Form 1120 for

What is the Form 1120F?

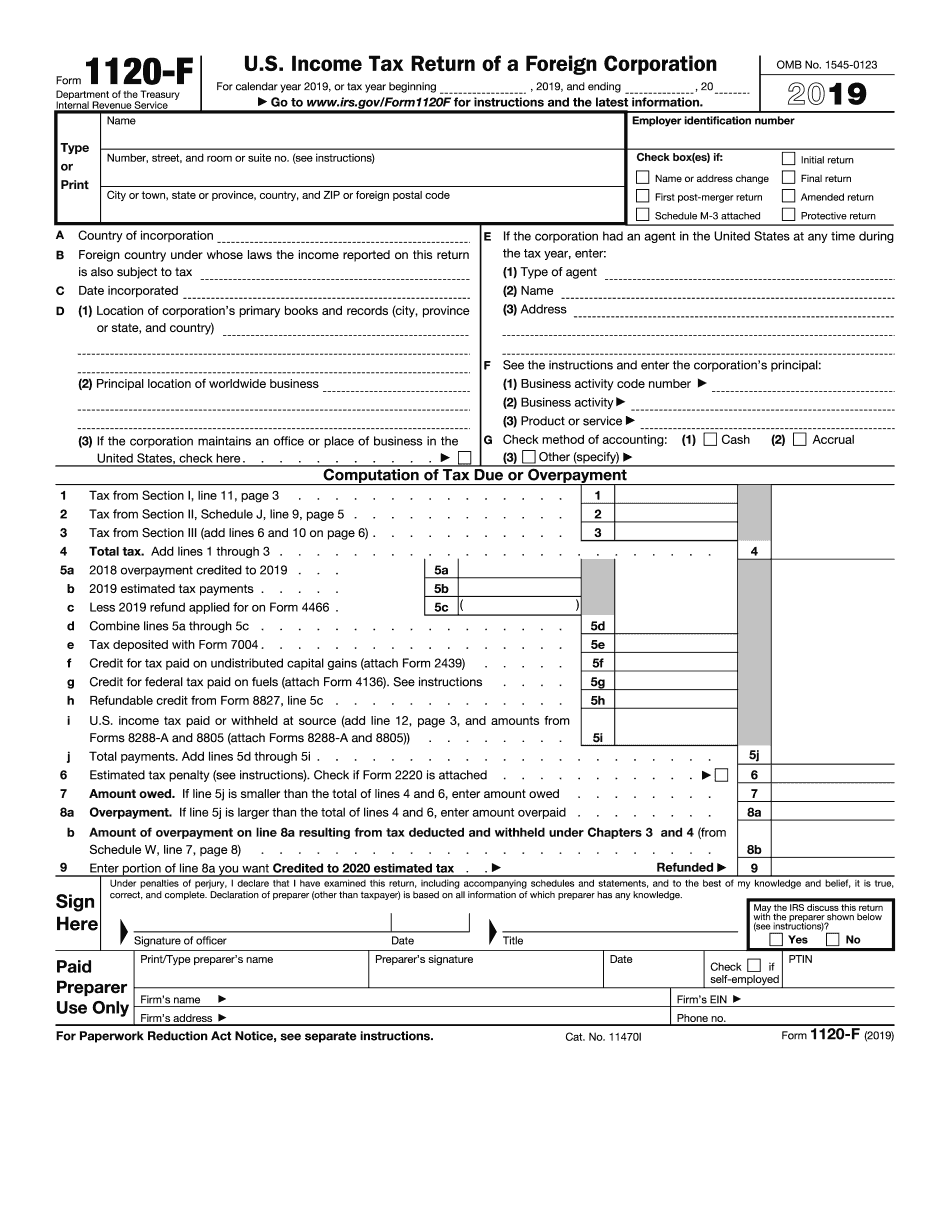

The Form 1120F is a U.S. federal tax form used by foreign corporations to report their income, gains, losses, deductions, and credits. This form is essential for foreign entities engaged in business activities within the United States, as it ensures compliance with U.S. tax laws. The information reported on Form 1120F helps the Internal Revenue Service (IRS) assess the tax liability of these corporations. It's important to note that this form is specifically designed for foreign corporations, distinguishing it from other forms used by domestic entities.

Steps to Complete the Form 1120F

Completing the Form 1120F involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, follow these steps:

- Fill out the identification section, including the corporation’s name, address, and Employer Identification Number (EIN).

- Report all sources of income, including effectively connected income and income not effectively connected with a U.S. trade or business.

- Detail deductions and credits, ensuring that all claimed amounts are substantiated by documentation.

- Complete the tax computation section to determine the corporation's tax liability.

- Review the form for accuracy and completeness before submission.

How to Obtain the Form 1120F

The Form 1120F can be obtained directly from the IRS website, where it is available for download in a fillable PDF format. This allows for easy completion and can be printed for submission. Additionally, tax professionals and software programs may provide access to the form as part of their services, ensuring that users have the latest version and instructions for filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 1120F is crucial for compliance. Generally, the form is due on the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a due date of June 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It's advisable to file the form on time to avoid penalties and interest on any unpaid taxes.

Legal Use of the Form 1120F

The legal use of Form 1120F is governed by U.S. tax regulations. This form must be filed by foreign corporations that have engaged in trade or business within the United States or have income sourced from U.S. sources. Properly completing and filing this form is essential to ensure that the corporation meets its tax obligations and avoids potential legal issues with the IRS. Failure to file can result in significant penalties and interest charges.

Key Elements of the Form 1120F

Several key elements are essential to understand when completing the Form 1120F. These include:

- Identification Information: This section captures the corporation's basic details, including its legal name and EIN.

- Income Reporting: Corporations must report all income earned, distinguishing between effectively connected and non-effectively connected income.

- Deductions and Credits: This section allows for the reporting of eligible deductions and tax credits, which can significantly affect the overall tax liability.

- Tax Computation: The form includes a section for calculating the corporation's tax due based on reported income and deductions.

Quick guide on how to complete 2019 form 1120 f us income tax return of a foreign corporation

Complete Form 1120 For effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an impeccable eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 1120 For on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Form 1120 For without hassle

- Obtain Form 1120 For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device of your choice. Alter and electronically sign Form 1120 For and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1120 f us income tax return of a foreign corporation

How to make an eSignature for your 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation in the online mode

How to make an electronic signature for the 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Chrome

How to make an eSignature for putting it on the 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Gmail

How to make an electronic signature for the 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation straight from your smartphone

How to generate an eSignature for the 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation on iOS

How to make an eSignature for the 2019 Form 1120 F Us Income Tax Return Of A Foreign Corporation on Android devices

People also ask

-

What is the 1120f 2019 pdf form used for?

The 1120f 2019 pdf form is used by foreign corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their U.S. tax liability. Businesses need this form to ensure compliance with IRS regulations. Properly filing the 1120f 2019 pdf helps avoid penalties and ensures accurate tax reporting.

-

How can I easily fill out the 1120f 2019 pdf form?

You can easily fill out the 1120f 2019 pdf form using airSlate SignNow's user-friendly platform. Our eSigning solutions allow you to upload the form, fill in the necessary fields, and sign electronically, ensuring a smooth and efficient process. This digital approach minimizes errors and saves time.

-

Is there a cost associated with using airSlate SignNow for the 1120f 2019 pdf?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan based on your document volume and features required. Cost-effective solutions mean you can manage your 1120f 2019 pdf processing without breaking the bank.

-

What features does airSlate SignNow offer for managing the 1120f 2019 pdf?

airSlate SignNow provides a suite of features designed for document management, including templates, audio notations, and collaboration tools. For the 1120f 2019 pdf, our platform allows for seamless editing, signing, and sharing, ensuring a streamlined experience from start to finish.

-

Can I track the status of my 1120f 2019 pdf document with airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your 1120f 2019 pdf document in real-time. Our platform provides notifications for each stage of the signing process, so you are always informed when changes occur.

-

Does airSlate SignNow integrate with other software for managing the 1120f 2019 pdf?

Yes, airSlate SignNow offers integrations with various software applications, enabling you to manage your 1120f 2019 pdf alongside your other business tools. Connect seamlessly with CRM systems, cloud storage solutions, and more to ensure a comprehensive document workflow.

-

What benefits do I gain from using airSlate SignNow for the 1120f 2019 pdf?

By using airSlate SignNow for your 1120f 2019 pdf, you gain access to a secure, efficient, and legally binding eSigning solution. This allows you to save time, reduce paperwork, and improve overall productivity in your business operations.

Get more for Form 1120 For

Find out other Form 1120 For

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free