Form 1120 REIT U S Income Tax Return for Real Estate Investment Trusts 2017

What is the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

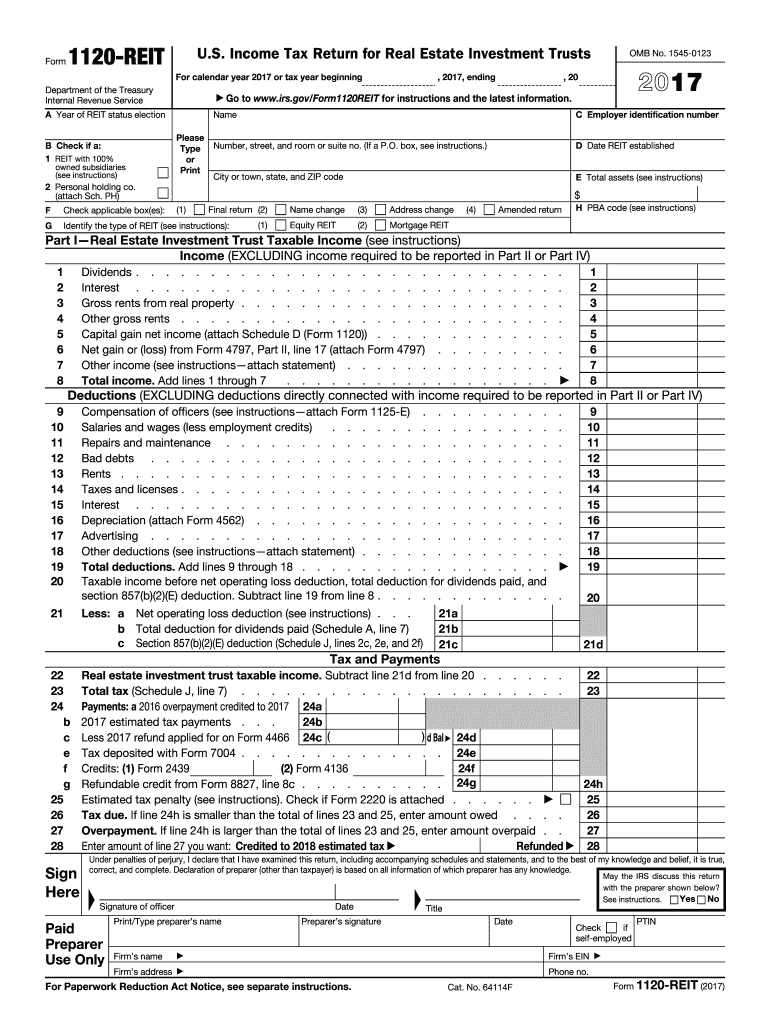

The Form 1120 REIT is a specific income tax return designed for Real Estate Investment Trusts (REITs) operating in the United States. This form is essential for REITs to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). It allows these entities to maintain their tax-exempt status under certain conditions, primarily by distributing at least ninety percent of their taxable income to shareholders. Understanding the purpose and requirements of this form is crucial for compliance and effective tax management for any REIT.

Steps to complete the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

Completing the Form 1120 REIT involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including income statements, balance sheets, and records of distributions made to shareholders. Next, fill out the form by providing detailed information about the REIT's income, deductions, and credits. Pay close attention to specific sections that require information about real estate assets and liabilities. After completing the form, review it thoroughly for any errors or omissions before submitting it. Finally, ensure that you file the form by the established deadlines to avoid penalties.

Key elements of the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

The Form 1120 REIT consists of several key elements that must be accurately reported. These include the REIT's gross income, which encompasses rental income, interest income, and capital gains. Additionally, the form requires detailed information on allowable deductions, such as operating expenses, depreciation, and distributions to shareholders. It also includes sections for reporting any tax credits the REIT may be eligible for. Properly understanding these elements is vital for ensuring that the REIT meets all IRS requirements and maintains its tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 REIT are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the REIT's tax year. For calendar year taxpayers, this means the deadline is April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable for REITs to keep track of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Form Submission Methods (Online / Mail / In-Person)

REITs can submit the Form 1120 REIT through various methods. The IRS allows for electronic filing, which is often the most efficient way to submit tax returns. This method can expedite processing and reduce the likelihood of errors. Alternatively, REITs may choose to mail the completed form to the appropriate IRS address, ensuring that it is sent via a traceable method to confirm delivery. In-person submissions are generally not an option for this form, making electronic or mail submissions the primary methods for filing.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form 1120 REIT can result in significant penalties. These may include fines for late filing, inaccuracies, or failure to meet distribution requirements. Additionally, if a REIT does not adhere to the necessary regulations, it risks losing its tax-exempt status, which can have severe financial implications. Understanding these potential penalties underscores the importance of accurate and timely filing of the Form 1120 REIT.

Quick guide on how to complete b check if a

Discover the most efficient method to complete and sign your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior way to complete and sign your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts and similar forms for public services. Our advanced eSignature solution offers you all the tools necessary to handle documents swiftly and in line with official guidelines - robust PDF editing, managing, securing, signing, and sharing features available within an easy-to-use interface.

Only a few steps are needed to finish filling out and signing your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts:

- Upload the editable template to the editor using the Get Form button.

- Verify what details you need to include in your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the blanks with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Highlight important sections or Blackout fields that are no longer relevant.

- Click on Sign to create a legally recognized eSignature using your preferred method.

- Add the Date next to your signature and finish your work with the Done button.

Store your completed Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our service also provides adaptable form sharing. There’s no need to print out your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct b check if a

FAQs

-

What's the best contemporary designed sign-up form, in terms of UX, on the internet?

Our in-house UX designer holds the Airbnb sign-up form up as an example of excellent UX design.These are his main reasons, which are all aspects that are easily transferrable (and that we always use on our forms!):Social media access - giving people the option to sign up with Google or Facebook allows them to choose an option that suits them (people love to feel in control - it’s the autonomy bias). They are also aware that signing up through social media may be a much speedier process which is always an attraction and, even better for you, it often allows you access to certain parts of their profile and details so can be an excellent source of invaluable data.Progressive disclosure - Instead of displaying the whole form on the first page, Airbnb uses progressive disclosure, only opening up the full form once the user clicks on “Sign up with Email” which keeps things clean, simple and doesn’t intimidate the user as they are being slowly introduced into the sign-up process.Column layout - There is just one column with each field listed one underneath the other. Again, this keeps it really clean and simple with ample space to fill out the fields.Icons used inside the fields - The icons bring a nice design element to it and also just add that extra ease of comprehension - you see the mail icon and you know that’s where your email address goes. The easier to understand quickly, the more likely it is that people will convert (this is because of Cognitive Ease).Password strength validation - This is always a reassuring tool to provide your customers. Security online (or lack thereof) can be a big factor in putting people off following through with a sign-up or purchase and so lending them this helping hand to show them how strong their password is will give a sense of safety and satisfaction.Overall field validation - When a field has been successfully completed, it is highlighted with a green outline to validate this clearly. It’s a nice way of giving the customer a sense of completion and closure for each step and letting them see their progress - this type of positive reinforcement can be useful in encouraging people to see through the sign-up process until the end.Clear indication of errors - Equally, it’s important to clearly notify customers when there is an issue with one of their completed fields. There’s nothing more frustrating than spending time filling out a form only for it to refuse to submit but with no clear identification of where the error is. Make it quick, obvious and easy for them to see and rectify any errors to ensure frustration doesn’t lead to a swift exit.At Convertize, we’ve compiled our neuromarketing and optimisation expertise into a list of 250 tactics - you can check them out here!

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can you cancel a Vodafone contract in the UK?

It is pretty simple, let me write a step by step guide:Go to this Vodafone page: How to cancel your Vodafone account and do the step by step steps - they will ask you some questions, give them a direct answer! Most of the times (depends on your specific plan) you will need to fill out some forms and done deal, your contract is canceled.In case you are trying to cancel a contract before it ended (shame on them!) you will need to: a. Login to your account b. check if you still have time to cancel the agreemnt c. Check your exit fee d. Cancel the contractIt takes about 30 days for them to cancel the contractI always record every chat, email or phone i take with any company. Just in case : )I hope my answer helped you.Costa Hagever.

-

Sales and Marketing Automation: What are some inexpensive alternatives to HubSpot, Marketo, and Pardot?

My favorite is Active Campaign.Active Campaign has CRM and sales automation, marketing automation, email marketing features and dozens integrations. It is pure gold when it comes to sales funnel management.Some key features.Web formsSome CRMs lack web forms or aren’t convenient (they don’t redirect URLs after form submission, or lack custom fields). So you need to find another solution and integrate it with CRM via Zapier.With Active Campaign, you can build as many web forms as you need, set up custom redirects after form submission, add tags (I forgot to tell you that Active Campaign is a tag-based system) and add them to specific lead-nurturing campaigns.Best of all, you can create pop-ups, floating bars and floating boxes so you won’t need other solutions for this.If you want to modify this, you can also add a custom CSS.As for custom fields, you can choose simple text field radio buttons, hidden fields, drop-down menus, multi-selection lists and date. This makes Active Campaign web forms perfect for MQL and SQL.All the collected data will be stored in the contact’s profile.Pipeline and contact managementPipeline management in Active Campaign is similar to that in modern CRMs. It has a drag-and-drop feature, a live desk with everything opened, and you can upload/download your list of contacts and the CRM and catch the social profiles of leads.But most importantly, it has a built-in sales automation process (which some CRMs make available only in high-cost packages) and it tracks the lead’s behaviour (like website visits, content downloaded, or links shared), which allows you to easily apply lead nurturing and lead scoring in one place.You can easily add tasks to the sales team based on the lead’s activity. As well, you can set up an automated process for when the lead should be driven to the next micro-stage in your sales funnel.This awesome and valuable feature helps you minimize the human factor in the lead- generation process.Lead nurturingActive Campaign makes it very easy to implement lead nurturing using a wide variety of marketing automation features.You have three core instruments: email marketing, website messages and SMS.Also, Active Campaign is a tag-based system, so you can add or remove tags for each lead action. This helps you to create hyper-targeted segments and increase the ROI of every marketing campaign you’re running.Lead scoringActive Campaign has a very simple and easy process to apply lead scoring.You just add a score based on behaviour or the lead’s characteristics in your automations. Active Campaign immediately displays it in the lead’s profile.All the data updates in real time, so your sales team will immediately be notified about every sales-ready lead.P.S. To learn more about marketing automation, visit Facebook community “B2B marketers&founders”.

-

How do I get an ISP license?

Step 1: How to (apply for &) get an ISP license in India? – Check EligibilityTo obtain an ISP license, you require a registered company under the Companies Act, 1956. You can log on to the Registrar of Companies’ website for more information on how to register a company if you haven’t already registered yours.Step 2: How to (apply for &) get an ISP license in India? – Choose a suitable ISP license category to apply underThe next step to obtaining an ISP license is to know / decide which category of license you require – category A, B or C. Click here to know more about how to select the right category for your ISP License.In India, there are 3 different categories of licenses to become an internet service provider, depending upon the City/State/Town/District/Village you want to start your ISP business in.The 3 categories of ISP licenses are:Class A (National Area)Class B (Telecom Circle/Metro Area)Class C (Secondary Switching Area)Naturally, a Class A ISP license would be quite expensive, followed by Class B & C respectively.Step 3: How to (apply for &) get an ISP license in India? – Budgeting and CostingTo promote internet access in smaller towns, cities & villages, the Government of India has made a conscious effort to ease prices of a Class C license compared to a Class A or B license.The total government cost for a Class C license is INR 90,000/- whereas for a Class A license is as high as 2 ½ crores.Thus, in order to become a Class C ISP licence holder, you don’t require more than Rs. 3-4 lakhs, depending on the lawyer / ISP consultant fees.Once you have selected the category of the ISP license you want to obtain, it is important to know how the entire application process goes.Now, let’s take you through on how to apply for an ISP license & the documents, legal help, etc. you will require.Step 4: How to (apply for &) get an ISP license in India? – Initial Application ProcessAfter you have chosen your ISP license category, you will need to fill out an application form. Click here to download the form.Along with the form, a non-refundable Processing Fee of INR 15,000/- must be paid by the applicant, along with 2 copies of the application form, by DD/Pay Order from a Schedule Bank payable at New Delhi issued in the name of Pay & Accounts Officer (Headquarter) DOT.Provide all required official documents. Click here to know the list of documents required.Step 5: How to (apply for &) get an ISP license in India? – Document ReviewOnce you have submitted your application form along with the required documents & fees, the Department of Telecom will review your application & respond to you, the applicant, in under 60 days,as far as practicable i.e. in case there are any issues with your application, there may be a delay in the issuing of a response from the DOT.If there is no problem with your complete application, the DOT will issue a ‘Letter of Intent’ in your favor.However, there are chances that your application may be rejected or delayed due to non-compliance with legal, security, hardware, commercial and contractual compliance and human errors such as incomplete form submission.Therefore, it is important to get an ISP consultant / lawyer to review your application before you submit your application form for obtaining the ISP authorization under the Unified License . Click here to know more.Disclaimer: the rules keep changing as per notifications by DOT and Govt. This information was published on Oct’2016. Do not treat this as professional advice, kindly contact us for up-to-date compliance and to avail professional assistance for your application.

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

If an American retires in Europe, how do they get healthcare? Are some countries better than others for healthcare?

I know this is difficult to understand for an american. But in many countries in western Europe when you need healthcare you just go and see a doctor and then rather than greeting your sick frame with thick wadges of paper and forms to fill out that mostly try to prevent the doctor from experiencing any form of liability the doctor will just say, “What can I do for you?”I think your question though really is - how do I get healthcare coverage. The answer is in many countries in western Europe, assuming you are legally immigrated in to the country (and in some cases when you aren’t) you already have healthcare coverage. Asking for how you “get coverage” is a bit like asking - how can you get permission to walk down the street, enter a public park or go to the library. The state pays doctors salaries and the doctors are just there.Its notable that this year alone in the US I spent roughly 100 hours of my personal time just getting coverage ( filing eligibility forms etc., getting all those hospitals to talk to each other without screwing it up, ensuring no gap in coverage as I move between health plans, etc.). I lived in the UK for 10 years and in the entire time I was there I don’t think I spent even 30 minutes of my life worrying about healthcare coverage - despite needing everything from ER visits to specialist care.Some places will require you register with a local general practitioner (GP), in which case you need to call round the various GP surgeries and pick one that you a) like and b) can take on new patients. I know that this sounds like signing on for high end concierge care here in the US, but it turns out that when you get rid of all that paperwork and build a system that actually tries to save as many lives as possible you can afford to deal with people that way (oh and it costs way less - the UK system is roughly 1/3rd - yes I said that correctly - one third the cost of the US system per capita - that is the full actual cost not a subsidized cost).In the UK anyway a lot of your care is directed by your GP so that’s the thing you’d need to sort out. I can tell you that having a GP who is an effective quarterback for your care - well that’s way better than myself trying to string together a team of providers as I was sometimes forced to do here in the US.As to your question as to whether some countries are better than others. This is definitely true. France is ranked the highest, but to be honest I’ve had pretty good care in several countries in europe - and all of the countries in western Europe beat the US easily on most important metrics of national healthcare (e.g. life expectancy, infant mortality, maternal mortality). There are variations even within the countries, but in general due to national institutions that try to set standards, the standard is more uniform than here in the US.For more information on various universal healthcare systems check out the excellent question:How much does healthcare cost the individual in countries with a universal healthcare system? Would you change it for the "American system"?some quotes from the responses found there:“Would I change to an American system? Not a chance. Never in my life!”“The impossible question is why—in the face of all of the evidence—a substantial number of US citizens still embrace a system that can only be adequately described as “f***ed up”.”“Again, not a chance I'd want the US system.”“Changing here to the American system? No one is that stupid.”“I wouldn’t swap the UK system for the US one in a million years. You are being ripped off guys, wake up and do something about it.”“Why would I change it? It is way beyond stupid.”

Create this form in 5 minutes!

How to create an eSignature for the b check if a

How to generate an electronic signature for the B Check If A online

How to make an electronic signature for your B Check If A in Chrome

How to generate an electronic signature for signing the B Check If A in Gmail

How to generate an electronic signature for the B Check If A straight from your smartphone

How to create an electronic signature for the B Check If A on iOS devices

How to make an electronic signature for the B Check If A on Android devices

People also ask

-

What is the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

The Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts is a tax return specifically designed for Real Estate Investment Trusts (REITs) to report their income, deductions, and tax liabilities. This form ensures compliance with the IRS regulations for REITs, allowing them to benefit from special tax treatments. Understanding how to accurately complete this form is crucial for REITs to maintain their tax-exempt status.

-

How can airSlate SignNow help with the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

airSlate SignNow streamlines the process of preparing and filing the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts by providing an easy-to-use platform for document management and e-signatures. With our solution, you can securely send, sign, and store your tax documents, ensuring that your filing process is efficient and compliant. This can save you time and reduce the risk of errors.

-

What features does airSlate SignNow offer for handling tax documents like the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

airSlate SignNow offers features such as customizable templates, easy electronic signatures, and secure document storage, all of which are essential for handling tax documents like the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts. Our platform also includes audit trails and notifications to keep you updated on the status of your documents. These features ensure that your tax filing process is organized and efficient.

-

Is airSlate SignNow cost-effective for filing the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage documents related to the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value for your investment. Plus, the time saved in document processing can lead to signNow cost savings.

-

Can I integrate airSlate SignNow with other accounting software for the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to easily manage the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts alongside your other financial documents. This integration streamlines your workflow, helping you maintain organization and efficiency in your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents such as the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Using airSlate SignNow for tax-related documents like the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts offers numerous benefits, including improved efficiency, enhanced security, and greater compliance. Our platform simplifies the signing process, reduces paperwork, and helps ensure that your documents are filed accurately and on time, which is crucial for REITs.

-

How secure is my information when using airSlate SignNow for the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Security is a top priority at airSlate SignNow. When you use our platform for the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts, you can trust that your information is protected with advanced encryption and secure access protocols. We adhere to industry standards to keep your tax documents safe and confidential.

Get more for Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

Find out other Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now