M Form

What is the M Form

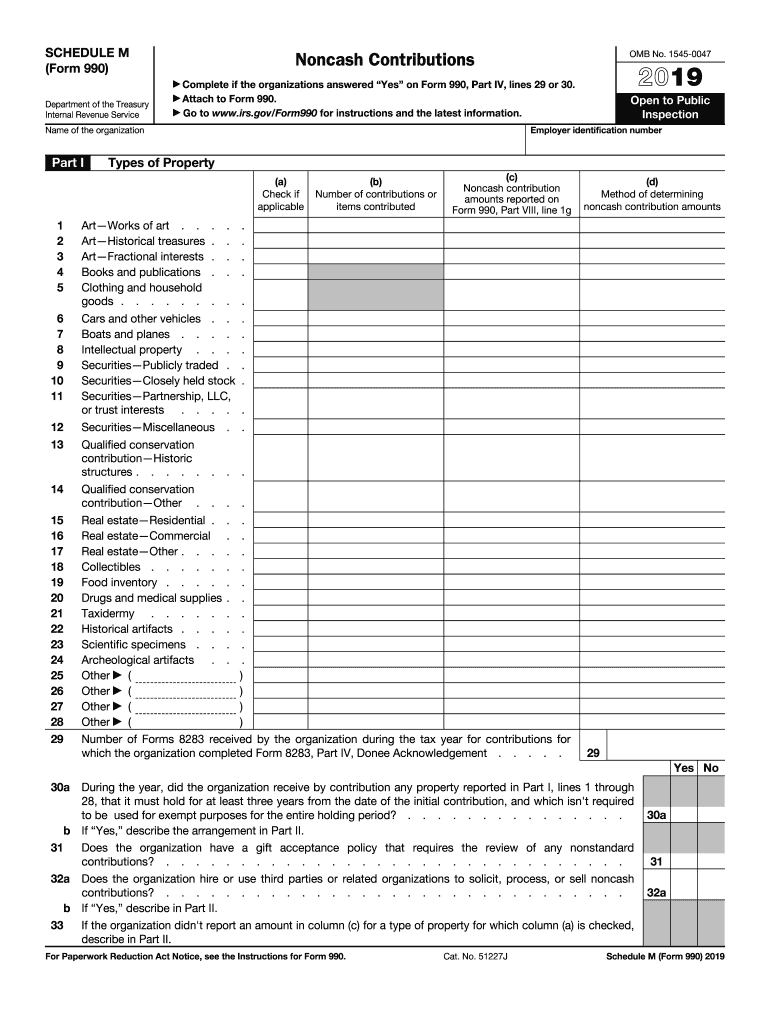

The 2019 Schedule M Form, also known as the 2019 IRS M Form, is a tax document used by taxpayers to report specific adjustments to income. This form is particularly relevant for individuals and entities that have non-cash contributions or other adjustments that affect their taxable income. Understanding the purpose of this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the M Form

Using the 2019 Schedule M Form involves several steps to ensure that all necessary information is accurately reported. Taxpayers should first gather relevant financial documents, such as records of contributions and any supporting documentation. After filling out the form, it is crucial to review all entries for accuracy before submission. The completed form can be included with your tax return to ensure that all adjustments are properly accounted for.

Steps to complete the M Form

Completing the 2019 Schedule M Form requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including receipts for non-cash contributions.

- Fill in your personal information, including your name, address, and Social Security number.

- Report any non-cash contributions in the designated sections, ensuring to provide accurate values.

- Double-check your entries for errors or omissions.

- Attach the completed form to your main tax return before submission.

Legal use of the M Form

The 2019 Schedule M Form is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is essential to comply with all relevant tax laws to avoid penalties. The form must be signed and dated by the taxpayer, confirming that the information provided is accurate and complete. Utilizing a reliable electronic signature solution can enhance the legal validity of the document.

Filing Deadlines / Important Dates

Timely submission of the 2019 Schedule M Form is crucial to avoid penalties. The deadline for filing your tax return, including the Schedule M, typically falls on April fifteenth of the following year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the 2019 Schedule M Form accurately, several documents are necessary. These include:

- Receipts for non-cash contributions.

- Your previous year’s tax return for reference.

- Any supporting documentation that verifies the values reported on the form.

Form Submission Methods

The 2019 Schedule M Form can be submitted in various ways. Taxpayers may choose to file their tax returns electronically using approved software, which often includes the option to complete and submit the Schedule M. Alternatively, the form can be printed and mailed to the IRS along with your tax return. It is important to ensure that the correct mailing address is used to avoid delays in processing.

Quick guide on how to complete form 990 schedule m

Effortlessly prepare M Form on any device

The management of online documents has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage M Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign M Form with ease

- Locate M Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign M Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule m

How to generate an eSignature for the Form 990 Schedule M online

How to create an eSignature for your Form 990 Schedule M in Google Chrome

How to create an eSignature for putting it on the Form 990 Schedule M in Gmail

How to make an eSignature for the Form 990 Schedule M straight from your smart phone

How to generate an eSignature for the Form 990 Schedule M on iOS devices

How to create an eSignature for the Form 990 Schedule M on Android OS

People also ask

-

What is the M Form in airSlate SignNow?

The M Form in airSlate SignNow is a customizable digital document designed for efficient electronic signing and management. It allows users to streamline their workflow by enabling easy collaboration and tracking of document status. With the M Form, businesses can enhance their document processes while ensuring compliance and security.

-

How much does the M Form cost with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the M Form feature. Pricing varies based on the plan selected, with options suitable for individuals, small businesses, and enterprises. You can choose a plan that fits your budget while enjoying all the benefits of the M Form for seamless document management.

-

What features does the M Form offer?

The M Form includes features like customizable templates, automated workflows, and real-time tracking of document statuses. Users can easily integrate fields for signatures, dates, and initials, optimizing the document signing process. Additionally, the M Form supports multiple file formats, ensuring versatile use across different industries.

-

How does the M Form improve document workflow?

By utilizing the M Form in airSlate SignNow, businesses can signNowly enhance their document workflow. The M Form allows for the elimination of paper-based processes, reducing time spent on manual tasks and minimizing errors. This efficiency leads to faster turnaround times and improved productivity overall.

-

Can I integrate the M Form with other software?

Yes, the M Form in airSlate SignNow can be seamlessly integrated with various third-party applications, enhancing its functionality. Popular integrations include CRM systems, project management tools, and cloud storage services. These integrations help streamline your workflow and ensure that documents are easily accessible.

-

What are the security features of the M Form?

The M Form is built with robust security features to protect sensitive information during the signing process. airSlate SignNow employs encryption, two-factor authentication, and secure cloud storage to ensure data integrity and confidentiality. Users can trust that their documents are safe and compliant with industry regulations.

-

Is the M Form suitable for remote teams?

Absolutely! The M Form in airSlate SignNow is designed to facilitate collaboration among remote teams. With its user-friendly interface and cloud-based access, team members can easily send, sign, and manage documents from anywhere, making it ideal for today's remote work environment.

Get more for M Form

Find out other M Form

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer