Form 140 2017

What is the Form 140

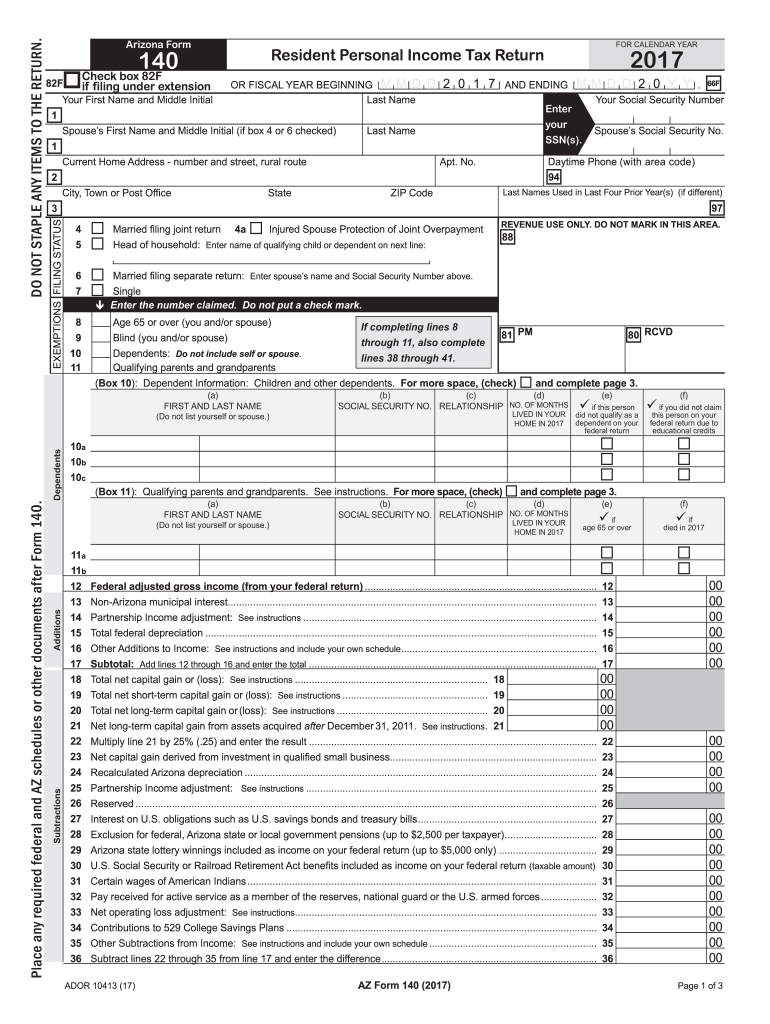

The Form 140 is a specific tax form used by individuals and businesses in the United States to report income and expenses to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations. It is designed to collect detailed information about the taxpayer's financial situation, including income sources, deductions, and credits. Understanding the purpose and requirements of Form 140 is crucial for accurate tax filing.

How to use the Form 140

Using Form 140 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and dating it. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail, depending on your preference.

Steps to complete the Form 140

Completing Form 140 requires a systematic approach to ensure accuracy:

- Collect all relevant financial documents, including income statements and expense receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include any taxable benefits.

- Detail deductions and credits you are eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 140

Form 140 must be used in accordance with IRS regulations to ensure its legal validity. This includes providing accurate information and adhering to deadlines for submission. The IRS has established guidelines for the use of this form, including acceptable methods for signatures, which may include electronic signatures under certain conditions. Understanding these legal requirements is essential for avoiding penalties and ensuring compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 140 are critical for taxpayers to observe. Typically, the deadline for submitting this form is April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, as well as the implications of late filing, which can include penalties and interest on unpaid taxes.

Required Documents

To complete Form 140 accurately, several documents are required:

- W-2 forms from employers detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any additional documentation that supports claims for credits or deductions.

Form Submission Methods (Online / Mail / In-Person)

Form 140 can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online filing through the IRS e-file system, which is often the quickest option.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this may require an appointment.

Quick guide on how to complete form 140 2017 2018

Your assistance manual on how to prepare your Form 140

If you’re wondering how to complete and submit your Form 140, here are some brief instructions on how to streamline tax processing signNowly.

To start, you only need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit sections to adjust information as needed. Simplify your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Form 140 within moments:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form 140 in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 140 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

Is it possible to prepare for UPSC within 4 months?

This is my story. Only CSE aspirants can relate to this.I had left my job on 31st Jan 2017 and moved to my brother’s place in Ghaziabad from Bangalore. It was already February, 2017 when I started and the exam was to begin in June with the Prelims. And 4 months aren’t considered enough to comfortably finish the syllabus. Is it just a myth? I started reading the basic material from scratch for various subjects – Geography, History, Polity, Culture, and Environment. I finished the basic material by mid March along with basic current affairs (booklets of VisionIAS and Insights). I didn’t read any newspapers. Everything appeared to be simple until I started attempting questions of the past year. I also gave a mock test and got 57/200. This was pathetic.In order to qualify for next stage I would require around 120 marks to be on safe side. I thought that clearing the exam this year is too ambitious. Even if I cleared the prelims, I would surely not qualify for interview as I am not preparing for Mains in anyway- I was not following opinions in Newspapers, no answer writing practice, not even started on optional ie Mathematics which, I heard, requires generally 6-7 months for thorough preparation. Then if I am not qualifying this year, it means I have till June 2018 i.e., 16 months before I appear in the exam. This is a lot of time.When the application form for the exam came in March 2017, I decided to fill in as I felt that 6 allowed attempts are more than enough for me to try and if I fill the form I would at least spend my time productively preparing for the exam. I also signed up for a Prelims test series.Now, since I was not able to answer the questions in the past year exam, I decided to analyze further what was that I was missing. It appeared to me that the questions based on static portion of the syllabus could be solved from the basic material only if I can get a thorough grasp. Next, I started revision of all the basic books that I had read. I again gave a mock, the score declined to 54/200. :(Then I created notes from all the monthly current affairs modules collecting all the information that appeared relevant for the prelims. I did that because I had realized that before the actual exam, I would not be in a position to revise from so many pdfs. I reappeared in another mock and got 60/200. A little improvement but far from what is required. The month of March had ended.Unable to improve the score despite constant efforts was depressing. I looked at other available material that would help me and started reading that. It was a mistake as the cost-benefit ratio was very poor. I could hardly remember the new information and it was making the revision process very difficult. Therefore, I took a step back and restarted revision of my notes on current affairs, the basic books, and few chapters of year book. Did this process again and again and again. My score started improving slowly but steadily. I also enrolled for another prelims test series and there also my score was looking better test by test. By mid-May, I started feeling that I should be able to qualify given I continue my process of revision and solving mock tests.At the same time, I started reading PT365 materials, a lot of which was already familiar to me as I had prepared notes for monthly current affairs.Apart from knowledge, the prelims also requires calculated risk taking in the exam. A lot of questions can be solved only partially from the information we have, but still there remains a doubt among 2 options or 3 options. In such cases one cannot leave these questions, else it would be very difficult to get a score beyond 100. Here I used my intuition and attempted those question where I am able to eliminate 2 options and in some cases even when I could only eliminate one option but had a gut feeling towards right answer. Many times these guesses would turn out to be wrong, but overall contribution would remain positive. [out of 20 such questions 11 went wrong and 9 went correct, so I got 9 times 2 minus 11 times 2/3, which is positive]IPL and ICC Champions Trophy acted as stress buster during this time.Here is my test series score, the final 141/200 was just days before the prelims.This is how my revision plan looked.(Here PT is PT365 booklet- Vision+Insights; file, register, onenote, folded pages, etc are all my notes.)Now as I started scoring well in these modules, I came to conclusion that as I am reading their current affair material, I am bound to improve on my score as the questions are based out of that material itself. So, I tried online free pdf tests from few other sources and did reasonably well. One week before the actual prelims I realized that its highly likely that I would qualify in the prelims exam. But as my mains preparation were zero, I had a tough task ahead. Therefore, I had ordered notes for Mathematics 3 days before the prelims, in anticipation of success and to not waste any time if that happens.It was the day of ICC Champions Trophy final and India was to face Pak. India badly defeated Pakistan in an initial match but since then Pakistan team had gained new energy from somewhere and they defeated SA, SL and Eng to face India again in finals. Unfortunately, it was also the day of the Prelims exam for me, 18 June 2017.I took an early morning metro to signNow the venue. During my journey, I saw colorful coaching materials in hands of various aspirants and many were trying to revise in metro. I didn’t do that as I had been a student of probability. The expected value of such revision is negative in my opinion (you rarely get any question form that revision and such revision would not remain in your memory if its already not there, it also creates stress as you feel you don’t know so many things).Two hours exam and I attempted 85/100 questions, 55 of which I was sure of and rest attempted on probabilistic methods. Then CSAT was over by 4:30 pm. On my way back I got to know that Fakhar Zaman was playing well and India team was unable to get many wickets.As I signNowed my home, Pak had scored more than 300 and I checked that my score was around 140/200. Within few overs of Indian innings, I knew that Indian team had screwed up but fortunately I hadn’t.PS- I have added my test series score improvement pic to inspire future aspirants to keep working hard even when they don’t see big improvements. The results only show up after a time delay. Same with my timetable pic.See this for the books/ study material that I used in above phase. Tanmay Vashistha Sharma's answer to What was your optional subject? Can you give a fair booklist for every phase of the exam?I have received many messages regarding notes making for mains. Please have a look at this- Tanmay Vashistha Sharma's answer to How did you prepare for international relations for the UPSC?

Create this form in 5 minutes!

How to create an eSignature for the form 140 2017 2018

How to make an eSignature for your Form 140 2017 2018 in the online mode

How to generate an electronic signature for the Form 140 2017 2018 in Chrome

How to generate an eSignature for putting it on the Form 140 2017 2018 in Gmail

How to create an electronic signature for the Form 140 2017 2018 straight from your smartphone

How to create an eSignature for the Form 140 2017 2018 on iOS devices

How to generate an electronic signature for the Form 140 2017 2018 on Android devices

People also ask

-

What is Form 140 and how can airSlate SignNow help with it?

Form 140 is commonly used for various tax-related purposes, and airSlate SignNow makes it easy to eSign and send this document securely. With our platform, you can quickly fill out Form 140, collect necessary signatures, and ensure compliance, all within a user-friendly interface.

-

Is airSlate SignNow a cost-effective solution for managing Form 140?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing Form 140. Our plans provide unlimited access to eSigning features, ensuring you can handle all your document needs without breaking the bank.

-

What features does airSlate SignNow provide for handling Form 140 documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, which are particularly useful for managing Form 140. These features streamline the process of preparing, signing, and storing your documents, enhancing overall efficiency.

-

Can I integrate airSlate SignNow with other applications for Form 140 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems to facilitate the processing of Form 140. This allows for a smoother workflow as you can manage all your documents in one place.

-

How secure is airSlate SignNow when handling sensitive Form 140 information?

Security is a top priority at airSlate SignNow. When handling Form 140, we utilize industry-standard encryption and compliance with regulations such as GDPR and HIPAA, ensuring that your sensitive information remains protected throughout the signing process.

-

What benefits does airSlate SignNow offer for businesses using Form 140?

Using airSlate SignNow for Form 140 brings several benefits, including increased efficiency, reduced turnaround time for document signing, and improved accuracy. Our platform simplifies the completion and eSigning process, allowing businesses to focus on their core activities.

-

How can I get started with airSlate SignNow for my Form 140 needs?

Getting started with airSlate SignNow for your Form 140 needs is simple! Just sign up for a free trial on our website, and you can begin creating, sending, and eSigning your Form 140 documents immediately. Our intuitive interface makes it easy for anyone to use.

Get more for Form 140

- Printed annual report pdf childrens hospital of philadelphia form

- Pdf rcp reinstatement application form

- Form 8 georgia secretary of state sos georgia

- Idaho claim of lien form

- Compensation complaint ic 1001 the idaho industrial commission iic idaho form

- Idaho disease case report form

- Idaho will form

- Other punction marks form

Find out other Form 140

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself