1041 Qft Form

What is the 1041 QFT

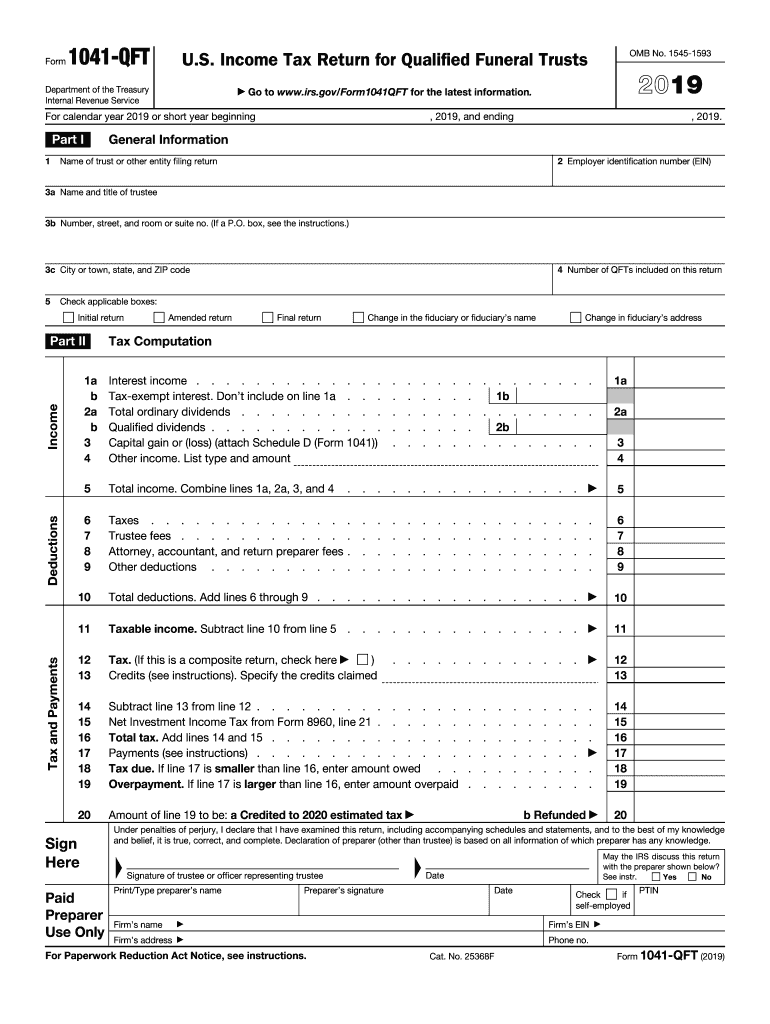

The 1041 QFT, or Qualified Funeral Trust, is a specific tax form used in the United States for reporting income generated by irrevocable funeral trusts. These trusts are designed to set aside funds for funeral expenses while ensuring that the assets are not counted against an individual's Medicaid eligibility. The form must be filed by the trust itself, typically on an annual basis, to report any income earned during the tax year. Understanding the 1041 QFT is essential for trustees and beneficiaries to ensure compliance with IRS regulations and to manage the trust effectively.

How to use the 1041 QFT

Using the 1041 QFT involves several key steps. First, the trustee must gather all necessary financial information related to the trust, including income earned and expenses incurred. Next, the trustee completes the form, providing details such as the trust's name, tax identification number, and the income generated during the tax year. It is important to ensure that all figures are accurate to avoid penalties. Once completed, the form should be submitted to the IRS, along with any required supporting documentation.

Steps to complete the 1041 QFT

Completing the 1041 QFT requires careful attention to detail. Here are the steps involved:

- Gather financial records for the trust, including income statements and expense receipts.

- Obtain the correct version of the 1041 QFT form from the IRS website.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the designated filing deadline.

Legal use of the 1041 QFT

The legal use of the 1041 QFT is governed by IRS regulations, which stipulate that the trust must be irrevocable and established for the purpose of paying funeral expenses. This means that once the trust is created, the assets cannot be withdrawn or altered by the grantor. Additionally, the income generated by the trust must be reported on the 1041 QFT to ensure compliance with tax laws. Failure to adhere to these legal requirements can result in penalties or the trust losing its qualified status.

IRS Guidelines

The IRS provides specific guidelines for the 1041 QFT, detailing how the trust should be structured and managed. These guidelines include information on the types of expenses that can be covered by the trust, the necessary documentation for filing, and the reporting requirements for income generated by the trust. It is crucial for trustees to familiarize themselves with these guidelines to ensure that the trust remains compliant and that beneficiaries receive the intended benefits without tax complications.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 QFT are typically aligned with the standard tax deadlines for trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For most trusts, this means the form is due on April 15. It is important for trustees to mark their calendars for these dates to avoid late filing penalties and ensure timely compliance with IRS regulations.

Quick guide on how to complete 2019 form 1041 qft us income tax return for qualified funeral trusts

Effortlessly Prepare 1041 Qft on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any delays. Manage 1041 Qft on any device with the airSlate SignNow applications available for Android and iOS, and enhance any document-based process today.

How to Edit and Electronically Sign 1041 Qft with Ease

- Obtain 1041 Qft and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 1041 Qft and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1041 qft us income tax return for qualified funeral trusts

How to create an eSignature for the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts online

How to generate an electronic signature for the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts in Chrome

How to make an eSignature for putting it on the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts in Gmail

How to make an electronic signature for the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts right from your smartphone

How to generate an eSignature for the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts on iOS

How to generate an electronic signature for the 2019 Form 1041 Qft Us Income Tax Return For Qualified Funeral Trusts on Android OS

People also ask

-

What is the 1041 qft and how does it relate to airSlate SignNow?

The 1041 qft is a tax form used to report income for trusts and estates. While it may not be directly related to airSlate SignNow, our platform can help you eSign and manage your 1041 qft documents efficiently, ensuring that your important paperwork is handled securely.

-

How much does it cost to use airSlate SignNow for signing 1041 qft documents?

airSlate SignNow offers various pricing plans starting at a competitive rate that makes it accessible for businesses of all sizes. Whether you need to sign a 1041 qft document or multiple forms, our pricing is designed to provide an effective solution without breaking the bank.

-

What features does airSlate SignNow offer for managing legal documents like the 1041 qft?

airSlate SignNow provides features such as document templates, customized workflows, and secure eSigning, making it ideal for managing legal documents like the 1041 qft. These features help streamline your document processes and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for processing 1041 qft forms?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to process 1041 qft forms. Whether you use CRM systems or cloud storage, our integrations make it easy to manage your documents across platforms effectively.

-

What are the benefits of using airSlate SignNow for eSigning my 1041 qft?

Using airSlate SignNow for eSigning your 1041 qft offers numerous benefits, including increased efficiency, reduced paper waste, and enhanced security. Our platform ensures that your documents are signed quickly while maintaining the integrity of your sensitive information.

-

Is airSlate SignNow compliant with legal standards for documents like the 1041 qft?

Absolutely! airSlate SignNow is designed to comply with legal standards for eSignatures, making it a reliable choice for documents like the 1041 qft. Our compliance assures users that their electronically signed documents hold legal weight and are recognized in court.

-

What support options are available for questions regarding my 1041 qft documents on airSlate SignNow?

airSlate SignNow provides a variety of support options to assist you with any questions about your 1041 qft documents. From comprehensive online resources to dedicated customer service, we're here to ensure you receive the assistance you need for smooth document management.

Get more for 1041 Qft

Find out other 1041 Qft

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online