Form 1040 Printable 2018

What is the Form 1040 Printable

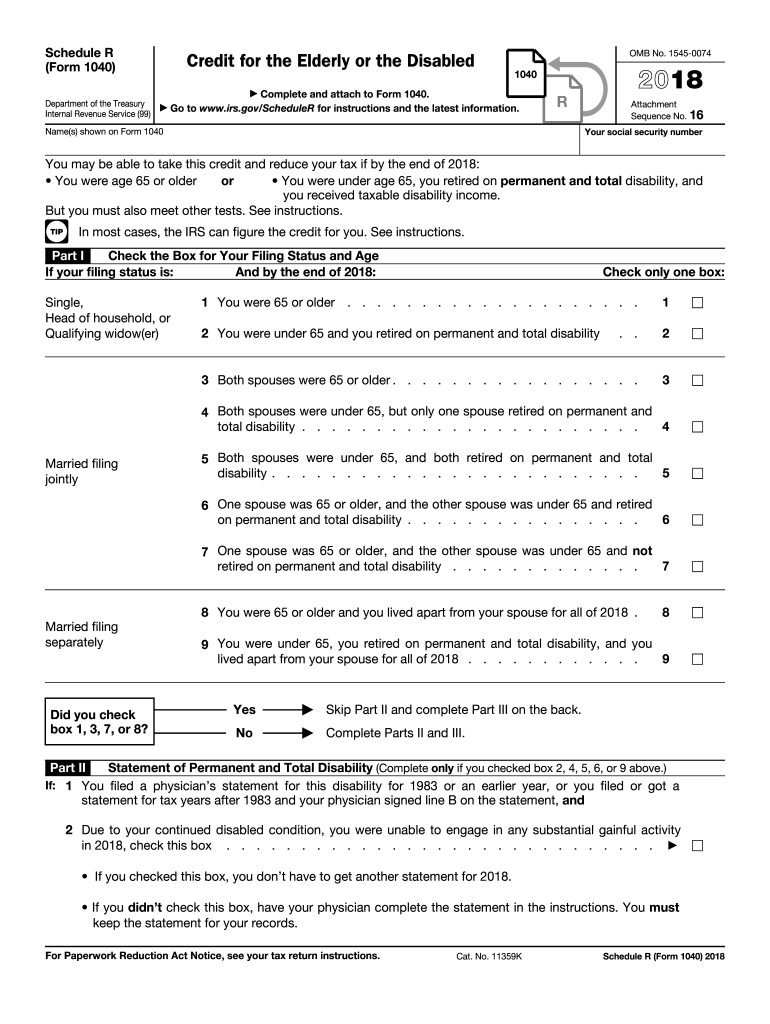

The Form 1040 Printable is the standard individual income tax return form used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form allows taxpayers to calculate their taxable income, claim deductions, and determine their tax liability or refund. The 2018 version of this form includes specific sections for reporting various types of income, such as wages, dividends, and capital gains, as well as credits like the elderly tax credit.

Eligibility Criteria

To qualify for the elderly tax credit in 2018, taxpayers must meet certain criteria. Generally, individuals aged sixty-five or older at the end of the tax year are eligible. The credit is designed to assist those with limited income. Additionally, the taxpayer must have a qualifying income level that falls below specific thresholds set by the IRS. It is important to review the eligibility requirements thoroughly to ensure compliance and maximize potential benefits.

Steps to complete the Form 1040 Printable

Completing the Form 1040 Printable involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income on the appropriate lines of the form.

- Claim deductions and credits, including the elderly tax credit, if eligible.

- Calculate total tax liability or refund by following the instructions provided on the form.

- Sign and date the form before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Printable. Taxpayers should refer to the instructions provided with the form, which detail how to report income, claim deductions, and apply for credits. The guidelines also outline the necessary documentation needed to support claims made on the form. Adhering to these guidelines is crucial for ensuring that the return is processed accurately and efficiently.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1040 Printable. The form can be filed electronically using approved software or through a tax professional. Alternatively, individuals may choose to print the completed form and mail it to the appropriate IRS address. In-person submission is generally not an option for individual tax returns, as the IRS does not accept walk-in filings. It is important to verify submission methods and ensure that the form is sent to the correct location based on the taxpayer's state of residence.

Filing Deadlines / Important Dates

The deadline for filing the Form 1040 Printable for the 2018 tax year was April 15, 2019. Taxpayers who were unable to meet this deadline could file for an extension, allowing for additional time to submit their return. However, it is essential to note that any taxes owed were still due by the original deadline to avoid penalties and interest. Keeping track of important dates is crucial for maintaining compliance with IRS regulations.

Quick guide on how to complete r form print 2018

Discover the simplest method to complete and sign your Form 1040 Printable

Are you still spending time creating your formal documents on paper instead of doing it online? airSlate SignNow provides a superior way to complete and sign your Form 1040 Printable and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - robust PDF editing, managing, securing, signing, and sharing features all available within a user-friendly interface.

Only a few steps are needed to finalize and sign your Form 1040 Printable:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to enter in your Form 1040 Printable.

- Navigate between the fields using the Next option to ensure you don’t miss anything.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Conceal areas that are no longer relevant.

- Hit Sign to generate a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and finish your task with the Done button.

Store your completed Form 1040 Printable in the Documents folder in your profile, download it, or export it to your chosen cloud storage. Our service also provides versatile file sharing. There’s no need to print your templates when you have to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct r form print 2018

FAQs

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

What is the process to fill out the CISF recruitment 2018 application form?

Central Industrial Security Force (CISF) Job Notification:Central Industrial Security Force (CISF) invited applications for the 519 posts of Assistant Sub-Inspector post. The eligible candidates can apply to the post through the prescribed format on or before 15 December 2018.Important Date:Last date of receipt of application by the Unit Commanders: 12 December 2018Last date of receipt of application by respective Zonal DIsG: 22 December 2018Written examination: 24 February 2019

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

Create this form in 5 minutes!

How to create an eSignature for the r form print 2018

How to make an eSignature for the R Form Print 2018 in the online mode

How to create an electronic signature for the R Form Print 2018 in Chrome

How to create an eSignature for putting it on the R Form Print 2018 in Gmail

How to generate an electronic signature for the R Form Print 2018 right from your smart phone

How to make an electronic signature for the R Form Print 2018 on iOS devices

How to make an eSignature for the R Form Print 2018 on Android

People also ask

-

What is a Form 1040 Printable and how can it be used?

A Form 1040 Printable is the standard IRS form used by individuals to file their annual income tax returns. You can download and print the Form 1040 Printable from the IRS website or use airSlate SignNow to electronically sign and submit it securely. This makes tax filing more efficient and ensures that your documents are handled safely.

-

Can I fill out a Form 1040 Printable online?

Yes, you can fill out a Form 1040 Printable online using airSlate SignNow. Our platform offers user-friendly tools that allow you to complete your tax form digitally, saving you time and reducing the risk of errors. Once completed, you can easily eSign and send it directly to the IRS.

-

Is there a cost associated with using the Form 1040 Printable feature on airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for managing your Form 1040 Printable. While basic features are often free, premium plans provide additional functionalities like unlimited cloud storage and advanced eSigning options. Check our pricing page for detailed information on plans and features.

-

What are the benefits of using airSlate SignNow for my Form 1040 Printable?

Using airSlate SignNow for your Form 1040 Printable enhances your tax filing experience by providing a straightforward and secure platform for document management. You can easily fill, eSign, and store your forms, all in one place, which simplifies the process and ensures compliance with IRS regulations.

-

Does airSlate SignNow integrate with other accounting software for handling Form 1040 Printable?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to streamline your workflow when handling Form 1040 Printable. This means you can easily import your financial data and export your completed forms for submission, improving efficiency and accuracy.

-

How can I ensure my Form 1040 Printable is secure when using airSlate SignNow?

AirSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect your Form 1040 Printable and any sensitive information. Our platform is designed to keep your documents safe, ensuring that your personal data is only accessible to authorized users.

-

Can I access my completed Form 1040 Printable after submission?

Absolutely! With airSlate SignNow, you can access your completed Form 1040 Printable at any time after submission. Our cloud storage feature allows you to securely save and retrieve your documents whenever needed, providing peace of mind and easy access to your tax records.

Get more for Form 1040 Printable

Find out other Form 1040 Printable

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form