Form 2441 2018

What is the Form 2441

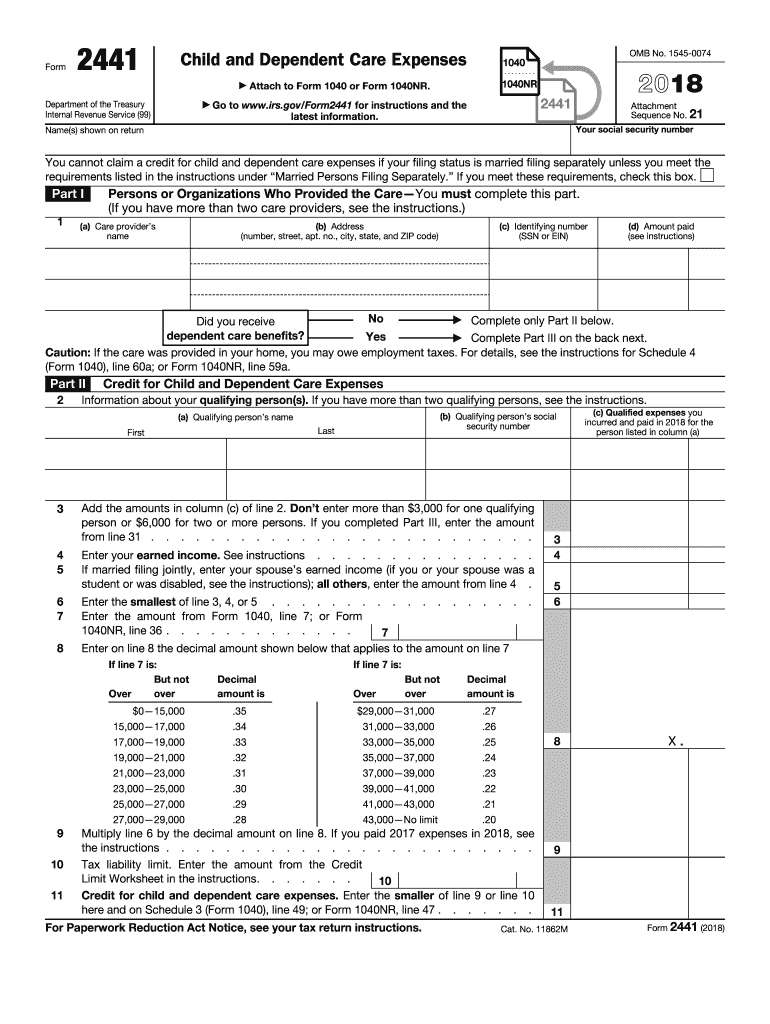

The Form 2441, also known as the Child and Dependent Care Expenses form, is a tax form used by taxpayers in the United States to claim a credit for child and dependent care expenses. This form is particularly relevant for individuals who pay for care so they can work or look for work. The credit can help offset the costs associated with caring for children under the age of thirteen or for a spouse or dependent who is unable to care for themselves.

How to use the Form 2441

To use the Form 2441 effectively, taxpayers must first determine their eligibility for the child care credit. This involves reviewing the expenses incurred for care and ensuring they meet IRS guidelines. After confirming eligibility, taxpayers can fill out the form, detailing the care provider information, the amount paid for care, and the qualifying children or dependents. This information will then be used to calculate the credit amount, which can be claimed on the taxpayer’s income tax return.

Steps to complete the Form 2441

Completing the Form 2441 involves several key steps:

- Gather necessary information, including care provider details and expense amounts.

- Fill out the personal information section at the top of the form.

- Provide details about the qualifying individuals receiving care.

- List the care provider's name, address, and taxpayer identification number.

- Calculate the total expenses and determine the credit amount based on IRS guidelines.

- Attach the completed form to your tax return when filing.

Eligibility Criteria

To qualify for the child and dependent care credit using Form 2441, taxpayers must meet specific criteria:

- The care must be provided for a child under the age of thirteen or for a qualifying individual.

- Taxpayers must have earned income from employment or self-employment.

- The care expenses must be necessary for the taxpayer to work or look for work.

- Care must be provided by a licensed provider, and expenses must be documented.

Required Documents

When completing the Form 2441, taxpayers should have the following documents ready:

- Receipts or invoices from care providers detailing the amount paid.

- The care provider's taxpayer identification number, such as a Social Security number or Employer Identification Number.

- Proof of income, such as W-2 forms or 1099 forms, to demonstrate eligibility.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines when submitting Form 2441. Generally, the deadline for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file Form 2441 along with the main tax return to ensure the credit is applied correctly.

Quick guide on how to complete form 2441 2018

Discover the simplest method to complete and endorse your Form 2441

Are you still spending time preparing your official paperwork on printed copies instead of managing it online? airSlate SignNow delivers a superior approach to complete and endorse your Form 2441 and corresponding forms for public services. Our intelligent eSignature platform equips you with everything necessary to handle documentation swiftly and in accordance with official standards - robust PDF editing, administration, protection, endorsement, and sharing capabilities all readily available through a user-friendly interface.

Only a few steps are needed to finish filling out and endorsing your Form 2441:

- Upload the editable template to the editor using the Get Form button.

- Determine what information you need to enter in your Form 2441.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Cover sections that are no longer relevant.

- Click on Sign to generate a legally enforceable eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Preserve your completed Form 2441 in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our platform also offers versatile file sharing options. There’s no need to print your forms when you can submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” shipment from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 2441 2018

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

Create this form in 5 minutes!

How to create an eSignature for the form 2441 2018

How to generate an eSignature for your Form 2441 2018 online

How to create an electronic signature for the Form 2441 2018 in Google Chrome

How to generate an eSignature for putting it on the Form 2441 2018 in Gmail

How to make an eSignature for the Form 2441 2018 right from your mobile device

How to create an electronic signature for the Form 2441 2018 on iOS devices

How to create an eSignature for the Form 2441 2018 on Android

People also ask

-

What is Form 2441 and why is it important?

Form 2441 is a tax form used to claim the Child and Dependent Care Expenses Credit. Understanding how to correctly fill out Form 2441 is crucial for taxpayers who wish to benefit from this credit, as it can signNowly reduce tax liability. Using airSlate SignNow, you can easily complete and eSign Form 2441, ensuring all necessary information is accurately submitted.

-

How can airSlate SignNow help me with Form 2441?

airSlate SignNow simplifies the process of completing Form 2441 by providing an intuitive platform for document management and eSigning. You can quickly fill out the form, save progress, and send it for signatures, all within a few clicks. This efficiency helps reduce errors and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for Form 2441?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can start with a free trial to explore features like eSigning and document management, specifically for Form 2441, before committing to a paid plan. This flexibility allows you to choose the best option that fits your budget.

-

Can I integrate airSlate SignNow with other applications for Form 2441 management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications such as Google Drive, Dropbox, and more. This means you can easily upload documents related to Form 2441, collaborate with team members, and keep everything organized in one place.

-

What features does airSlate SignNow provide for handling Form 2441?

airSlate SignNow offers features such as customizable templates, eSigning, and real-time collaboration, which are all beneficial for handling Form 2441. These tools streamline the document preparation process, making it easier to ensure that all required information is accurately captured.

-

Is my data secure when using airSlate SignNow for Form 2441?

Yes, security is a top priority for airSlate SignNow. The platform uses advanced encryption and complies with industry standards to protect your data when filling out and eSigning Form 2441. You can trust that your sensitive information is handled with the utmost care.

-

How can I get support if I have questions about Form 2441 on airSlate SignNow?

airSlate SignNow provides comprehensive customer support to assist you with any questions regarding Form 2441. You can access a knowledge base, FAQs, and even signNow out to customer service representatives for personalized assistance, ensuring you have the help you need.

Get more for Form 2441

Find out other Form 2441

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe