Uta 1098 T Form 2017

What is the Uta 1098 T Form

The Uta 1098 T form, also known as the Tuition Statement, is an important tax document used by eligible educational institutions in the United States. This form reports qualified tuition and related expenses paid by students during the tax year. It is primarily used by students and their families to claim education-related tax benefits, such as the American Opportunity Credit or the Lifetime Learning Credit. Understanding this form is crucial for maximizing potential tax deductions and credits associated with higher education expenses.

How to Use the Uta 1098 T Form

Using the Uta 1098 T form involves several steps. First, students should receive this form from their educational institution, typically by January 31 of each year. Once received, students should review the information for accuracy, including tuition amounts and personal details. The form can then be used to complete tax returns, allowing taxpayers to claim education credits. It is essential to keep a copy of the form for personal records and to refer to it when preparing tax documents.

Steps to Complete the Uta 1098 T Form

Completing the Uta 1098 T form requires careful attention to detail. Here are the key steps:

- Gather all relevant documentation, including tuition payment receipts and enrollment records.

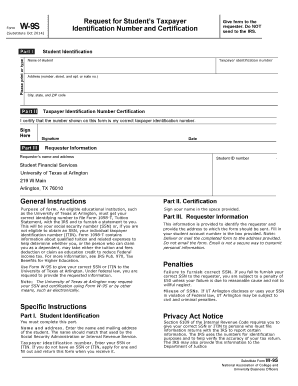

- Ensure that the personal information on the form is correct, including the student's name, Social Security number, and address.

- Review the amounts reported in Box 1 (payments received) and Box 2 (amounts billed) to determine which is applicable for tax purposes.

- If applicable, calculate the eligible education credits using the information provided on the form.

- File the completed tax return, including the Uta 1098 T form, by the deadline.

Who Issues the Form

The Uta 1098 T form is issued by eligible educational institutions, which include colleges, universities, and other post-secondary educational organizations. These institutions are responsible for reporting the tuition and related expenses incurred by students. Students should ensure they receive this form from their institution, as it is essential for claiming education-related tax benefits.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Uta 1098 T form is crucial for timely tax preparation. Educational institutions must send out the form to students by January 31 of the following tax year. Students should aim to file their tax returns by April 15 to avoid penalties. Keeping track of these dates helps ensure that all necessary tax documents are submitted on time, allowing for the potential to receive any applicable refunds or credits.

IRS Guidelines

The IRS provides specific guidelines regarding the Uta 1098 T form. These guidelines outline who is required to file the form, the information that must be reported, and the tax benefits that can be claimed based on the information provided. Students should familiarize themselves with these guidelines to ensure compliance and maximize their tax benefits. The IRS also updates these guidelines periodically, so it is important to check for any changes each tax year.

Quick guide on how to complete uta 1098 t form

Prepare Uta 1098 T Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Uta 1098 T Form on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and electronically sign Uta 1098 T Form with ease

- Find Uta 1098 T Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Edit and electronically sign Uta 1098 T Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uta 1098 t form

Create this form in 5 minutes!

How to create an eSignature for the uta 1098 t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uta 1098 t form and why is it important?

The uta 1098 t form is a tax document that universities provide to students, detailing tuition payments and related expenses. It is important for students to accurately report their education expenses when filing taxes, as it can affect their eligibility for tax credits and deductions.

-

How can airSlate SignNow help with the uta 1098 t process?

airSlate SignNow streamlines the process of sending and signing the uta 1098 t form electronically. With our easy-to-use platform, educational institutions can efficiently manage document workflows, ensuring timely delivery and compliance with tax regulations.

-

What features does airSlate SignNow offer for managing uta 1098 t forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated reminders for the uta 1098 t forms. These tools help organizations save time and reduce errors, making the document management process more efficient.

-

Is airSlate SignNow cost-effective for handling uta 1098 t forms?

Yes, airSlate SignNow provides a cost-effective solution for managing uta 1098 t forms. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can efficiently handle your document needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for uta 1098 t management?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage uta 1098 t forms. This allows for a more cohesive workflow, connecting your document management with existing systems.

-

What are the benefits of using airSlate SignNow for uta 1098 t forms?

Using airSlate SignNow for uta 1098 t forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled safely and can be accessed anytime, anywhere.

-

How secure is airSlate SignNow when handling uta 1098 t forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your uta 1098 t forms. You can trust that your sensitive information is safe while using our platform for electronic signatures and document management.

Get more for Uta 1098 T Form

- Texas dealer reassignment form pdf 249695531

- Fun run waiver template 253074601 form

- Denotation and connotation practice exercises answer key form

- Assam gramin vikash bank aadhaar link form

- Higher pension option form epfo

- Shriram motor insurance claim form

- Commission addendum r ci builders form

- Third party commission agreement template form

Find out other Uta 1098 T Form

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now