Meridian RMD Form with Substitute W 4R SW 12 2024-2026

Understanding the Required Minimum Distribution Election Form

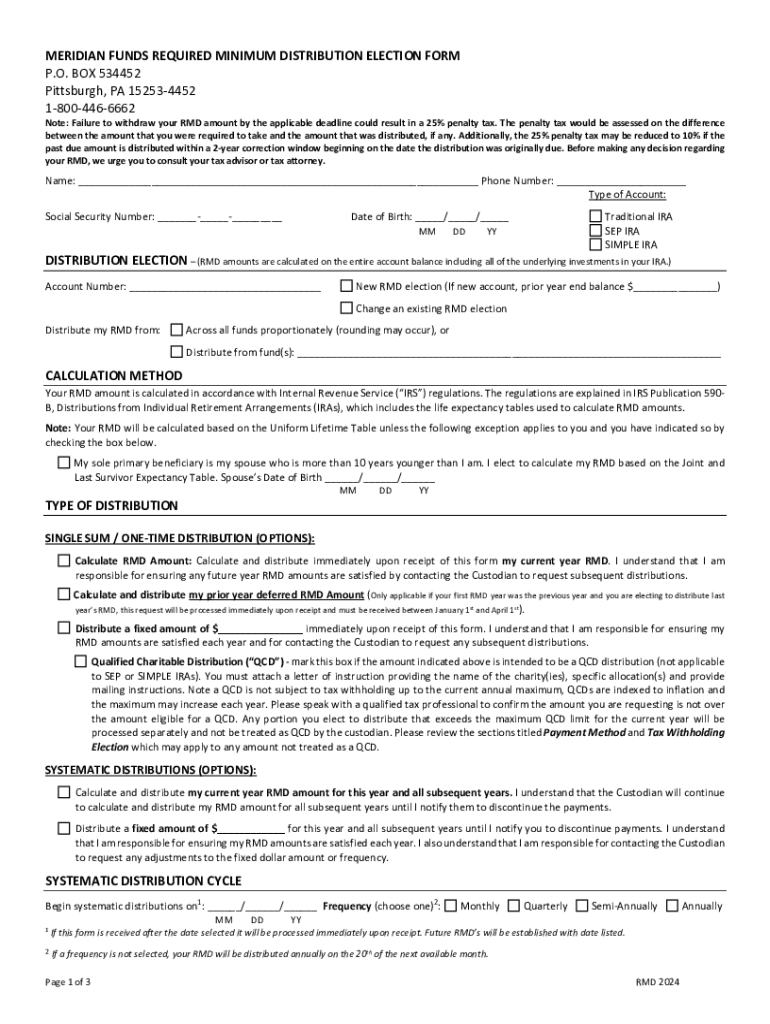

The required minimum distribution election form is a crucial document for individuals who are mandated to withdraw a minimum amount from their retirement accounts, such as IRAs and 401(k)s, once they reach a certain age. This form helps ensure compliance with IRS regulations regarding minimum distributions, which are designed to prevent tax-deferred retirement savings from being left untouched indefinitely. Understanding the purpose and requirements of this form is essential for maintaining tax compliance and managing retirement funds effectively.

Steps to Complete the Required Minimum Distribution Election Form

Completing the required minimum distribution election form involves a series of straightforward steps. First, gather necessary personal information, including your name, Social Security number, and account details. Next, indicate the amount you wish to withdraw, ensuring it meets or exceeds the IRS minimum requirement. After filling out the form, review all entries for accuracy. Finally, sign and date the form before submitting it to your financial institution. Each of these steps is vital to ensure that your distributions are processed correctly and on time.

Legal Use of the Required Minimum Distribution Election Form

The required minimum distribution election form serves a legal purpose by documenting your election to take distributions from your retirement accounts. This form must comply with IRS guidelines to avoid penalties associated with non-compliance. Proper use of this form helps protect individuals from tax liabilities that can arise from failing to withdraw the required amounts. It is important to understand the legal implications of this form, as incorrect submissions can lead to significant financial consequences.

Filing Deadlines and Important Dates

Filing deadlines for the required minimum distribution election form are critical to avoid penalties. Generally, individuals must begin taking distributions by April first of the year following the year they turn seventy-two. It is advisable to submit the election form well in advance of this deadline to ensure timely processing. Keeping track of these important dates helps individuals manage their retirement funds effectively and remain compliant with IRS regulations.

Who Issues the Required Minimum Distribution Election Form

The required minimum distribution election form is typically issued by financial institutions that manage retirement accounts. This includes banks, brokerage firms, and other entities that provide retirement savings plans. It is essential to obtain the correct version of the form from your financial institution, as variations may exist based on the type of retirement account you hold. Always ensure that you are using the most current and applicable form to avoid any issues with your distributions.

Penalties for Non-Compliance

Failure to comply with the required minimum distribution regulations can result in significant penalties. The IRS imposes a hefty excise tax on any amount that is not withdrawn as required, which can be as high as fifty percent of the shortfall. Understanding these penalties emphasizes the importance of timely and accurate completion of the required minimum distribution election form. Staying informed about compliance requirements helps individuals avoid unnecessary financial burdens during retirement.

Quick guide on how to complete meridian rmd form with substitute w 4r sw 12

Complete Meridian RMD Form With Substitute W 4R SW 12 effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, alter, and electronically sign your documents promptly without delays. Handle Meridian RMD Form With Substitute W 4R SW 12 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Meridian RMD Form With Substitute W 4R SW 12 without hassle

- Obtain Meridian RMD Form With Substitute W 4R SW 12 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and eSign Meridian RMD Form With Substitute W 4R SW 12 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct meridian rmd form with substitute w 4r sw 12

Create this form in 5 minutes!

How to create an eSignature for the meridian rmd form with substitute w 4r sw 12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a required minimum distribution election form?

A required minimum distribution election form is a document that allows individuals to elect how and when they will take their required minimum distributions from retirement accounts. This form is essential for ensuring compliance with IRS regulations regarding retirement withdrawals.

-

How can airSlate SignNow help with the required minimum distribution election form?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning your required minimum distribution election form. Our user-friendly interface ensures that you can complete the form quickly and securely, making the process hassle-free.

-

Is there a cost associated with using airSlate SignNow for the required minimum distribution election form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, allowing you to manage your required minimum distribution election form without breaking the bank.

-

What features does airSlate SignNow offer for managing the required minimum distribution election form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for your required minimum distribution election form. These features enhance efficiency and ensure that your documents are always accessible.

-

Can I integrate airSlate SignNow with other software for the required minimum distribution election form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your required minimum distribution election form alongside your existing tools. This integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the required minimum distribution election form?

Using airSlate SignNow for your required minimum distribution election form provides numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform simplifies the eSigning process, making it easier for you to stay compliant with IRS requirements.

-

How secure is the required minimum distribution election form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your required minimum distribution election form is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for Meridian RMD Form With Substitute W 4R SW 12

Find out other Meridian RMD Form With Substitute W 4R SW 12

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later