Irs 8824 Form

What is the IRS 8824?

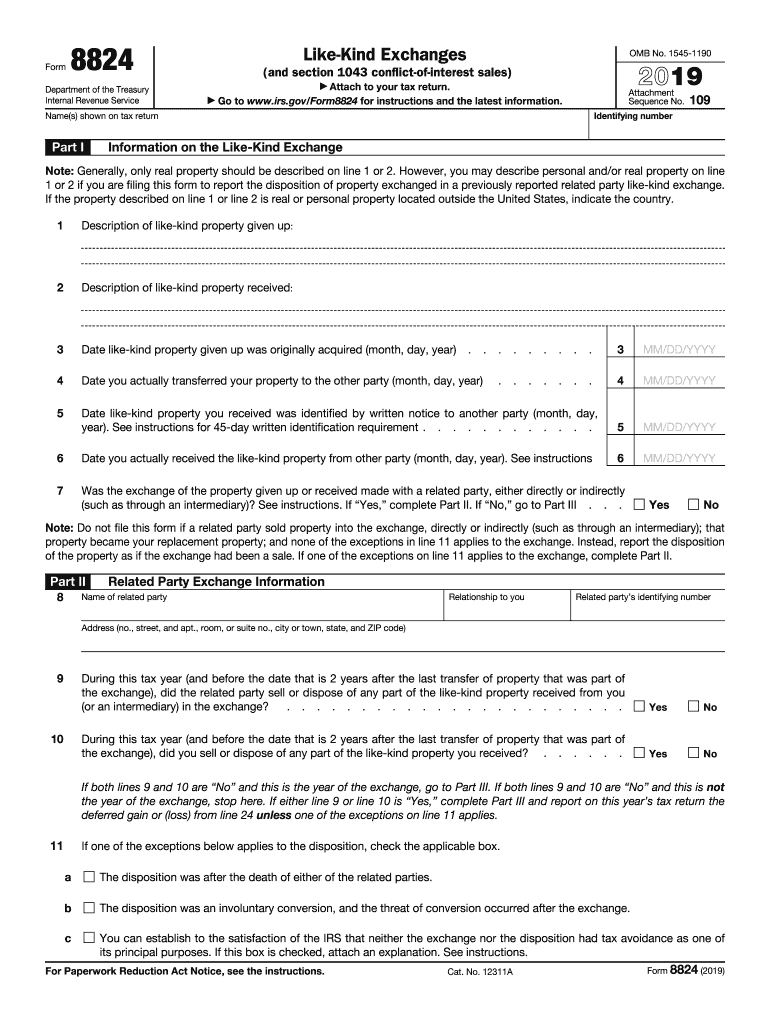

The IRS 8824, also known as the Like-Kind Exchange form, is a tax form used by taxpayers to report the exchange of real property held for productive use in a trade or business or for investment. This form is essential for individuals or businesses engaging in a 1031 exchange, allowing them to defer capital gains taxes on the sale of an investment property when it is exchanged for another similar property. The 8 version outlines the necessary information required by the IRS to validate the exchange and ensure compliance with tax regulations.

How to Use the IRS 8824

Using the IRS 8824 involves several steps to accurately report the details of your like-kind exchange. First, gather all relevant information regarding the properties involved, including their fair market values and the dates of acquisition and exchange. Next, complete the form by providing details such as the identification of the properties, the nature of the exchange, and any gain or loss realized. It is important to ensure that all information is accurate and complete to avoid issues with the IRS.

Steps to Complete the IRS 8824

Completing the IRS 8824 requires careful attention to detail. Follow these steps:

- Begin with the taxpayer's information, including name and taxpayer identification number.

- Identify the relinquished property and the replacement property, including their respective fair market values.

- Provide the dates of acquisition and exchange for both properties.

- Complete the section detailing any gain or loss realized during the exchange.

- Sign and date the form to certify its accuracy.

Review the completed form for any errors before submission to ensure compliance with IRS requirements.

Legal Use of the IRS 8824

The legal use of the IRS 8824 is governed by the rules surrounding like-kind exchanges under Section 1031 of the Internal Revenue Code. To qualify, the properties exchanged must be of similar nature or character, and both must be held for investment or productive use in a trade or business. Proper completion and submission of the form are crucial for deferring taxes on any gains realized from the exchange, thereby ensuring compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 8824 typically coincide with the taxpayer's annual tax return due date. For most individual taxpayers, this is April 15 of the following year. If additional time is needed, taxpayers may file for an extension, but the IRS 8824 must still be submitted along with the tax return. It is essential to keep track of these deadlines to avoid penalties and ensure proper tax compliance.

Required Documents

When completing the IRS 8824, several documents are required to support the information provided on the form. These may include:

- Closing statements for the relinquished and replacement properties.

- Appraisals or valuations of the properties involved.

- Any relevant contracts or agreements related to the exchange.

- Documentation proving that both properties were held for investment or business use.

Having these documents readily available can facilitate a smoother filing process and ensure compliance with IRS regulations.

Quick guide on how to complete 2019 form 8824 like kind exchanges and section 1043 conflict of interest sales

Effortlessly complete Irs 8824 on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Irs 8824 on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

How to modify and electronically sign Irs 8824 with ease

- Locate Irs 8824 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhaustive form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs 8824 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8824 like kind exchanges and section 1043 conflict of interest sales

How to create an eSignature for your 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales online

How to create an electronic signature for the 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales in Google Chrome

How to create an eSignature for signing the 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales in Gmail

How to create an electronic signature for the 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales straight from your smartphone

How to generate an eSignature for the 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales on iOS

How to generate an eSignature for the 2019 Form 8824 Like Kind Exchanges And Section 1043 Conflict Of Interest Sales on Android OS

People also ask

-

What is the 8824 2019 IRS form used for?

The 8824 2019 IRS form is used to report like-kind exchanges under the Internal Revenue Code. This form helps taxpayers to document the exchange of property and defer capital gains tax. Understanding how to fill out this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist in managing the 8824 2019 IRS form?

airSlate SignNow empowers users to easily create, send, and eSign documents, including the 8824 2019 IRS form. With its intuitive interface, users can quickly fill out required information and securely sign, simplifying the reporting process signNowly. This streamlines tax preparation during the filing season.

-

What pricing plans does airSlate SignNow offer for businesses handling the 8824 2019 IRS?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring an affordable solution for processing the 8824 2019 IRS form. Each plan includes key features such as unlimited document signing and integrations that enhance productivity. Explore our pricing options to find the one that best fits your needs.

-

What features does airSlate SignNow provide for eSigning the 8824 2019 IRS form?

airSlate SignNow offers robust features for eSigning documents, including legally binding signatures, document tracking, and reminders. These features enhance the efficiency of submitting forms like the 8824 2019 IRS. Users can enjoy a seamless signing experience and ensure their documents are always secure and compliant.

-

What are the benefits of using airSlate SignNow for the 8824 2019 IRS form?

Using airSlate SignNow for the 8824 2019 IRS form offers numerous benefits including time savings and increased accuracy. The platform's templates and built-in validations help prevent errors that could lead to IRS penalties. Additionally, it reduces the need for physical paperwork, enhancing productivity.

-

Can I integrate airSlate SignNow with other tools for managing the 8824 2019 IRS form?

Yes, airSlate SignNow seamlessly integrates with various business tools including Google Drive, Salesforce, and more. Integrating these tools allows for smoother workflows when managing the 8824 2019 IRS form and other documents. This ensures that all your data is connected and easily accessible.

-

Is airSlate SignNow compliant with IRS regulations for the 8824 2019 IRS form?

Absolutely, airSlate SignNow complies with all legal standards to ensure your use of the 8824 2019 IRS form is secure and valid. The platform utilizes advanced security measures and maintains compliance with eSignature laws. Users can confidently manage their tax documents knowing they are in accordance with IRS regulations.

Get more for Irs 8824

Find out other Irs 8824

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney