Personal Tax Credits Return Form

What is the Personal Tax Credits Return

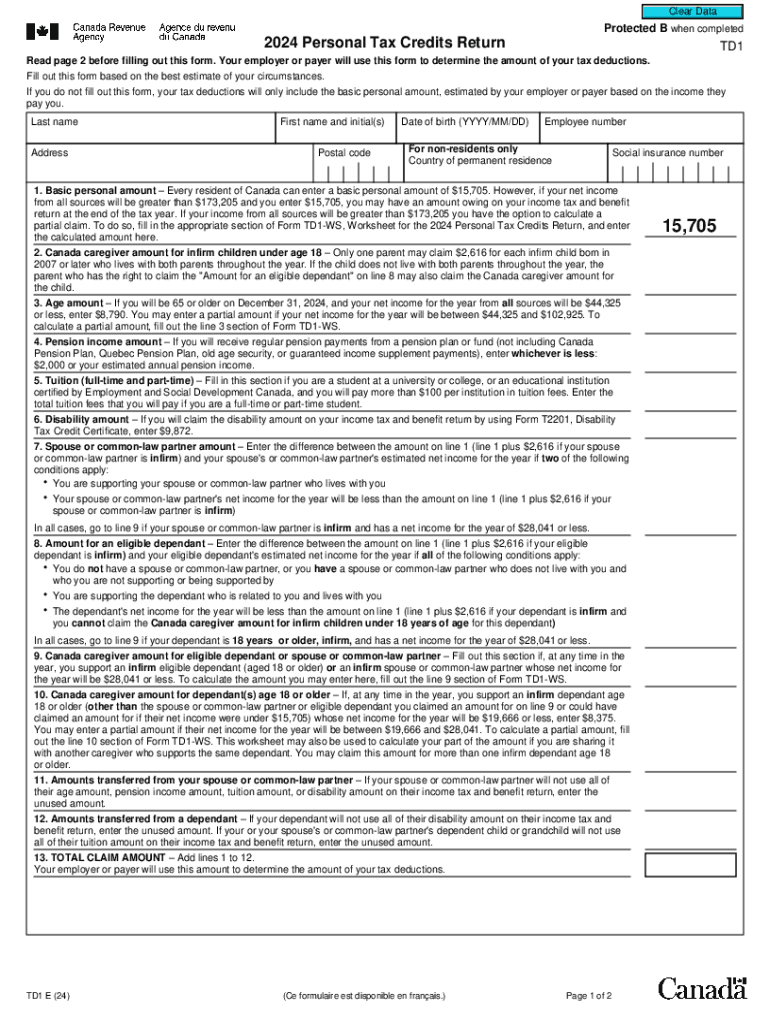

The Personal Tax Credits Return, commonly referred to as the TD1 form, is a crucial document used in Canada to determine the amount of tax to be withheld from an employee's income. This form allows individuals to claim personal tax credits, which can reduce their overall tax liability. By providing information about their personal circumstances, such as marital status and dependents, taxpayers can ensure that the correct amount of tax is deducted from their paychecks.

How to use the Personal Tax Credits Return

To effectively use the Personal Tax Credits Return, individuals must complete the form accurately and submit it to their employer. This ensures that the employer can withhold the appropriate amount of tax from their earnings. The form includes sections for various tax credits, such as the basic personal amount, spousal amount, and amounts for dependents. It is important to review the form annually or whenever there is a significant change in personal circumstances, as this may affect the credits claimed.

Steps to complete the Personal Tax Credits Return

Completing the Personal Tax Credits Return involves several key steps:

- Obtain the latest version of the TD1 form, available from the Canada Revenue Agency (CRA) website.

- Fill out personal information, including name, address, and social insurance number.

- Indicate your eligibility for various tax credits by checking the appropriate boxes and providing necessary details.

- Sign and date the form to confirm the information is accurate.

- Submit the completed form to your employer, who will use it to calculate tax deductions from your pay.

Key elements of the Personal Tax Credits Return

The Personal Tax Credits Return consists of several key elements that taxpayers should be aware of:

- Basic Personal Amount: A standard credit available to all taxpayers.

- Spousal Amount: Available if you support a spouse or common-law partner.

- Dependent Amounts: Additional credits for children or other dependents.

- Other Credits: Additional credits may apply based on specific circumstances, such as disability or age.

Eligibility Criteria

To be eligible to complete the Personal Tax Credits Return, individuals must meet certain criteria:

- Must be a resident of Canada for tax purposes.

- Must have income from employment or other sources that requires tax withholding.

- Must provide accurate personal information and any relevant documentation to support claims for tax credits.

Form Submission Methods

The completed Personal Tax Credits Return can be submitted in various ways:

- Online: Some employers may allow electronic submission through payroll systems.

- Mail: Send a physical copy of the completed form to your employer's payroll department.

- In-Person: Deliver the form directly to your employer's HR or payroll office.

Legal use of the Personal Tax Credits Return

The Personal Tax Credits Return is a legally binding document. Providing false information or failing to submit the form can lead to incorrect tax withholding, which may result in penalties or additional taxes owed at the end of the tax year. It is essential for taxpayers to ensure that all information is accurate and up to date to comply with Canadian tax laws.

Quick guide on how to complete personal tax credits return

Effortlessly Prepare Personal Tax Credits Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Personal Tax Credits Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Personal Tax Credits Return Effortlessly

- Find Personal Tax Credits Return and click Get Form to begin your process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new document prints. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign Personal Tax Credits Return and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal tax credits return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TD1 forms in Ontario?

TD1 forms in Ontario are used to determine the amount of tax to be deducted from an employee's income. These forms allow employees to claim personal tax credits and deductions, ensuring accurate tax withholding. Understanding TD1 forms Ontario is essential for both employers and employees to comply with tax regulations.

-

How can airSlate SignNow help with TD1 forms in Ontario?

airSlate SignNow simplifies the process of sending and signing TD1 forms in Ontario. With our platform, you can easily create, send, and eSign these forms, ensuring a smooth and efficient workflow. This not only saves time but also enhances accuracy in tax documentation.

-

Is there a cost associated with using airSlate SignNow for TD1 forms in Ontario?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution provides access to features that streamline the management of TD1 forms in Ontario. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing TD1 forms in Ontario?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for TD1 forms in Ontario. These tools enhance efficiency and ensure that all necessary information is captured accurately. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for TD1 forms in Ontario?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage TD1 forms in Ontario seamlessly. Whether you use HR software or accounting tools, our platform can connect with them to streamline your document workflow.

-

What are the benefits of using airSlate SignNow for TD1 forms in Ontario?

Using airSlate SignNow for TD1 forms in Ontario provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible. This leads to a more organized approach to managing tax forms.

-

How secure is airSlate SignNow when handling TD1 forms in Ontario?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your TD1 forms in Ontario. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Personal Tax Credits Return

- Dads form 5515 nfa fillable

- James william yadkinville real estate forms

- Form no 61

- Cyberdrive illinois rdp form

- Flis licapp 001 affidavit form

- Viora reaction consent facial techniques form

- Michigan statement victims impact form

- Jv 260 notice of court hearing and temporary restraining order against a child judicial council forms

Find out other Personal Tax Credits Return

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer