Irs Form 8854

What is the IRS Form 8854

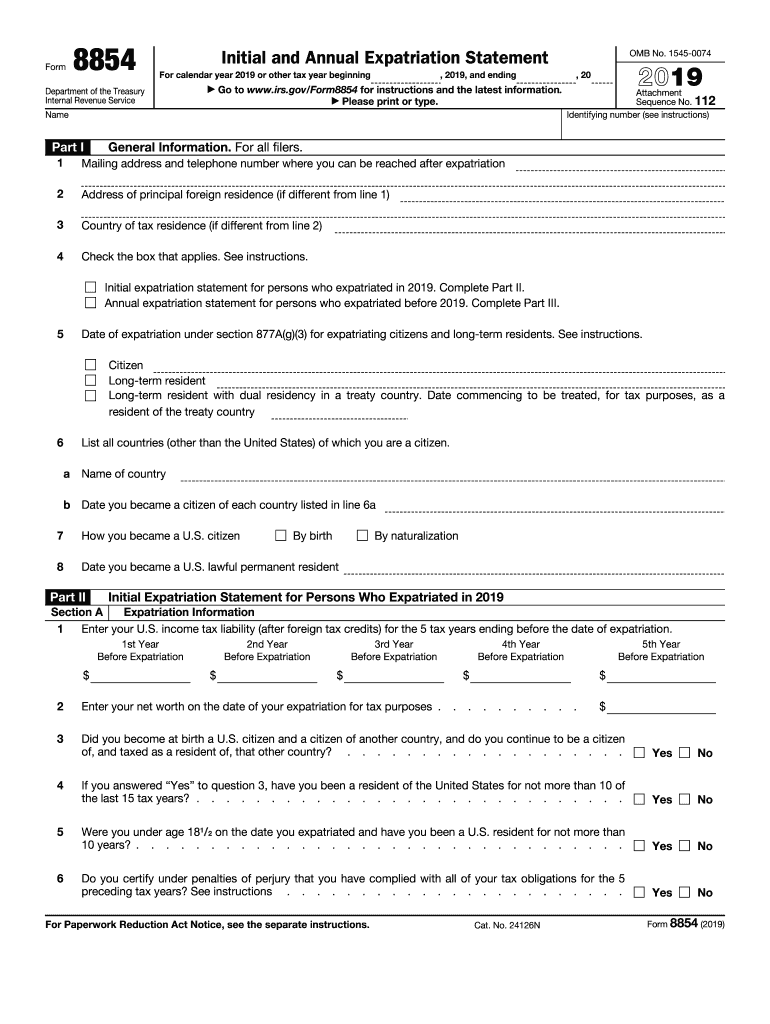

The IRS Form 8854, also known as the Initial and Annual Expatriation Statement, is a crucial document for individuals who have chosen to expatriate from the United States. This form is primarily used to report the expatriation of U.S. citizens and long-term residents. It helps the IRS determine whether an individual meets the criteria for expatriation and assesses any potential tax obligations that may arise from this status change. The form requires detailed information about the individual's tax compliance history, assets, and liabilities, ensuring that all expatriates fulfill their legal responsibilities.

Steps to complete the IRS Form 8854

Completing the IRS Form 8854 involves several important steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary documents, including your tax returns for the past five years, financial statements, and information on your assets and liabilities.

- Fill out the form, providing your personal information, including your name, address, and Social Security number.

- Complete Part I, which addresses your expatriation status and the date of expatriation.

- In Part II, disclose your assets and liabilities, ensuring that all values are accurately reported.

- Sign and date the form, certifying that the information provided is complete and accurate.

How to obtain the IRS Form 8854

The IRS Form 8854 can be obtained directly from the IRS website. It is available as a downloadable PDF file, which can be easily filled out electronically or printed for manual completion. Additionally, tax professionals may provide assistance in obtaining and completing this form, ensuring that all necessary information is accurately captured. It is essential to use the most recent version of the form to comply with current IRS regulations.

Key elements of the IRS Form 8854

The IRS Form 8854 consists of several key elements that must be accurately completed to ensure compliance. These include:

- Personal Information: This section requires basic identifying information such as your name, address, and taxpayer identification number.

- Expatriation Date: You must specify the date on which you expatriated from the United States.

- Tax Compliance: You need to confirm that you have complied with U.S. tax obligations for the five years preceding your expatriation.

- Asset Disclosure: A detailed account of your assets and liabilities is required to assess any potential tax implications.

Filing Deadlines / Important Dates

Filing the IRS Form 8854 is subject to specific deadlines that expatriates must adhere to. Generally, the form must be submitted on or before the due date of your tax return for the year in which you expatriate. If you expatriate during the year, you must file the form along with your tax return for that year. It is crucial to stay informed about any changes in deadlines to avoid penalties.

Penalties for Non-Compliance

Failing to file the IRS Form 8854 or providing inaccurate information can result in significant penalties. Individuals who do not comply with the expatriation requirements may face an exit tax, which is calculated based on the net worth of the expatriate at the time of expatriation. Additionally, there may be fines for failing to report income or assets accurately. Understanding these penalties emphasizes the importance of thorough and accurate completion of the form.

Quick guide on how to complete initial and annual expatriation statement internal revenue

Accomplish Irs Form 8854 effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents quickly without complications. Handle Irs Form 8854 on any gadget with airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

How to modify and eSign Irs Form 8854 with ease

- Obtain Irs Form 8854 and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or redact sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Irs Form 8854 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the initial and annual expatriation statement internal revenue

How to make an eSignature for your Initial And Annual Expatriation Statement Internal Revenue in the online mode

How to generate an electronic signature for the Initial And Annual Expatriation Statement Internal Revenue in Google Chrome

How to create an electronic signature for signing the Initial And Annual Expatriation Statement Internal Revenue in Gmail

How to generate an eSignature for the Initial And Annual Expatriation Statement Internal Revenue from your smart phone

How to create an eSignature for the Initial And Annual Expatriation Statement Internal Revenue on iOS devices

How to create an eSignature for the Initial And Annual Expatriation Statement Internal Revenue on Android OS

People also ask

-

What is the significance of form 8854 2019 for expatriates?

Form 8854 2019 is essential for expatriates as it certifies that they have complied with U.S. tax obligations upon relinquishing their citizenship. This form helps the IRS determine the individual's tax status and any potential exit tax liabilities. Ensuring successful submission can prevent future tax complications.

-

How can airSlate SignNow simplify the process of submitting form 8854 2019?

AirSlate SignNow streamlines the process of preparing and submitting form 8854 2019 by allowing users to easily create, edit, and sign documents digitally. Its user-friendly interface ensures that expatriates can complete their paperwork efficiently without the hassles of traditional methods. This reduces the time and effort involved in ensuring compliance.

-

What features does airSlate SignNow offer to assist with form 8854 2019?

AirSlate SignNow includes features such as document templates, customizable workflows, and mobile access, which can signNowly aid in managing form 8854 2019. Users can utilize templates specifically designed for expatriate tax forms to save time. Additionally, the ability to track document status ensures that nothing is overlooked.

-

Is there a cost associated with using airSlate SignNow for form 8854 2019?

Yes, airSlate SignNow offers a subscription-based pricing model that provides access to all features needed for managing form 8854 2019. Pricing varies based on the plan selected, which suits various business sizes and needs. Investing in this solution can save time and reduce the risk of errors in the submission process.

-

Can I integrate other platforms with airSlate SignNow to help with form 8854 2019?

Absolutely! AirSlate SignNow integrates seamlessly with various platforms like CRMs and document management systems to enhance the process of handling form 8854 2019. These integrations facilitate the transfer of information and improve workflow efficiency, making compliance easier for users.

-

What are the benefits of using airSlate SignNow for affiliates dealing with form 8854 2019?

Using airSlate SignNow offers affiliates the advantage of a straightforward signing experience for form 8854 2019. The digital signing process is secure and complies with legal standards, enhancing credibility. Moreover, affiliates can manage multiple documents concurrently, which streamlines operations.

-

How does airSlate SignNow ensure the security of documents like form 8854 2019?

AirSlate SignNow employs advanced encryption and secure cloud storage to ensure the safety of sensitive documents like form 8854 2019. Users can rest assured that their data is protected against unauthorized access and bsignNowes. This focus on security provides users with peace of mind while utilizing eSigning solutions.

Get more for Irs Form 8854

- Revenue minnesota form

- Changes to the alternative minimum tax as proposed in form

- Your search search page mn gov minnesotas state portal form

- Form 25 100 annual insurance premium tax report

- Minnesota form m1 instructions

- Irs posts form 4972 used to claim special tax

- What credit is available for taxes paid to another state form

- M15c fill out and sign printable pdf template form

Find out other Irs Form 8854

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure