Forma 941 Pr

What is the Forma 941 Pr

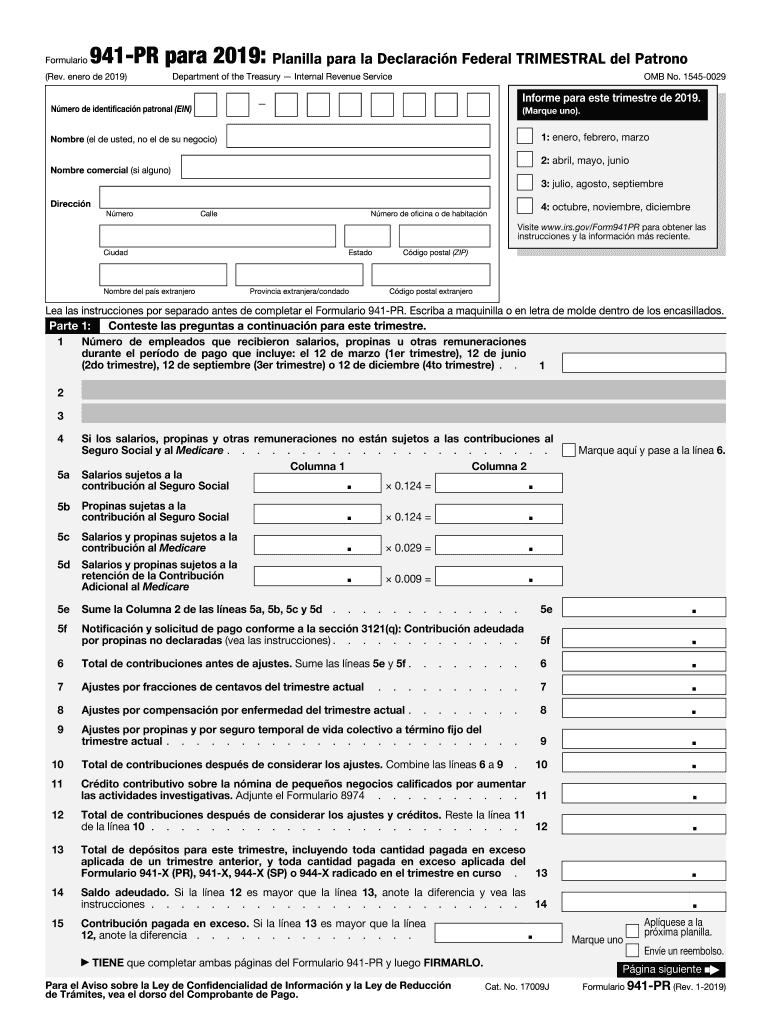

The Forma 941 Pr, also known as the IRS Form 941 PR, is a quarterly tax form used by employers in Puerto Rico to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. This form is essential for compliance with federal tax regulations and helps ensure that both employees and employers meet their tax obligations. The information reported on this form is crucial for the IRS to track tax payments and maintain accurate records of employment taxes.

How to use the Forma 941 Pr

Using the Forma 941 Pr involves several steps to ensure accurate reporting of employment taxes. Employers must gather necessary information, such as total wages paid, taxes withheld, and any adjustments for prior quarters. The form must be filled out completely and accurately to avoid penalties. After completing the form, employers can submit it electronically or by mail. It is important to keep a copy for your records and ensure that all deadlines are met to maintain compliance with IRS regulations.

Steps to complete the Forma 941 Pr

Completing the Forma 941 Pr requires a systematic approach. Follow these steps:

- Gather all relevant payroll information for the quarter, including total wages and tips paid.

- Calculate the total taxes withheld from employee wages, including federal income tax and Social Security and Medicare taxes.

- Fill out the form, ensuring all sections are completed accurately, including any adjustments for prior quarters.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the due date, either electronically or by mail.

Legal use of the Forma 941 Pr

The Forma 941 Pr is legally binding when completed and submitted according to IRS guidelines. It is important for employers to understand that inaccuracies or late submissions can lead to penalties and interest charges. The form must be signed by an authorized individual, affirming that the information provided is true and accurate. Compliance with all applicable laws and regulations is essential for the legal use of this form.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Forma 941 Pr to avoid penalties. The form is due on the last day of the month following the end of each quarter. For example, the due dates for the 2019 tax year were as follows:

- First quarter (January - March): April 30

- Second quarter (April - June): July 31

- Third quarter (July - September): October 31

- Fourth quarter (October - December): January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The Forma 941 Pr can be submitted through various methods. Employers have the option to file electronically using approved e-filing software or the IRS e-file system. This method is often faster and allows for quicker processing. Alternatively, employers can print the completed form and mail it to the appropriate IRS address based on their location. In-person submissions are typically not available for this form, making electronic and mail submissions the primary methods.

Quick guide on how to complete images for is itformulario941pr para 2019 planilla para la declaracin federal trimestral del patronorev enero de 2019department

Prepare Forma 941 Pr effortlessly on any device

Online document management has grown increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Forma 941 Pr on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Forma 941 Pr without stress

- Locate Forma 941 Pr and click on Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Forma 941 Pr and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the images for is itformulario941pr para 2019 planilla para la declaracin federal trimestral del patronorev enero de 2019department

How to create an eSignature for the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department in the online mode

How to make an electronic signature for the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department in Chrome

How to make an electronic signature for putting it on the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department in Gmail

How to create an electronic signature for the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department from your smartphone

How to make an electronic signature for the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department on iOS devices

How to make an electronic signature for the Images For Is Itformulario941pr Para 2019 Planilla Para La Declaracin Federal Trimestral Del Patronorev Enero De 2019department on Android

People also ask

-

What are the pricing options available for airSlate SignNow in 2019?

In 2019, airSlate SignNow offers a variety of pricing plans tailored to suit different business needs. You can choose from individual, business, or enterprise models, each designed to maximize value and affordability. Explore our pricing page for detailed information on each plan and how they can benefit your organization.

-

What features does airSlate SignNow offer for document e-signing?

airSlate SignNow provides a robust set of features for e-signing documents, including customizable templates, in-person signing, and real-time tracking of document statuses. With improvements made in 2019, the platform is even more user-friendly, allowing businesses to streamline their signing processes effortlessly.

-

How can airSlate SignNow benefit my business in 2019?

Using airSlate SignNow in 2019 can signNowly enhance your document workflow efficiency. By eliminating the need for physical signatures, you not only save time but also reduce costs associated with printing and mailing documents. The platform's ease of use ensures that businesses of all sizes can adapt quickly to digital signing.

-

Is airSlate SignNow compliant with legal regulations in 2019?

Yes, airSlate SignNow is fully compliant with legal regulations in 2019, including eIDAS and UETA. This compliance ensures that your electronic signatures are legally valid and recognized in court, providing peace of mind to businesses that require secure and reliable solutions for document signing.

-

Can I integrate airSlate SignNow with other tools in 2019?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of applications, including CRMs, cloud storage services, and other business tools. In 2019, users will benefit from enhanced integration capabilities that allow for a more connected and efficient workflow.

-

What kind of support does airSlate SignNow provide in 2019?

In 2019, airSlate SignNow offers comprehensive customer support through various channels, including live chat, email support, and extensive online resources. Our dedicated support team is always ready to assist with any inquiries, ensuring that you can maximize the platform's potential for your business.

-

How does airSlate SignNow ensure document security in 2019?

Security is a top priority for airSlate SignNow in 2019. The platform employs advanced encryption methods to protect documents and personal information during transmission and storage. Additionally, unique access controls and audit trails provide businesses with the reassurance they need regarding document integrity and access.

Get more for Forma 941 Pr

- 990 k form 2018

- Form 502h 2012 maryland heritage structure rehabilitation tax credit for applications received by maryland historical trust on

- Irs 8804 2018 form

- 2012 new york form

- 2017 1099 div form

- In response to rising instances of identity theft and in an effort to reduce refund fraud the department form

- Irs form cp 575 pdf

- Instructions for schedule a form 990

Find out other Forma 941 Pr

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement