1040a Form 2017-2026

What is the 1040A Form

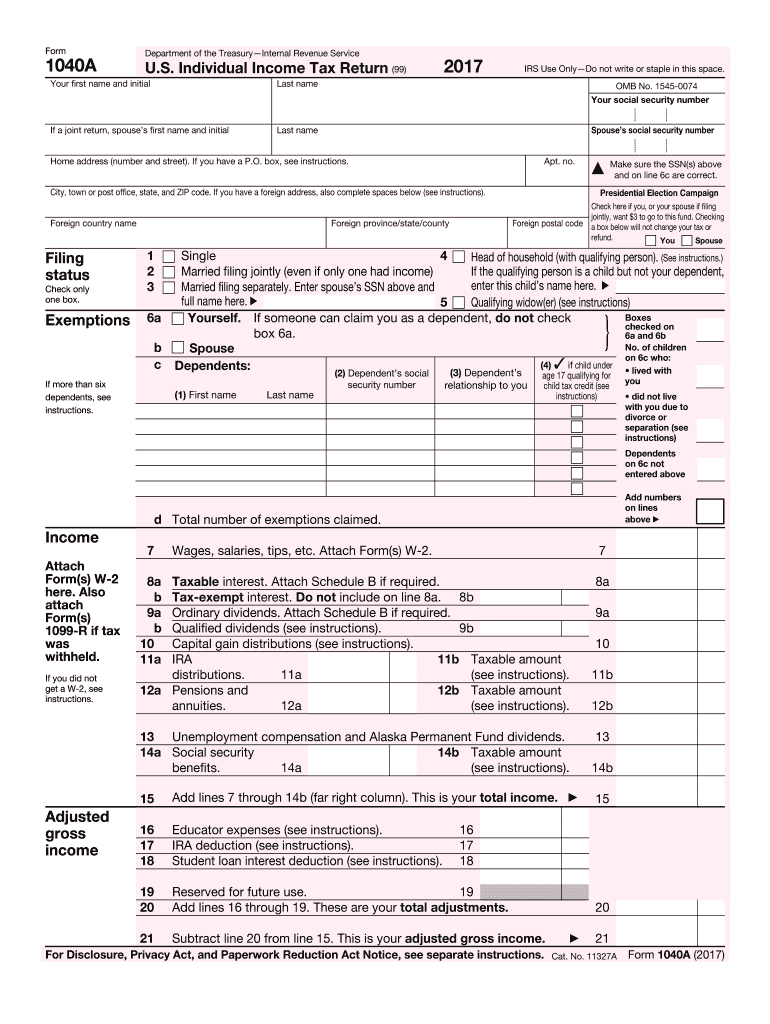

The 1040A form is a simplified version of the federal income tax return used by individuals in the United States. This form is suitable for taxpayers with straightforward tax situations, allowing them to report income, claim deductions, and calculate their tax liability. It is shorter than the standard 1040 form and is designed for those earning less than one hundred thousand dollars. The 1040A form includes sections for reporting wages, interest, dividends, and certain retirement distributions.

How to Use the 1040A Form

Using the 1040A form involves several steps to ensure accurate reporting of your income and deductions. Begin by gathering all necessary documents, such as W-2s, 1099s, and records of any other income. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income in the appropriate sections, and claim any eligible deductions, such as the standard deduction. After completing the form, review all entries for accuracy before submission.

Steps to Complete the 1040A Form

Completing the 1040A form can be done efficiently by following these steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Enter your personal information at the top of the form.

- Report your income in the designated sections, ensuring all amounts are accurate.

- Claim deductions, such as the standard deduction, in the appropriate fields.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submitting it to the IRS.

Required Documents

When filling out the 1040A form, you will need several documents to ensure accurate reporting. These include:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work.

- Records of any interest or dividend income.

- Documentation for any deductions you plan to claim, such as student loan interest or tuition payments.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the 1040A form to avoid penalties. Typically, the deadline for filing your federal income tax return is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, which allows for additional time to submit the form, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1040A form. Taxpayers should refer to the IRS instructions for the 1040A, which outline eligibility criteria, required documentation, and detailed instructions for each section of the form. Following these guidelines ensures compliance with federal tax laws and helps minimize the risk of errors that could lead to audits or penalties.

Quick guide on how to complete 1040a 2015 2017 2018 form

Explore the easiest method to complete and sign your 1040a Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior approach to fill out and sign your 1040a Form and related forms for public services. Our advanced eSignature solution provides all the tools necessary to handle documents swiftly and in compliance with official guidelines - robust PDF editing, management, security, signing, and sharing resources are readily available within a user-friendly interface.

Only a few steps are needed to complete and sign your 1040a Form:

- Upload the fillable template to the editor by clicking the Get Form button.

- Review what information you need to enter in your 1040a Form.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is signNow or Cover sections that are no longer relevant.

- Press Sign to create a legally binding eSignature using your preferred method.

- Insert the Date alongside your signature and finalize your task with the Done button.

Store your finished 1040a Form in the Documents folder in your profile, download it, or send it to your preferred cloud storage. Our tool also offers versatile form sharing options. There's no need to print out your templates when submitting them to the appropriate public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a go now!

Create this form in 5 minutes or less

Find and fill out the correct 1040a 2015 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the 1040a 2015 2017 2018 form

How to make an electronic signature for your 1040a 2015 2017 2018 Form online

How to create an electronic signature for the 1040a 2015 2017 2018 Form in Google Chrome

How to make an electronic signature for signing the 1040a 2015 2017 2018 Form in Gmail

How to make an electronic signature for the 1040a 2015 2017 2018 Form from your smartphone

How to generate an eSignature for the 1040a 2015 2017 2018 Form on iOS devices

How to create an electronic signature for the 1040a 2015 2017 2018 Form on Android

People also ask

-

What is the 1040a Form and when should I use it?

The 1040a Form is a simplified version of the IRS Form 1040, designed for taxpayers with straightforward tax situations. You should use the 1040a Form if you meet specific criteria, such as having a taxable income below a certain threshold and claiming only certain credits or deductions. It's a user-friendly option that streamlines the filing process.

-

How can airSlate SignNow help me with my 1040a Form?

airSlate SignNow provides an efficient platform for electronically signing and sending your 1040a Form. With our intuitive interface, you can easily upload your completed form and request signatures from other parties, ensuring your tax documents are handled securely and quickly.

-

Is there a cost associated with using airSlate SignNow for my 1040a Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including plans tailored for businesses and individuals. While there is a cost associated with using our services, many users find it cost-effective compared to traditional methods of document signing and management, especially for forms like the 1040a Form.

-

Can I customize my 1040a Form template with airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your 1040a Form template to fit your specific requirements. This flexibility allows you to add fields, logos, and other branding elements, making it easy to create a professional-looking document that meets your needs.

-

What features does airSlate SignNow offer for managing the 1040a Form?

airSlate SignNow offers a range of features designed to streamline the management of your 1040a Form. Key features include electronic signatures, document tracking, cloud storage for easy access, and integration with other applications, allowing for a seamless workflow.

-

Can I integrate airSlate SignNow with my accounting software for the 1040a Form?

Yes, airSlate SignNow integrates with popular accounting software solutions, making it easy to manage your 1040a Form alongside your financial records. This integration ensures that your documents are synchronized, reducing the risk of errors and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for my 1040a Form?

Using airSlate SignNow for your 1040a Form offers numerous benefits, including increased efficiency, improved security, and ease of use. Our digital solution allows you to complete and sign your tax documents quickly, reducing the time spent on administrative tasks and ensuring your sensitive information is protected.

Get more for 1040a Form

Find out other 1040a Form

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast