find out other Form 5471

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free