37326 Required Minimum Distribution Request 2024

What is the 37326 Required Minimum Distribution Request

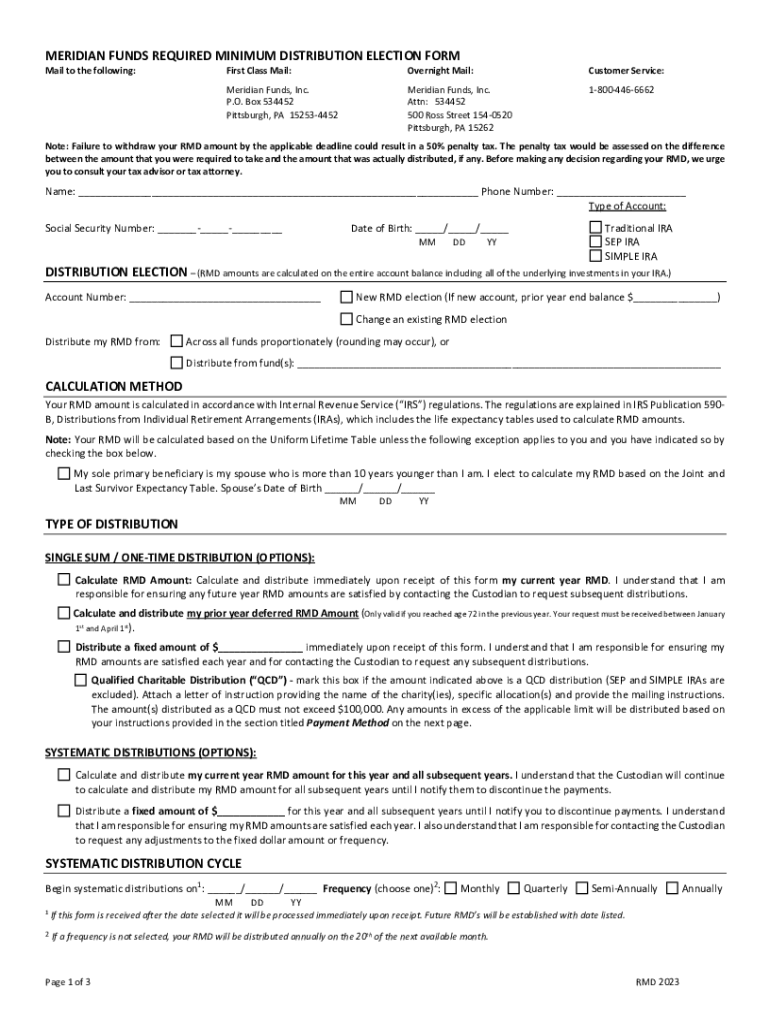

The 37326 Required Minimum Distribution Request is a formal document used by individuals to request the distribution of funds from their retirement accounts, such as IRAs or 401(k)s. This form is essential for those who have reached the age of seventy-two, as it ensures compliance with IRS regulations regarding minimum distributions. By submitting this request, account holders can manage their retirement funds effectively while adhering to legal requirements.

Steps to complete the 37326 Required Minimum Distribution Request

Completing the 37326 Required Minimum Distribution Request involves several key steps:

- Gather necessary personal information, including your Social Security number and account details.

- Determine the amount you wish to withdraw, ensuring it meets the IRS minimum distribution requirements.

- Fill out the form accurately, providing all requested information.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, either online, by mail, or in person.

How to obtain the 37326 Required Minimum Distribution Request

The 37326 Required Minimum Distribution Request can be obtained through various channels:

- Visit the official website of your retirement account provider, where the form is typically available for download.

- Contact customer service for assistance in obtaining the form directly.

- Check with financial advisors or tax professionals who may have access to the form.

Key elements of the 37326 Required Minimum Distribution Request

When filling out the 37326 Required Minimum Distribution Request, several key elements must be included:

- Account holder's name and contact information.

- Social Security number or taxpayer identification number.

- Details of the retirement account from which the distribution is requested.

- The specific amount to be distributed.

- Signature and date to validate the request.

IRS Guidelines

The IRS provides specific guidelines regarding Required Minimum Distributions (RMDs). According to these guidelines, individuals must begin taking distributions from their retirement accounts by the age of seventy-two. The amount of the distribution is calculated based on life expectancy and account balance. It is crucial to adhere to these guidelines to avoid potential penalties.

Penalties for Non-Compliance

Failure to comply with the Required Minimum Distribution rules can result in significant penalties. If an account holder does not withdraw the required amount, the IRS may impose a penalty of fifty percent on the amount that should have been withdrawn but was not. This underscores the importance of submitting the 37326 Required Minimum Distribution Request in a timely manner.

Quick guide on how to complete 37326 required minimum distribution request

Effortlessly Complete 37326 Required Minimum Distribution Request on Any Device

The management of online documents has become increasingly preferred by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow offers all the tools required to quickly create, modify, and eSign your documents without delays. Handle 37326 Required Minimum Distribution Request on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign 37326 Required Minimum Distribution Request with Ease

- Find 37326 Required Minimum Distribution Request and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or hide sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet-ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document search, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign 37326 Required Minimum Distribution Request to ensure outstanding communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 37326 required minimum distribution request

Create this form in 5 minutes!

How to create an eSignature for the 37326 required minimum distribution request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 37326 Required Minimum Distribution Request?

The 37326 Required Minimum Distribution Request is a form used to request the minimum distribution from retirement accounts. This form ensures compliance with IRS regulations regarding required minimum distributions, helping you avoid penalties. Using airSlate SignNow, you can easily fill out and eSign this document securely.

-

How can airSlate SignNow help with the 37326 Required Minimum Distribution Request?

airSlate SignNow streamlines the process of completing the 37326 Required Minimum Distribution Request by providing an intuitive interface for filling out forms. You can eSign documents quickly and securely, ensuring that your requests are processed without delays. This efficiency helps you manage your retirement distributions effectively.

-

Is there a cost associated with using airSlate SignNow for the 37326 Required Minimum Distribution Request?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that simplify the 37326 Required Minimum Distribution Request process. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for the 37326 Required Minimum Distribution Request?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the 37326 Required Minimum Distribution Request. These features enhance the user experience and ensure that your documents are handled efficiently. Additionally, you can integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other software for the 37326 Required Minimum Distribution Request?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the 37326 Required Minimum Distribution Request alongside your existing tools. This flexibility allows you to enhance your document management processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the 37326 Required Minimum Distribution Request?

Using airSlate SignNow for the 37326 Required Minimum Distribution Request provides numerous benefits, including time savings and improved accuracy. The platform reduces the risk of errors and ensures that your requests are submitted on time. Additionally, the secure eSigning feature enhances the confidentiality of your sensitive information.

-

How secure is airSlate SignNow when handling the 37326 Required Minimum Distribution Request?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling the 37326 Required Minimum Distribution Request, you can trust that your information is safe and secure. Our platform meets industry standards to ensure confidentiality and integrity.

Get more for 37326 Required Minimum Distribution Request

- Missouri department of corrections law enforcement notification system form

- Sdcera form

- Peia prior authorization form

- Pershing llc joint transfer on death form

- Define deed of trust in real estate form

- Extensionsecretarys recordryearcounty44eeetitni form

- Ama guides 6th edition training february registration form ok

- Add amp drop course form registrars office byuhawaii

Find out other 37326 Required Minimum Distribution Request

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free