Form 2555

What is the Form 2555

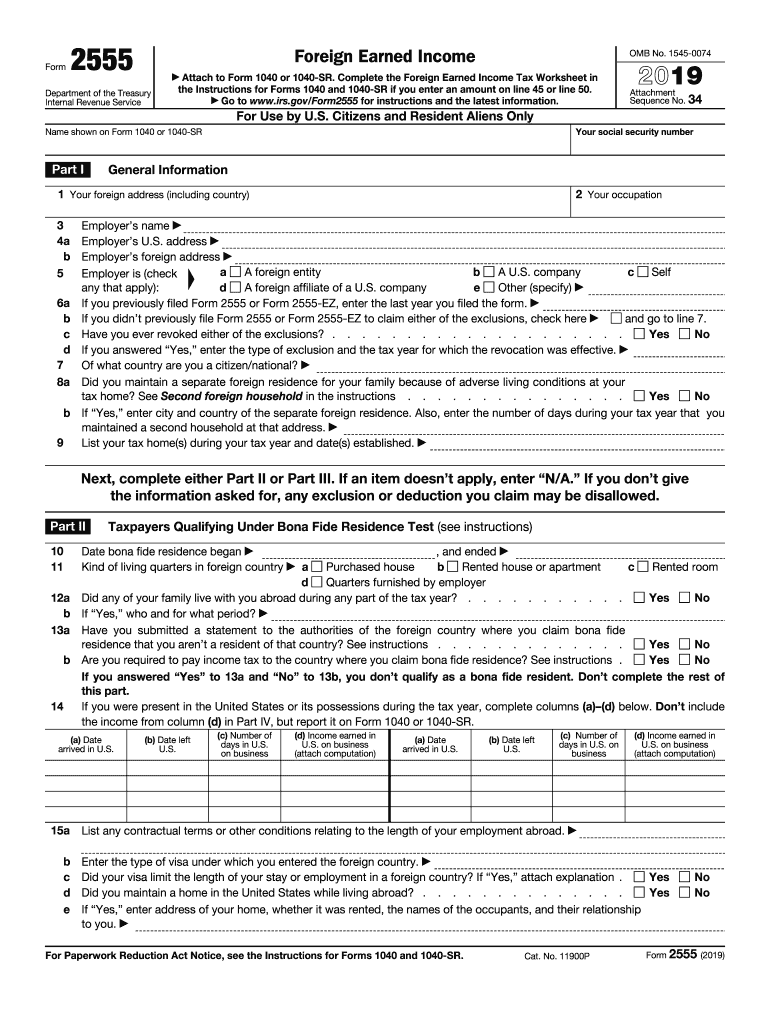

The 2019 IRS Form 2555 is used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation, provided they meet specific criteria regarding their residency and the nature of their work abroad. Understanding this form is essential for anyone who has earned income in a foreign country and wants to ensure compliance with U.S. tax laws while maximizing their tax benefits.

How to use the Form 2555

To effectively use the 2019 Form 2555, taxpayers must first determine their eligibility based on residency and income thresholds. The form requires detailed information about the taxpayer's foreign income, the countries in which they worked, and the duration of their stay abroad. Once completed, the form should be attached to the taxpayer's annual income tax return. It is crucial to ensure that all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Form 2555

Completing the 2019 Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign residency and income statements.

- Fill out the form, starting with personal information and details about your foreign earned income.

- Calculate the exclusion amount based on the foreign earned income and the applicable limits for the tax year.

- Review the form for accuracy and completeness before submission.

- Attach the completed form to your tax return and file it with the IRS by the deadline.

Legal use of the Form 2555

The legal use of the 2019 Form 2555 is governed by U.S. tax laws, specifically the Internal Revenue Code. To ensure that the form is legally valid, taxpayers must meet the eligibility requirements, including the physical presence test or the bona fide residence test. Additionally, the form must be filed correctly and on time to avoid penalties. Utilizing electronic signatures through a reliable platform can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing the Form 2555 is typically April fifteenth, aligning with the standard tax return deadline. However, if a taxpayer is living abroad, they may qualify for an automatic two-month extension, pushing the deadline to June fifteenth. It's essential to be aware of these dates to avoid late filing penalties and ensure compliance with IRS regulations.

Required Documents

When completing the 2019 Form 2555, taxpayers should have the following documents ready:

- Proof of foreign earned income, such as pay stubs or tax documents from the foreign country.

- Documentation supporting residency status, including visas or residency permits.

- Any additional forms or schedules that pertain to income and deductions relevant to the taxpayer's situation.

Eligibility Criteria

To qualify for the benefits of the 2019 Form 2555, taxpayers must meet specific eligibility criteria. This includes being a U.S. citizen or resident alien, having foreign earned income, and meeting either the bona fide residence test or the physical presence test. The foreign earned income must also exceed the exclusion limit set by the IRS for the tax year. Understanding these criteria is crucial for maximizing tax benefits and ensuring compliance.

Quick guide on how to complete 2019 form 2555 foreign earned income

Complete Form 2555 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and safely keep it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 2555 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 2555 with ease

- Obtain Form 2555 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searching, or mistakes that require reprinting documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 2555 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 2555 foreign earned income

How to create an eSignature for your 2019 Form 2555 Foreign Earned Income online

How to make an eSignature for the 2019 Form 2555 Foreign Earned Income in Google Chrome

How to generate an eSignature for signing the 2019 Form 2555 Foreign Earned Income in Gmail

How to create an electronic signature for the 2019 Form 2555 Foreign Earned Income from your smart phone

How to make an electronic signature for the 2019 Form 2555 Foreign Earned Income on iOS devices

How to create an electronic signature for the 2019 Form 2555 Foreign Earned Income on Android OS

People also ask

-

What is the 2019 IRS Form 2555?

The 2019 IRS Form 2555 is used by U.S. citizens and residents living abroad to report their foreign earned income and claim the Foreign Earned Income Exclusion. This form helps taxpayers avoid double taxation on their income earned outside the U.S. It's crucial for those qualifying for the exclusion to fill out this form accurately to benefit from its provisions.

-

How do I fill out the 2019 IRS Form 2555?

To fill out the 2019 IRS Form 2555, you need to gather your income information and documents that prove your residency abroad. The form requires details about your foreign earned income, travel dates, and qualifying foreign residency. With airSlate SignNow, you can securely send and eSign these documents as you prepare your tax filings.

-

What are the filing requirements for the 2019 IRS Form 2555?

Filing the 2019 IRS Form 2555 is required for U.S. taxpayers with foreign earned income who wish to claim the Foreign Earned Income Exclusion. You must meet the physical presence test or the bona fide residence test to qualify. Ensuring all criteria are met can streamline your tax filing process and maximize your exclusions.

-

What benefits does the 2019 IRS Form 2555 provide?

The 2019 IRS Form 2555 provides signNow tax benefits, allowing eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation. This can lead to substantial savings for expatriates and those living overseas. Using airSlate SignNow can make submitting the necessary documents for this form simpler and more efficient.

-

Is there a fee to file the 2019 IRS Form 2555?

While there’s no direct fee for filing the 2019 IRS Form 2555 itself, associated costs may arise from hiring tax professionals or using online tax services. AirSlate SignNow offers an affordable solution for document management and eSigning, making it cost-effective to handle your tax documentation efficiently.

-

Can I electronically file the 2019 IRS Form 2555?

Yes, you can electronically file the 2019 IRS Form 2555 using IRS-approved e-filing services. This method ensures faster processing times and quicker receipt of any refunds. With airSlate SignNow, you can create, send, and eSign your tax documents securely and conveniently online.

-

What documents do I need to submit with the 2019 IRS Form 2555?

When submitting the 2019 IRS Form 2555, you'll need documents proving your foreign earned income and compliance with residency requirements. These may include pay stubs, employment contracts, or tax statements from foreign governments. AirSlate SignNow can help you collect and eSign these documents seamlessly for a smoother filing process.

Get more for Form 2555

- Rpie form

- Form 891402281000 rev 1022reset formmississipp

- Ms 80 107 form

- Form mt 203 distributor of tobacco products tax return revised 3

- Ny dtf st 100 10 i fill out tax template onlineus legal forms

- 84 105 mississippi ms gov form

- Instructions for form dtf 686 att tax ny gov

- Instructions for form it 2105 estimated income tax payment voucher for individuals new york state new york city yonkers mctmt

Find out other Form 2555

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple