Dept of the Treasury Irs Form 941

What is the Dept Of The Treasury IRS Form 941?

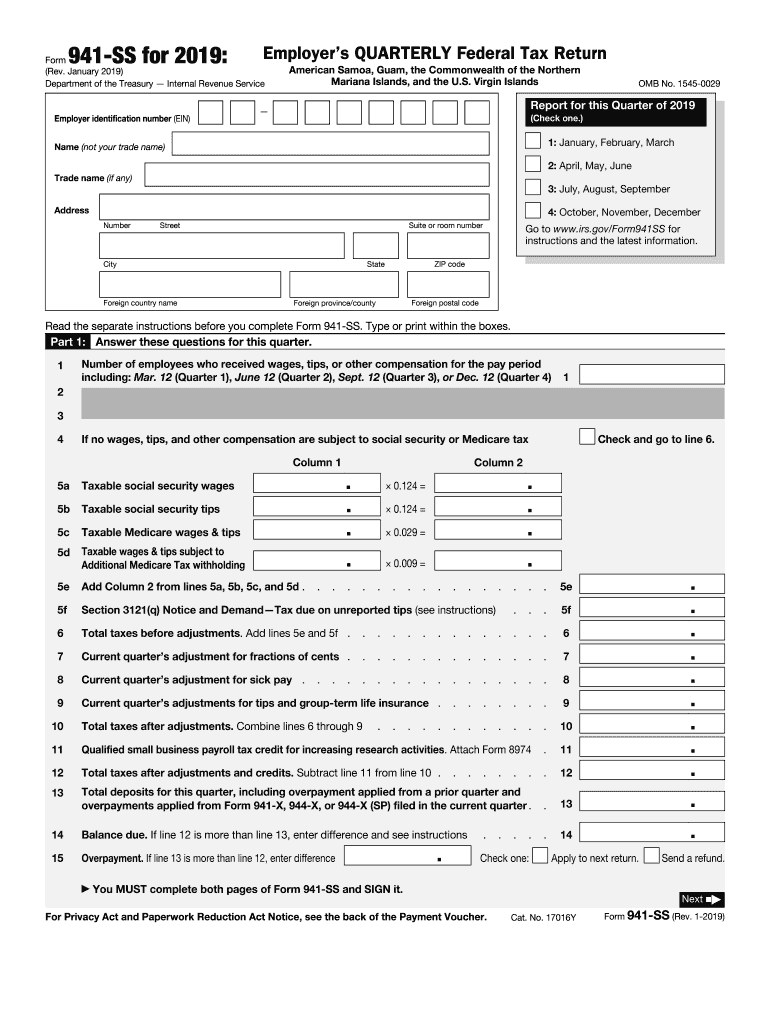

The Dept Of The Treasury IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and is essential for ensuring compliance with federal tax obligations. Businesses must accurately report the total wages paid to employees, the taxes withheld, and the employer's share of Social Security and Medicare taxes. The information provided on Form 941 is vital for the IRS to track tax liabilities and ensure that employers are meeting their tax responsibilities.

Steps to complete the Dept Of The Treasury IRS Form 941

Completing the IRS Form 941 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as the total number of employees, wages paid, and taxes withheld during the quarter. Follow these steps:

- Enter your business information, including the name, address, and Employer Identification Number (EIN).

- Report the total number of employees who received wages during the quarter.

- Calculate the total wages paid and the corresponding federal income tax withheld.

- Determine the employer's share of Social Security and Medicare taxes.

- Complete the section for any adjustments, such as sick pay or tips.

- Sign and date the form to certify the accuracy of the information provided.

Once completed, the form can be submitted electronically or by mail, depending on your preference and the requirements set by the IRS.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for IRS Form 941 to avoid penalties. The form must be filed quarterly, with the following deadlines:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Employers should ensure that the form is filed by these deadlines to maintain compliance and avoid potential penalties.

Legal use of the Dept Of The Treasury IRS Form 941

The legal use of IRS Form 941 is essential for employers to fulfill their tax obligations under federal law. Filing this form accurately and on time is crucial for maintaining compliance with the Internal Revenue Code. Employers must ensure that all information reported is truthful and complete, as any discrepancies can lead to audits or penalties. Additionally, the form serves as documentation of the employer's tax responsibilities and contributions to Social Security and Medicare, which are vital for employee benefits.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting IRS Form 941. The form can be filed electronically through the IRS e-file system, which is often the quickest and most efficient method. Alternatively, employers may choose to mail a paper version of the form to the appropriate IRS address based on their location. In some cases, in-person submission may be available, but this is less common. Regardless of the method chosen, it is crucial to keep a copy of the submitted form for your records.

Key elements of the Dept Of The Treasury IRS Form 941

Understanding the key elements of IRS Form 941 is essential for accurate completion. The form includes sections for reporting:

- Employer information, including name, address, and EIN.

- Total number of employees and wages paid during the quarter.

- Federal income tax withheld from employees' wages.

- Employer's share of Social Security and Medicare taxes.

- Any adjustments for sick pay or tips.

Each element must be carefully filled out to ensure compliance with IRS regulations and to avoid potential issues with tax liabilities.

Quick guide on how to complete about form 941 ssinternal revenue service irsgov

Complete Dept Of The Treasury Irs Form 941 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly without interruptions. Manage Dept Of The Treasury Irs Form 941 on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Dept Of The Treasury Irs Form 941 with minimal effort

- Find Dept Of The Treasury Irs Form 941 and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Dept Of The Treasury Irs Form 941 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 941 ssinternal revenue service irsgov

How to create an eSignature for the About Form 941 Ssinternal Revenue Service Irsgov online

How to make an electronic signature for the About Form 941 Ssinternal Revenue Service Irsgov in Google Chrome

How to generate an electronic signature for putting it on the About Form 941 Ssinternal Revenue Service Irsgov in Gmail

How to create an eSignature for the About Form 941 Ssinternal Revenue Service Irsgov from your mobile device

How to create an eSignature for the About Form 941 Ssinternal Revenue Service Irsgov on iOS

How to make an eSignature for the About Form 941 Ssinternal Revenue Service Irsgov on Android

People also ask

-

What is the ss 941 2019 form?

The ss 941 2019 form is a tax reporting document used by employers to report income taxes withheld from employee wages and the employer's portion of Social Security and Medicare taxes. Understanding this form is crucial for compliance and avoiding penalties. With airSlate SignNow, you can easily manage and eSign your documents related to the ss 941 2019.

-

How can airSlate SignNow help with ss 941 2019 submissions?

airSlate SignNow provides an intuitive platform that allows you to quickly prepare and eSign your ss 941 2019 forms. Our easy-to-use features streamline the process of completing necessary paperwork, ensuring timely submissions. Benefit from templates and reminders to keep you organized in handling these critical tax documents.

-

What are the pricing options for using airSlate SignNow for ss 941 2019 forms?

Our pricing structure at airSlate SignNow is designed to be cost-effective for all types of businesses looking to manage their ss 941 2019 forms. We offer a range of plans based on your needs, including a free trial for new users. This allows you to explore how our platform can simplify your document management.

-

Can I integrate airSlate SignNow with other tools for managing ss 941 2019?

Yes, airSlate SignNow supports integrations with various business tools and software. You can connect it with your existing accounting platforms or document management systems to efficiently handle your ss 941 2019 submissions. This integration enhances productivity by streamlining your workflow.

-

What security measures does airSlate SignNow offer for handling ss 941 2019 forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive ss 941 2019 documents. Our platform employs industry-standard encryption, secure cloud storage, and strict access controls to protect your information. You can confidently eSign and store your forms knowing they are safe.

-

Is it easy to make changes to ss 941 2019 forms with airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily edit and make changes to your ss 941 2019 forms before eSigning. The intuitive interface makes it simple to update any information and ensure compliance before submitting the documents to the IRS.

-

How does airSlate SignNow enhance the accuracy of my ss 941 2019 filings?

With airSlate SignNow, you can minimize errors in your ss 941 2019 filings through template usage and form validation features. Our system prompts you to fill out all necessary fields, ensuring compliance with IRS requirements. This signNowly reduces the chances of costly mistakes.

Get more for Dept Of The Treasury Irs Form 941

- Ucc financing statement amendment additional party california form

- Nrels cost of renewable energy form

- Delaware state fire school 488249218 form

- Statement of consent u s passport issuance form

- Indiana pro se motion forms fillable and downloadable

- Occupational rent contract template form

- Occupation wales contract template form

- Occupational therapy contract template form

Find out other Dept Of The Treasury Irs Form 941

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement