Form 1042 T

What is the Form 1042 T

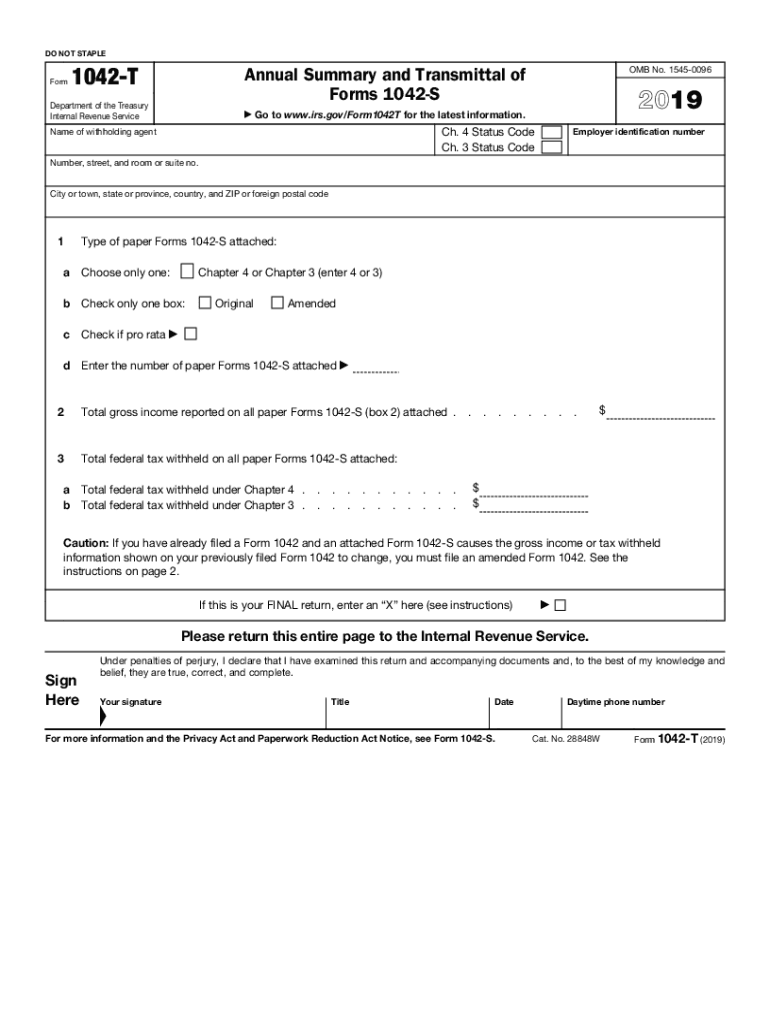

The Form 1042 T is a transmittal form used by withholding agents to report certain payments made to foreign persons. This form is essential for compliance with U.S. tax regulations, particularly for those who are subject to withholding under the Internal Revenue Code. It serves as a summary of the information reported on Forms 1042-S, which detail the income paid to foreign recipients and the associated withholding amounts. Understanding this form is crucial for businesses and individuals involved in international transactions.

How to use the Form 1042 T

To utilize the Form 1042 T effectively, withholding agents must first gather all relevant information regarding payments made to foreign persons. This includes details such as the recipient's name, address, and taxpayer identification number, along with the amounts paid and the taxes withheld. Once this information is compiled, the agent can complete the Form 1042 T, ensuring that all entries are accurate and reflective of the corresponding Forms 1042-S. This form must then be submitted to the IRS, along with the Forms 1042-S, to fulfill reporting obligations.

Steps to complete the Form 1042 T

Completing the Form 1042 T involves several key steps:

- Gather all necessary documentation, including Forms 1042-S and any relevant payment records.

- Fill out the identification section with the withholding agent's information, including name, address, and Employer Identification Number (EIN).

- Provide a summary of the total amounts reported on Forms 1042-S, including the total income paid and total tax withheld.

- Review the completed form for accuracy, ensuring all figures match the supporting documentation.

- Submit the Form 1042 T to the IRS along with the Forms 1042-S by the specified deadline.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 1042 T. These guidelines outline the requirements for reporting payments to foreign persons, including the types of income that must be reported and the applicable withholding rates. It is important for withholding agents to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS also specifies deadlines for submission, which must be adhered to in order to maintain good standing with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 T and associated Forms 1042-S are critical for compliance. Generally, the forms must be submitted to the IRS by March 15 of the year following the tax year in which the payments were made. Additionally, withholding agents should keep in mind that if they are required to file electronically, different deadlines may apply. Staying informed about these important dates helps prevent late filing penalties and ensures that all reporting requirements are met in a timely manner.

Penalties for Non-Compliance

Failure to comply with the reporting requirements associated with the Form 1042 T can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to file altogether. These penalties can accumulate quickly, making it essential for withholding agents to ensure that their forms are accurate and submitted on time. Understanding the potential consequences of non-compliance can motivate agents to prioritize their reporting obligations and maintain proper records.

Quick guide on how to complete fillable form 1042 t annual summary and transmittal of

Effortlessly Prepare Form 1042 T on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Form 1042 T on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Most Efficient Way to Edit and Electronically Sign Form 1042 T with Ease

- Find Form 1042 T and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1042 T to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form 1042 t annual summary and transmittal of

How to make an electronic signature for the Fillable Form 1042 T Annual Summary And Transmittal Of in the online mode

How to create an eSignature for your Fillable Form 1042 T Annual Summary And Transmittal Of in Chrome

How to make an eSignature for signing the Fillable Form 1042 T Annual Summary And Transmittal Of in Gmail

How to generate an electronic signature for the Fillable Form 1042 T Annual Summary And Transmittal Of right from your mobile device

How to make an eSignature for the Fillable Form 1042 T Annual Summary And Transmittal Of on iOS devices

How to create an electronic signature for the Fillable Form 1042 T Annual Summary And Transmittal Of on Android devices

People also ask

-

What are 2019 transmittal forms and how are they used?

2019 transmittal forms are essential documents used for transmitting information and materials between parties in a business context. They help ensure that all necessary documents are included when sending files, making the management of paperwork more efficient. Using airSlate SignNow, you can easily eSign and send these forms, streamlining your workflow.

-

How does airSlate SignNow simplify the process of handling 2019 transmittal forms?

airSlate SignNow simplifies handling 2019 transmittal forms by enabling users to create, send, and eSign documents online in just a few clicks. The platform provides templates that you can customize for your needs, ensuring compliance with any requirements. This reduction in paperwork and time lead to increased productivity for your business.

-

Are there any costs associated with using airSlate SignNow for 2019 transmittal forms?

Yes, there are costs associated with using airSlate SignNow, but they are competitive for the features offered. We provide various pricing plans designed to fit different business sizes and needs, including features specifically for managing 2019 transmittal forms. You'll find that the value and efficiency gained far outweigh the costs.

-

Can I integrate airSlate SignNow with other software for managing 2019 transmittal forms?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions, making it easy to manage your 2019 transmittal forms alongside your existing business tools. Whether you use CRM systems, cloud storage, or project management applications, our platform can enhance your workflow.

-

What benefits does airSlate SignNow provide for businesses using 2019 transmittal forms?

By using airSlate SignNow for your 2019 transmittal forms, you gain benefits like faster processing, enhanced accuracy, and improved compliance. The electronic signing feature allows for instant approvals, reducing the time spent on manual paperwork. Overall, it helps streamline operations and boosts productivity.

-

Is there technical support available for users with questions about 2019 transmittal forms?

Yes, airSlate SignNow offers robust technical support for users navigating the use of 2019 transmittal forms. Our support team is available to assist with any questions, ensuring you can effectively utilize all features of the platform. We also provide comprehensive resources and guides to help you get the most out of our service.

-

How secure is airSlate SignNow when handling 2019 transmittal forms?

Security is a top priority for airSlate SignNow when managing 2019 transmittal forms. Our platform utilizes advanced encryption technology to protect your documents and sensitive information. Additionally, we comply with industry standards to ensure your data remains secure at all times.

Get more for Form 1042 T

Find out other Form 1042 T

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT