Form 2555

What is the Form 2555

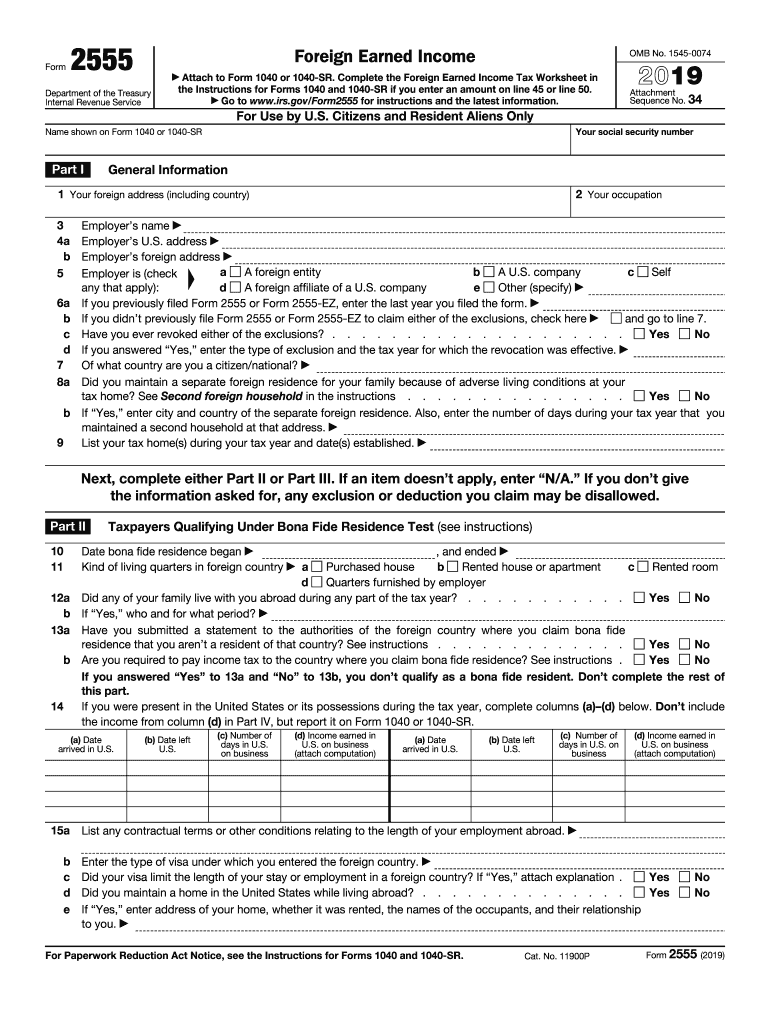

The 2019 IRS Form 2555 is used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation, provided they meet specific criteria regarding their residency and the nature of their work abroad. Understanding this form is essential for anyone who has earned income in a foreign country and wants to ensure compliance with U.S. tax laws while maximizing their tax benefits.

How to use the Form 2555

To effectively use the 2019 Form 2555, taxpayers must first determine their eligibility based on residency and income thresholds. The form requires detailed information about the taxpayer's foreign income, the countries in which they worked, and the duration of their stay abroad. Once completed, the form should be attached to the taxpayer's annual income tax return. It is crucial to ensure that all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Form 2555

Completing the 2019 Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign residency and income statements.

- Fill out the form, starting with personal information and details about your foreign earned income.

- Calculate the exclusion amount based on the foreign earned income and the applicable limits for the tax year.

- Review the form for accuracy and completeness before submission.

- Attach the completed form to your tax return and file it with the IRS by the deadline.

Legal use of the Form 2555

The legal use of the 2019 Form 2555 is governed by U.S. tax laws, specifically the Internal Revenue Code. To ensure that the form is legally valid, taxpayers must meet the eligibility requirements, including the physical presence test or the bona fide residence test. Additionally, the form must be filed correctly and on time to avoid penalties. Utilizing electronic signatures through a reliable platform can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing the Form 2555 is typically April fifteenth, aligning with the standard tax return deadline. However, if a taxpayer is living abroad, they may qualify for an automatic two-month extension, pushing the deadline to June fifteenth. It's essential to be aware of these dates to avoid late filing penalties and ensure compliance with IRS regulations.

Required Documents

When completing the 2019 Form 2555, taxpayers should have the following documents ready:

- Proof of foreign earned income, such as pay stubs or tax documents from the foreign country.

- Documentation supporting residency status, including visas or residency permits.

- Any additional forms or schedules that pertain to income and deductions relevant to the taxpayer's situation.

Eligibility Criteria

To qualify for the benefits of the 2019 Form 2555, taxpayers must meet specific eligibility criteria. This includes being a U.S. citizen or resident alien, having foreign earned income, and meeting either the bona fide residence test or the physical presence test. The foreign earned income must also exceed the exclusion limit set by the IRS for the tax year. Understanding these criteria is crucial for maximizing tax benefits and ensuring compliance.

Quick guide on how to complete 2019 form 2555 foreign earned income

Complete Form 2555 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and safely keep it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 2555 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 2555 with ease

- Obtain Form 2555 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searching, or mistakes that require reprinting documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 2555 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 2555 foreign earned income

How to create an eSignature for your 2019 Form 2555 Foreign Earned Income online

How to make an eSignature for the 2019 Form 2555 Foreign Earned Income in Google Chrome

How to generate an eSignature for signing the 2019 Form 2555 Foreign Earned Income in Gmail

How to create an electronic signature for the 2019 Form 2555 Foreign Earned Income from your smart phone

How to make an electronic signature for the 2019 Form 2555 Foreign Earned Income on iOS devices

How to create an electronic signature for the 2019 Form 2555 Foreign Earned Income on Android OS

People also ask

-

What is Form 2555 and how can airSlate SignNow help with it?

Form 2555 is a tax form used by U.S. citizens and residents to claim the Foreign Earned Income Exclusion. With airSlate SignNow, you can easily prepare and eSign Form 2555, ensuring your documents are secure and compliant. Our platform streamlines the signing process, making it effortless to manage your international tax matters.

-

Is there a cost associated with eSigning Form 2555 using airSlate SignNow?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs. Depending on the features you require for managing documents like Form 2555, you can choose from our affordable subscription options. We also provide a free trial, allowing you to explore our services before committing.

-

What features does airSlate SignNow offer for completing Form 2555?

airSlate SignNow provides a user-friendly interface for filling out and eSigning Form 2555, along with features like document templates and secure cloud storage. You can easily collaborate with others, track the signing status, and integrate with other tools to streamline your workflow. Our features ensure that managing your tax documents is both efficient and secure.

-

Can I integrate airSlate SignNow with other software for handling Form 2555?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage Form 2555 and other documents. Whether you use CRM software, cloud storage solutions, or accounting tools, our integrations simplify the document management process and improve productivity.

-

How does airSlate SignNow ensure the security of my Form 2555 documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your Form 2555 and other sensitive documents during transmission and storage. Additionally, we offer features like two-factor authentication and audit trails to ensure your data remains safe and compliant.

-

What are the benefits of using airSlate SignNow for Form 2555?

Using airSlate SignNow for Form 2555 offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. Our platform simplifies the eSigning process, allowing you to complete and submit your tax forms quickly. This efficiency not only saves you time but also helps avoid potential errors that can occur with traditional methods.

-

Is airSlate SignNow suitable for individuals filing Form 2555?

Yes, airSlate SignNow is suitable for both individuals and businesses filing Form 2555. Our platform is designed to accommodate various users, providing a straightforward and efficient way to eSign and manage your tax documents. Whether you are self-employed or filing for an entity, our solution can help streamline your process.

Get more for Form 2555

Find out other Form 2555

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement