Schedule K 1 Form 2017

What is the Schedule K-1 Form

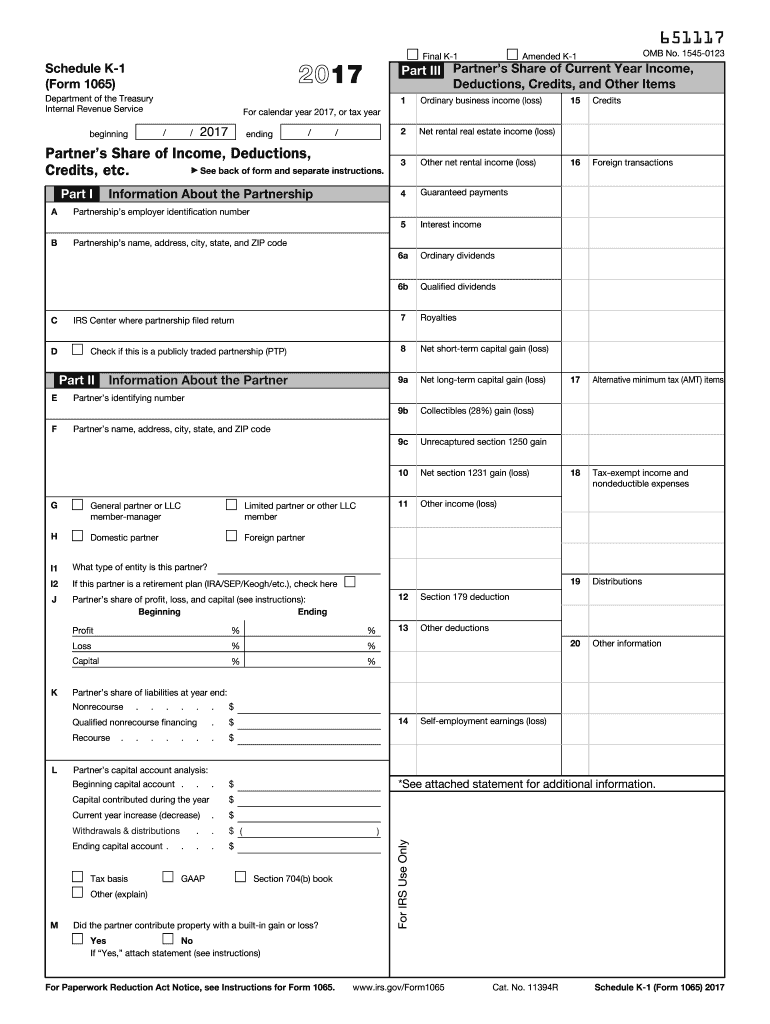

The Schedule K-1 (Form 1065) is a tax document used in the United States to report income, deductions, and credits from partnerships. This form is essential for partnerships, as it allows them to pass income directly to their partners, who then report it on their personal tax returns. Each partner receives a K-1 that outlines their share of the partnership's income, losses, and other tax-related items. The information provided on the K-1 is crucial for partners to accurately complete their individual tax filings.

How to use the Schedule K-1 Form

To effectively use the Schedule K-1, partners should first ensure they have received their K-1 from the partnership. This document includes vital information such as the partner's share of profits and losses. Partners should carefully review the form for accuracy, as any discrepancies could lead to issues with the IRS. The K-1 should be used to report income on the partner's personal tax return, typically on Form 1040. It is important to keep the K-1 for personal records and future reference, especially if the partnership's financial situation changes.

Steps to complete the Schedule K-1 Form

Completing the Schedule K-1 involves several steps. First, gather all necessary financial information from the partnership, including income, deductions, and credits. Next, fill out the K-1 form by entering the partner's information, such as name, address, and taxpayer identification number. Then, report the partner's share of the partnership's income, losses, and other relevant tax items. After completing the form, review it for accuracy before distributing it to the partners and filing it with the IRS. It is advisable to consult a tax professional if there are any uncertainties during this process.

Filing Deadlines / Important Dates

The Schedule K-1 must be filed with the IRS by the partnership's tax return deadline, which is typically the 15th of March for partnerships operating on a calendar year. Each partner should receive their K-1 in a timely manner to allow sufficient time for personal tax preparation. It is essential to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations. Partners should also be aware of any state-specific filing requirements that may apply.

Who Issues the Form

The Schedule K-1 is issued by the partnership itself. Partnerships are required to prepare and distribute K-1 forms to each partner after the end of the tax year. This form reflects each partner's share of the partnership's income, deductions, and credits. It is the partnership's responsibility to ensure that the K-1 is accurate and provided to partners by the filing deadline. Partners should verify that they receive their K-1, as it is necessary for completing their personal tax returns.

IRS Guidelines

The IRS provides specific guidelines for the completion and filing of the Schedule K-1. These guidelines outline the information that must be reported, the format of the form, and the deadlines for submission. It is crucial for partnerships and partners to familiarize themselves with these guidelines to ensure compliance. The IRS also offers resources and instructions that can assist in accurately completing the K-1 and understanding the implications of the reported income on personal tax returns.

Quick guide on how to complete schedule k 1 2017 2018 form

Discover the easiest method to complete and sign your Schedule K 1 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to finish and sign your Schedule K 1 Form and related forms for public services. Our innovative electronic signature solution provides all the tools you need to handle documentation efficiently and conform to legal standards - comprehensive PDF editing, management, security, signing, and sharing features readily available in a user-friendly interface.

You only need to take a few steps to complete and sign your Schedule K 1 Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information required in your Schedule K 1 Form.

- Use the Next button to navigate through the fields to ensure nothing is overlooked.

- Utilize Text, Checkbox, and Cross tools to fill in the fields with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Remove irrelevant fields.

- Click on Sign to create a legally valid electronic signature using your preferred method.

- Add the Date beside your signature and complete your task by clicking the Done button.

Store your finalized Schedule K 1 Form in the Documents section of your profile, download it, or export it to your chosen cloud storage. Our service also offers adaptable file sharing options. There’s no need to print your forms when you need to deliver them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 2017 2018 form

How to make an electronic signature for the Schedule K 1 2017 2018 Form online

How to make an electronic signature for the Schedule K 1 2017 2018 Form in Chrome

How to make an electronic signature for putting it on the Schedule K 1 2017 2018 Form in Gmail

How to make an electronic signature for the Schedule K 1 2017 2018 Form right from your mobile device

How to generate an electronic signature for the Schedule K 1 2017 2018 Form on iOS

How to create an electronic signature for the Schedule K 1 2017 2018 Form on Android devices

People also ask

-

What is a Schedule K 1 Form and why is it important?

The Schedule K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and estates. It is essential for ensuring that partners or shareholders accurately report their share of the entity's income on their tax returns. Understanding how to properly fill out a Schedule K 1 Form can help individuals avoid tax discrepancies.

-

How can airSlate SignNow help with the Schedule K 1 Form?

airSlate SignNow streamlines the process of sending and signing the Schedule K 1 Form by providing an easy-to-use digital platform. Users can quickly prepare, send, and collect signatures on their Schedule K 1 Forms, ensuring that all parties receive their documents in a timely manner. This efficiency minimizes delays in tax reporting and enhances compliance.

-

Is airSlate SignNow cost-effective for managing Schedule K 1 Forms?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for businesses of all sizes. With our affordable subscription options, you can manage multiple Schedule K 1 Forms without incurring high overhead costs. The value gained from features like eSigning and document tracking makes it a smart investment.

-

What features does airSlate SignNow offer for handling Schedule K 1 Forms?

airSlate SignNow provides features specifically beneficial for managing Schedule K 1 Forms, including customizable templates, secure eSigning, and document storage. These tools allow users to easily create, send, and track their Schedule K 1 Forms, ensuring a smooth workflow. Additionally, the platform integrates with various third-party applications for enhanced functionality.

-

Can I integrate airSlate SignNow with my accounting software for Schedule K 1 Forms?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to easily manage your Schedule K 1 Forms alongside your financial records. This integration helps streamline the process of preparing and submitting tax documents, reducing the risk of errors and saving time.

-

What benefits does eSigning provide for Schedule K 1 Forms?

eSigning with airSlate SignNow provides numerous benefits for Schedule K 1 Forms, including increased security and faster turnaround times. Signers can complete the process from anywhere, eliminating the need for physical document handling. This not only boosts efficiency but also enhances the overall experience for both senders and recipients.

-

How secure is the data when using airSlate SignNow for Schedule K 1 Forms?

Security is a top priority at airSlate SignNow. When using our platform for Schedule K 1 Forms, your data is protected with advanced encryption and secure access controls. This ensures that sensitive financial information remains confidential and safe from unauthorized access.

Get more for Schedule K 1 Form

Find out other Schedule K 1 Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile