Irs Form 5498

What is the IRS Form 5498?

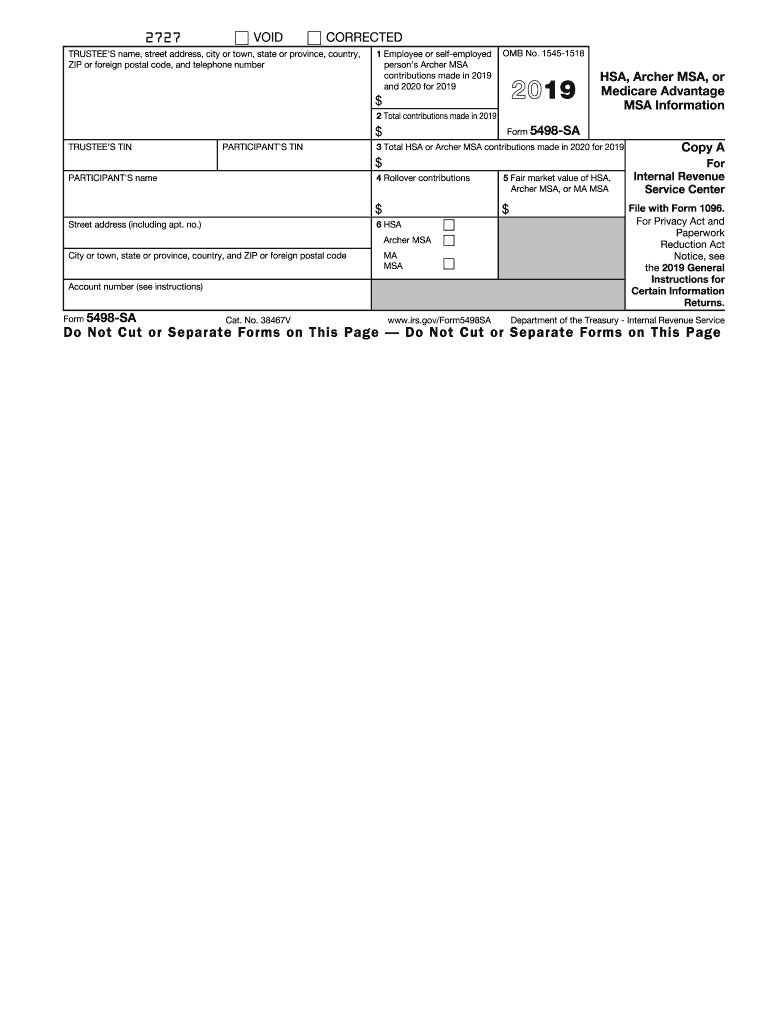

The IRS Form 5498 is a tax document used to report contributions to various types of retirement accounts. This form is essential for individuals who have made contributions to IRAs, including traditional IRAs, Roth IRAs, and Health Savings Accounts (HSAs). The 2 SA form specifically pertains to contributions made during the tax year 2019. It is important for taxpayers to understand that this form provides critical information to both the IRS and the account holders regarding their retirement savings.

How to Use the IRS Form 5498

Using the IRS Form 5498 involves several key steps. First, individuals must ensure that they receive the form from their financial institution or custodian by the deadline, which is typically May 31 of the year following the tax year. The form will outline the contributions made to the retirement account, including any rollovers or conversions. Taxpayers should retain this form for their records, as it is necessary for accurately reporting retirement contributions on their tax returns. Additionally, the information on the form can help individuals track their retirement savings progress.

Steps to Complete the IRS Form 5498

Completing the IRS Form 5498 involves a few straightforward steps. First, gather all relevant information regarding your retirement accounts, including contribution amounts and types of accounts. Next, accurately fill out the form with the required details, such as your name, address, and Social Security number. Be sure to include the total contributions made during the year, as well as any rollover amounts. Once completed, retain a copy for your records. The financial institution will file the form with the IRS on your behalf, so ensure that all information is accurate to avoid any discrepancies.

Legal Use of the IRS Form 5498

The IRS Form 5498 serves a legal purpose by documenting contributions to retirement accounts, which can impact tax liabilities and retirement planning. It is crucial to file this form accurately, as it provides proof of contributions that may qualify for tax deductions or credits. Failure to report contributions correctly can lead to penalties or disqualification of certain tax benefits. Understanding the legal implications of the form helps ensure compliance with IRS regulations and supports effective retirement planning.

Filing Deadlines / Important Dates

For the IRS Form 5498, the filing deadline is typically May 31 of the year following the tax year in which contributions were made. This means that for contributions made in 2019, the form must be filed by May 31, 2020. It is important for taxpayers to keep this date in mind to ensure that they receive the form in a timely manner and can accurately report their contributions on their tax returns. Additionally, individuals should be aware of any specific deadlines related to their retirement accounts, as these may vary depending on the type of account and the financial institution.

Who Issues the Form?

The IRS Form 5498 is issued by the financial institutions or custodians that manage the retirement accounts. These entities are responsible for reporting the contributions made by account holders to the IRS. It is important for individuals to ensure that their financial institution has accurate information regarding their contributions, as this will reflect on the form. If there are any discrepancies or if the form is not received by the deadline, individuals should contact their financial institution for clarification and correction.

Quick guide on how to complete form 5498 sa irsgov

Complete Irs Form 5498 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, alter, and eSign your documents promptly without any holdups. Manage Irs Form 5498 on any device with airSlate SignNow mobile apps for Android or iOS and enhance any document-centric process today.

How to alter and eSign Irs Form 5498 with ease

- Find Irs Form 5498 and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Irs Form 5498 to ensure exceptional communication at every stage of your form development process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5498 sa irsgov

How to make an electronic signature for your Form 5498 Sa Irsgov in the online mode

How to generate an electronic signature for the Form 5498 Sa Irsgov in Google Chrome

How to create an electronic signature for putting it on the Form 5498 Sa Irsgov in Gmail

How to generate an eSignature for the Form 5498 Sa Irsgov right from your smartphone

How to make an eSignature for the Form 5498 Sa Irsgov on iOS devices

How to make an electronic signature for the Form 5498 Sa Irsgov on Android devices

People also ask

-

What is Form 5498 SA 2019?

Form 5498 SA 2019 is an IRS form used to report contributions to an individual retirement account (IRA). It provides important information about contributions, rollovers, and the fair market value of the account. Understanding this form can help ensure compliance with tax regulations.

-

How can airSlate SignNow help with Form 5498 SA 2019?

airSlate SignNow simplifies the process of preparing and sending Form 5498 SA 2019 electronically. With our eSignature solution, users can easily sign and share the form securely, ensuring timely submission and reducing paper usage. This enhances efficiency and helps meet reporting deadlines.

-

Is there a cost associated with using airSlate SignNow for Form 5498 SA 2019?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions include features that support the preparation and electronic signing of forms like Form 5498 SA 2019. Check our pricing page for more details on the options available.

-

What features of airSlate SignNow are beneficial for managing Form 5498 SA 2019?

airSlate SignNow provides key features such as customizable templates, secure cloud storage, and electronic signature capabilities, specifically for forms like Form 5498 SA 2019. These features streamline the document workflow, making it easier to manage and share important tax documents.

-

Can I integrate airSlate SignNow with other software for Form 5498 SA 2019?

Yes, airSlate SignNow offers a variety of integrations with popular software solutions that can help you manage Form 5498 SA 2019. Whether you are using accounting, CRM, or document management systems, our integration capabilities ensure a seamless experience. This helps in maintaining data consistency and streamlining processes.

-

What benefits does airSlate SignNow provide for businesses preparing Form 5498 SA 2019?

airSlate SignNow offers numerous benefits for businesses, such as reducing processing time and enhancing compliance when preparing Form 5498 SA 2019. Our solution helps eliminate the hassle of paper forms and allows for easy tracking of document status. This can signNowly improve overall efficiency and productivity.

-

How secure is airSlate SignNow for submitting Form 5498 SA 2019?

Security is a top priority at airSlate SignNow. Our platform complies with industry-leading security standards, ensuring that your Form 5498 SA 2019 and other sensitive documents are protected. Features like secure data encryption and audit trails provide peace of mind in managing important information.

Get more for Irs Form 5498

- Complementary and alternative therapies in hospice form

- Transfer of blicense formb

- P31202201w west virginia tax division form

- Consent to disclose medical information

- No fault contract template form

- No drink contract template form

- No harm contract template 787752919 form

- No liability contract template form

Find out other Irs Form 5498

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter