SBI Dynamic Bond Fund Form

What is the SBI Dynamic Bond Fund

The SBI Dynamic Bond Fund is a type of mutual fund that primarily invests in a diversified portfolio of fixed-income securities. This fund aims to provide investors with capital appreciation and regular income by adjusting its duration based on market conditions. The fund's management team actively manages the portfolio to respond to changes in interest rates and economic indicators, making it suitable for investors looking for a flexible investment option in the bond market.

How to use the SBI Dynamic Bond Fund

Investors can use the SBI Dynamic Bond Fund as part of their overall investment strategy to achieve specific financial goals. It can serve as a source of steady income, particularly for those approaching retirement. By investing in this fund, individuals can gain exposure to a variety of debt instruments without the need for extensive knowledge of the bond market. Regular contributions can enhance the potential for growth over time, and investors can redeem their units as needed for liquidity.

Key elements of the SBI Dynamic Bond Fund

Several key elements define the SBI Dynamic Bond Fund:

- Investment Strategy: The fund adopts an active management approach, adjusting its portfolio based on interest rate forecasts.

- Diversification: It invests in various fixed-income securities, including government bonds, corporate bonds, and money market instruments.

- Liquidity: Investors can buy or sell units of the fund on any business day, providing flexibility and access to their funds.

- Risk Management: The fund aims to mitigate risks associated with interest rate fluctuations through strategic asset allocation.

Eligibility Criteria

To invest in the SBI Dynamic Bond Fund, investors must meet certain eligibility criteria. Generally, this includes being a resident of the United States, having a valid Social Security number, and being at least eighteen years old. Additionally, investors should have a clear understanding of their financial goals and risk tolerance before investing in this fund. It is advisable to consult with a financial advisor to ensure that this investment aligns with individual financial plans.

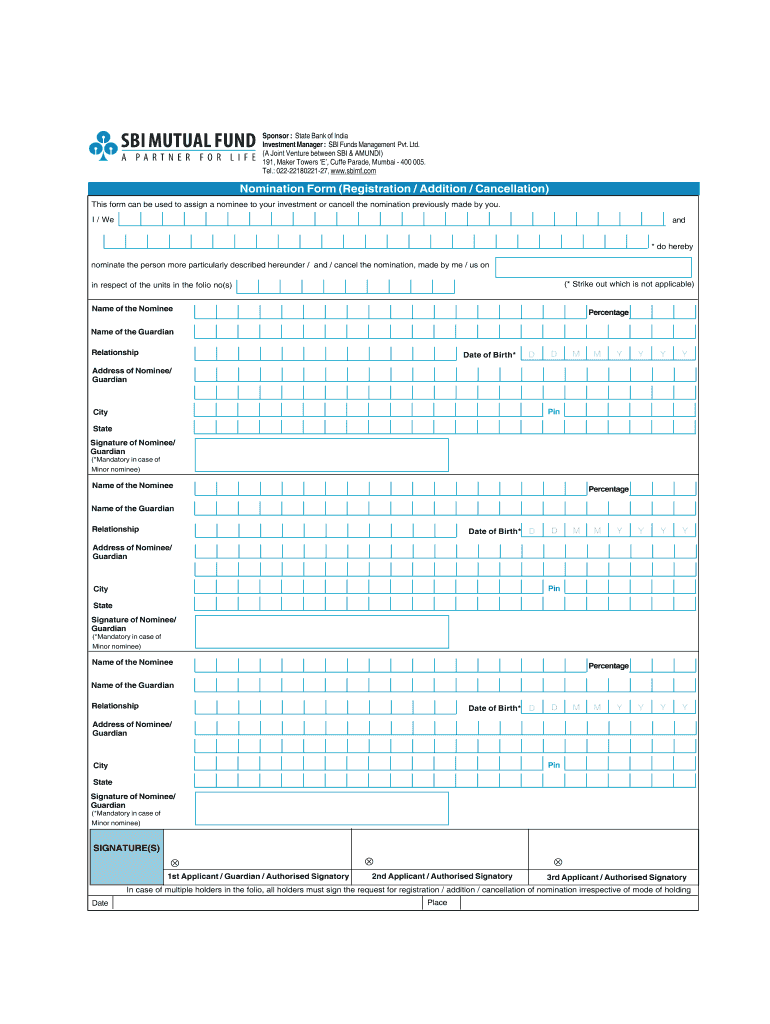

Application Process & Approval Time

The application process for the SBI Dynamic Bond Fund typically involves filling out an application form, providing necessary identification documents, and making an initial investment. Investors can complete the application online or through authorized distributors. After submission, the approval time may vary, but it usually takes a few business days for the application to be processed and for the investment to be reflected in the investor's account. Keeping all required documents ready can help expedite the process.

Examples of using the SBI Dynamic Bond Fund

Investors can utilize the SBI Dynamic Bond Fund in various scenarios:

- A retiree seeking regular income can allocate a portion of their portfolio to this fund for steady cash flow.

- A young professional may invest in the fund to build wealth over time while balancing risk in their investment portfolio.

- Individuals looking to diversify their investments can include this fund as part of a broader strategy that encompasses equities and other asset classes.

Quick guide on how to complete sbi dynamic bond fund

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and safely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform through the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you choose. Customize and eSign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SBI Dynamic Bond Fund

Create this form in 5 minutes!

How to create an eSignature for the sbi dynamic bond fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBI Dynamic Bond Fund?

The SBI Dynamic Bond Fund is a mutual fund that invests in a diversified portfolio of fixed-income securities. It aims to provide investors with optimal returns by dynamically managing the duration of the portfolio based on interest rate movements. This fund is suitable for those looking for a balance between risk and return in their investment strategy.

-

What are the key features of the SBI Dynamic Bond Fund?

The SBI Dynamic Bond Fund features active management of interest rate risk, allowing it to adapt to changing market conditions. It offers a mix of government and corporate bonds, providing a diversified investment approach. Additionally, the fund is managed by experienced professionals who utilize in-depth market analysis to optimize returns.

-

How can I invest in the SBI Dynamic Bond Fund?

Investing in the SBI Dynamic Bond Fund can be done through various channels, including direct investment via the SBI Mutual Fund website or through financial advisors. You can choose between systematic investment plans (SIPs) or lump-sum investments based on your financial goals. Ensure you review the fund's performance and risk factors before investing.

-

What are the benefits of investing in the SBI Dynamic Bond Fund?

The SBI Dynamic Bond Fund offers several benefits, including potential capital appreciation and regular income through interest payments. Its dynamic management strategy helps mitigate interest rate risk, making it a suitable choice for conservative investors. Furthermore, it provides liquidity, allowing investors to redeem their units as needed.

-

What is the expense ratio of the SBI Dynamic Bond Fund?

The expense ratio of the SBI Dynamic Bond Fund is competitive compared to other mutual funds in the same category. This ratio reflects the costs associated with managing the fund, including management fees and operational expenses. A lower expense ratio can enhance your overall returns, making it an attractive option for investors.

-

Is the SBI Dynamic Bond Fund suitable for long-term investment?

Yes, the SBI Dynamic Bond Fund is suitable for long-term investment, especially for those seeking stability and income generation. Its strategy of adjusting the portfolio based on interest rate trends can lead to better performance over time. However, investors should assess their risk tolerance and investment horizon before committing.

-

How does the SBI Dynamic Bond Fund compare to other bond funds?

The SBI Dynamic Bond Fund stands out due to its active management approach, which allows it to respond to market changes more effectively than static bond funds. This flexibility can lead to enhanced returns in varying interest rate environments. Additionally, its diversified portfolio helps reduce risk compared to single-asset bond funds.

Get more for SBI Dynamic Bond Fund

- Distinction in biology poster biology duke university biology duke form

- Csulb staff day california state university long beach form

- Travel authorization form csulb foundation california state foundation csulb

- Between friends contract template form

- Between family members contract template form

- Between parent and teenager contract template form

- Between two individuals contract template form

- Between two companies contract template form

Find out other SBI Dynamic Bond Fund

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast