Income Tax Applications for Filing Extensions Department of Taxation 2012

What is the Income Tax Applications For Filing Extensions Department Of Taxation

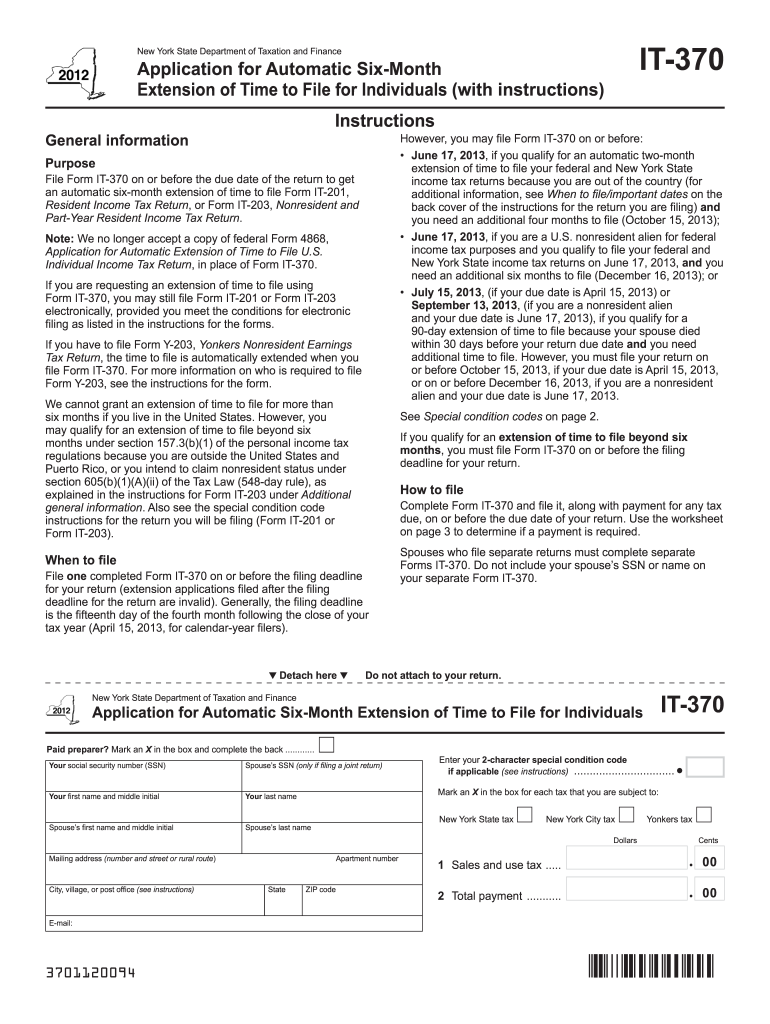

The Income Tax Applications For Filing Extensions Department Of Taxation is a formal request submitted by taxpayers to extend the deadline for filing their income tax returns. This application is essential for individuals and businesses that require additional time to prepare their tax documents. By submitting this application, taxpayers can avoid penalties associated with late filing while ensuring they have adequate time to gather necessary financial information. The application process varies by state, but it generally requires basic personal information and the reason for the extension request.

Steps to complete the Income Tax Applications For Filing Extensions Department Of Taxation

Completing the Income Tax Applications For Filing Extensions involves several key steps to ensure a smooth submission. First, gather all necessary personal and financial information, including your Social Security number, income details, and any relevant deductions. Next, access the correct form for your state, which can usually be found on the Department of Taxation's website. Fill out the form accurately, providing all required information. After completing the form, review it for any errors before submitting it. Finally, submit the application either online, by mail, or in person, depending on your state’s guidelines.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Income Tax Applications For Filing Extensions. Typically, the deadline to submit this application is the same as the original tax return due date, which is usually April 15 for individual taxpayers. However, some states may have different deadlines. If the application is submitted on time, the taxpayer can receive an extension, often allowing an additional six months to file the actual tax return. It is important to check with your state’s Department of Taxation for specific dates and any changes that may occur annually.

Required Documents

When applying for an extension, certain documents may be required to support your application. Commonly needed documents include your previous year's tax return, income statements such as W-2s or 1099s, and any relevant financial records that substantiate your income and deductions. If you are self-employed or own a business, additional documentation regarding business income and expenses may also be necessary. Ensuring that you have all required documents ready can facilitate a smoother application process and help avoid delays.

Eligibility Criteria

Eligibility for the Income Tax Applications For Filing Extensions generally includes all individuals and businesses required to file an income tax return. However, specific criteria may vary by state. Typically, taxpayers must have a valid reason for requesting an extension, such as needing more time to gather documentation or facing unforeseen circumstances. It is important to check your state’s guidelines to confirm eligibility and any specific requirements that may apply to your situation.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Income Tax Applications For Filing Extensions using various methods, depending on their state’s regulations. Common submission methods include online filing through the state’s tax portal, mailing a completed paper form to the appropriate tax office, or delivering it in person. Online submission is often the quickest and most efficient method, allowing for immediate confirmation of receipt. It is advisable to verify the accepted submission methods for your specific state to ensure compliance and timely processing.

Quick guide on how to complete 2012 new york form

Your assistance manual on how to prepare your Income Tax Applications For Filing Extensions Department Of Taxation

If you wish to learn how to finalize and submit your Income Tax Applications For Filing Extensions Department Of Taxation, here are a few brief guidelines on how to streamline your tax submission process.

To begin, you simply need to set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a highly accessible and robust document management solution that enables you to edit, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to modify information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the steps below to finish your Income Tax Applications For Filing Extensions Department Of Taxation in a matter of minutes:

- Create your account and commence working on PDFs in just a few minutes.

- Utilize our directory to find any IRS tax document; explore different versions and schedules.

- Click Obtain form to load your Income Tax Applications For Filing Extensions Department Of Taxation in our editor.

- Complete the necessary fillable fields with your information (text, numerical data, check marks).

- Employ the Signature Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can result in increased errors and delayed refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct 2012 new york form

FAQs

-

Do US citizens need a visa to visit Russia? How difficult is it to get one?

NOTE: ** MY EXPERIENCE in Nov-Dec, 2012 in New York.I'm an American and I've been getting annual visas (sometimes 3-month ones) for about 20 years to live and work in Russia. It's a complex, involved process but truly do-able if you have some money and patience. You must start with an "invitation" which many visa agencies can sell you and from there you need to go to a Russian Consulate to file for and get your actual visa.The rules and requirements have changed over the years and a few years ago it got much tougher. I even had to get HIV Blood tests several years to get a 1 year visa. A new agreement has been signed by the U.S. and Russian authorities (Jan 2012) to relax the procedure and lengthen the visa but it has yet to be approved by the Russian Duma.**MY APPLICATION FOR THE NEW 3-YEAR BUSINESS VISA WAS JUST REFUSED by the head of the New York Russian Consulate Visa Department. I had to settle for a double-entry, 3-month one filed through the new Visa Center (charging an extra $30. fee) there.For the past three years, Americans can get their visa quickly in the U.S. (I've found New York City Consulate very pleasant) or, if you try to do it in Europe you may be refused (The Netherlands and Denmark) or otherwise be required to wait for two weeks (since you don't have residency in the European Union). I've found Helsinki very pleasant and efficient.Entering Russia with a passport and visa still requires two more steps to stay legal:**THE MIGRATION CARD IS NOW DONE AT PASSPORT CONTROL FOR YOU (if you are flying) filling out a Migration Card (actually a slip of paper) upon crossing the border that you must have with you until you exit and,registering your visa if you stay in one city for five days (I believe that's the new period). The registration can be done by a hotel or hostel or, if you are staying in a private home, the Russian owner of the flat can fill out the forms and pay a small fee at certain post offices. **NEW LOCATION FOR REGISTRATION

-

Why did New York Times staffers stage a walk-out on Oct. 8, 2012?

Colleagues:There is no longer any time to waste.At every bargaining session for the last year and a half, negotiators for The Times have offered us the same poisoned chalice: perpetually shrinking compensation.Today we begin a series of actions to make sure that the company hears and understands our position. We have more than earned fair wages and benefits. We will accept nothing less.That message has not yet gotten through, despite huge concessions by our representatives. It is time to raise our voices.Having been told that The Times urgently needed to freeze pension obligations, the Guild brought to the table an alternative plan that absolves the company of all volatility, and shifts the risks entirely to us.How did the company respond to this historic change? Its negotiators returned with radical demands to slash our wages and benefits. Their early proposals called for an overall $12,000 annual cut, in real dollars, to our compensation package.Then it got worse.In their latest proposal, The Times proposed to extend the term of the contract, piling on additional years of reduced wages and benefits. That would make the new real cost to each one of us at least $15,000 annually. Other responsible estimates reckon that the losses to us are even higher. No matter how hard you squint at the numbers, they never get better.As far as the eye can see, your wages and benefits would decline.By itself, that is a formula for disaster, for us as individuals, and for the ability of The New York Times to attract and keep talented people. But there’s even more. Now they want – or so they say – separate contracts for digital and print journalists, even though there are no longer meaningful distinctions in the work we do. Our journalism is distributed across multiple platforms, print, digital, audio and video. That was and (we think) still is the vision of Arthur O. Sulzberger, Jr. for The New York Times of the 21st Century. It was a vision embraced without reservation throughout the newsroom. That took plenty of work. But we all saw it as necessity and opportunity.Any proposal to dismantle the decade of work that has been done to unify the newsroom, securing its place as the world’s premier news organization, could be laughed off as far-fetched legal gimmickry. After all, that would be an act of self-immolation. But even if it’s not worth serious consideration, it has landed just we are heading at full speed toward a crisis over genuine issues like our pay and benefits.They threaten to declare impasse; they burn up hours on low-farce; then they slap down another version of their repugnant demands to cut our compensation.It is long past time for the company and its negotiators to pay attention to what matters most of all to us. Together, we can make sure that happens. Join in, as beginning today, we will repeat our message until they hear it:Nothing less than fair wages and benefits.Believe us.New York Newspaper Guild’s message to Times members

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

Which New York City startups are going to SxSW 2012?

SecondMarket will be there, and we will be helping you quench your thirst for liquidity all weekend. We are taking over the Thirsty Nickel on 6th Street and will be hosting parties on both Saturday and Sunday night, have some great panels with fantastic speakers lined up, and most importantly, will be THE place to go to cure your hangover in the morning. Join us at the SecondMarket/CNET Recovery Lounge on the mornings of 3/10 and 3/11 to relax and refuel with some Blue Bottle Coffee,breakfast sandwiches, mimosas and bloodies and some more surprises. For more information: https://www.secondmarket.com/dis...If you want a VIP bracelet, find us in Austin (follow @SecondMarket on Twitter or #SMAustin) or ping me through Quora!

Create this form in 5 minutes!

How to create an eSignature for the 2012 new york form

How to make an electronic signature for your 2012 New York Form online

How to generate an eSignature for your 2012 New York Form in Google Chrome

How to create an eSignature for putting it on the 2012 New York Form in Gmail

How to create an eSignature for the 2012 New York Form straight from your smart phone

How to create an eSignature for the 2012 New York Form on iOS devices

How to generate an eSignature for the 2012 New York Form on Android devices

People also ask

-

What are the benefits of using airSlate SignNow for Income Tax Applications For Filing Extensions Department Of Taxation?

Using airSlate SignNow for your Income Tax Applications For Filing Extensions Department Of Taxation offers numerous benefits. It simplifies the process, allowing you to eSign and send documents securely without the hassle of printing or scanning. Additionally, the platform provides real-time tracking, ensuring you know the status of your applications at all times.

-

How does airSlate SignNow ensure the security of my Income Tax Applications For Filing Extensions Department Of Taxation?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Income Tax Applications For Filing Extensions Department Of Taxation. The platform uses advanced encryption protocols to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for Income Tax Applications For Filing Extensions Department Of Taxation?

Yes, airSlate SignNow offers seamless integration with various applications to enhance your workflow for Income Tax Applications For Filing Extensions Department Of Taxation. Whether you use CRM systems, cloud storage solutions, or other productivity tools, our platform can connect effortlessly, allowing for a more streamlined process.

-

What is the pricing structure for using airSlate SignNow for Income Tax Applications For Filing Extensions Department Of Taxation?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it an affordable choice for handling Income Tax Applications For Filing Extensions Department Of Taxation. You can choose from monthly or annual subscriptions, with options for additional features based on your requirements, ensuring you get the best value.

-

Is there a mobile app for airSlate SignNow to manage Income Tax Applications For Filing Extensions Department Of Taxation?

Yes, airSlate SignNow provides a mobile app that allows you to manage your Income Tax Applications For Filing Extensions Department Of Taxation on the go. This feature enables you to eSign documents, track your applications, and communicate with clients or team members from your smartphone or tablet, ensuring flexibility and convenience.

-

How quickly can I complete my Income Tax Applications For Filing Extensions Department Of Taxation using airSlate SignNow?

With airSlate SignNow, you can complete your Income Tax Applications For Filing Extensions Department Of Taxation quickly and efficiently. The platform streamlines the signing process, often allowing users to finalize their applications within minutes, signNowly reducing the time compared to traditional methods.

-

What types of documents can I sign related to Income Tax Applications For Filing Extensions Department Of Taxation?

airSlate SignNow supports a wide range of document types related to Income Tax Applications For Filing Extensions Department Of Taxation. Whether you need to sign IRS forms, state tax extension documents, or any other related paperwork, our platform allows you to manage all your signing needs in one place.

Get more for Income Tax Applications For Filing Extensions Department Of Taxation

Find out other Income Tax Applications For Filing Extensions Department Of Taxation

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online