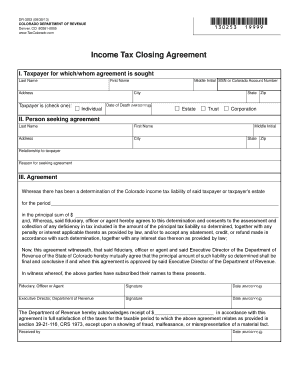

Income Tax Closing Agreement Form

What is the Income Tax Closing Agreement

The Income Tax Closing Agreement is a formal arrangement between a taxpayer and the Internal Revenue Service (IRS) that resolves specific tax issues for a particular tax year. This agreement provides certainty regarding the taxpayer's tax liability and is often used to settle disputes or clarify tax obligations. By entering into this agreement, both parties can avoid future audits or disputes related to the agreed-upon tax matters.

Steps to complete the Income Tax Closing Agreement

Completing the Income Tax Closing Agreement involves several key steps:

- Gather relevant financial documents, including income statements, deductions, and any prior correspondence with the IRS.

- Complete the appropriate form, ensuring that all information is accurate and comprehensive.

- Review the agreement with a tax professional if necessary, to ensure compliance with IRS guidelines.

- Submit the completed form along with any required attachments to the IRS.

- Await confirmation from the IRS regarding the acceptance of the agreement.

Legal use of the Income Tax Closing Agreement

The legal validity of the Income Tax Closing Agreement hinges on compliance with IRS regulations and guidelines. It is essential that the agreement is executed correctly and that all parties understand the terms. Once signed, the agreement becomes legally binding, preventing either party from revisiting the settled issues unless new information arises. This legal framework provides both the taxpayer and the IRS with a clear understanding of their obligations moving forward.

Key elements of the Income Tax Closing Agreement

Several critical components define the Income Tax Closing Agreement:

- Identification of Parties: The agreement must clearly identify the taxpayer and the IRS.

- Tax Year: It should specify the tax year or years being addressed.

- Issues Being Resolved: The specific tax issues or disputes must be outlined in detail.

- Terms of Agreement: This includes the agreed-upon tax liability and any payment arrangements.

- Signatures: Both parties must sign the agreement for it to be valid.

IRS Guidelines

The IRS has established specific guidelines for the use of the Income Tax Closing Agreement. These guidelines outline the conditions under which the agreement can be utilized, including eligibility criteria and the types of tax issues that can be resolved. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to understand their rights and obligations under the agreement.

Filing Deadlines / Important Dates

Timely filing of the Income Tax Closing Agreement is crucial to avoid penalties and ensure that the agreement is valid. Taxpayers should be aware of key deadlines, including:

- The date by which the agreement must be submitted to the IRS.

- Any specific deadlines related to the tax year in question.

- Timeframes for responding to IRS inquiries regarding the agreement.

Who Issues the Form

The Income Tax Closing Agreement form is issued by the IRS. Taxpayers can obtain the form directly from the IRS website or through a tax professional. It is important to use the most current version of the form to ensure compliance with IRS requirements.

Quick guide on how to complete income tax closing agreement

Complete Income Tax Closing Agreement seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly replacement for traditional printed and signed documents, enabling you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your materials swiftly and without interruptions. Manage Income Tax Closing Agreement on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Income Tax Closing Agreement effortlessly

- Obtain Income Tax Closing Agreement and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for submitting your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Income Tax Closing Agreement and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

Which income tax form should be filled out by a beautician?

As a beautician, since you are self-employed, your income would come under the source- income from business or profession. So you could either file your ITR using ITR3 (if you wish to file normally) or you can use ITR4 (if you wish to file on presumptive basis).Hope you find my answer helpfulFeel free to contact me at abhinandansethia90@gmail.com for any assistanceRegardsAbhinandan

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the income tax closing agreement

How to generate an eSignature for your Income Tax Closing Agreement in the online mode

How to create an eSignature for your Income Tax Closing Agreement in Chrome

How to make an electronic signature for signing the Income Tax Closing Agreement in Gmail

How to make an eSignature for the Income Tax Closing Agreement from your smart phone

How to create an electronic signature for the Income Tax Closing Agreement on iOS

How to create an electronic signature for the Income Tax Closing Agreement on Android devices

People also ask

-

What is an Income Tax Closing Agreement?

An Income Tax Closing Agreement is a legally binding contract between a taxpayer and the IRS that clarifies the tax obligations and liabilities for a specific tax year. This agreement helps taxpayers avoid disputes and provides certainty regarding their income tax responsibilities. By utilizing an Income Tax Closing Agreement, you can secure a mutually acceptable resolution with the IRS.

-

How can airSlate SignNow assist with Income Tax Closing Agreements?

airSlate SignNow streamlines the process of creating and signing Income Tax Closing Agreements by providing an easy-to-use electronic signature solution. With our platform, you can quickly prepare documents, obtain signatures, and maintain compliance with IRS requirements. This efficiency saves you time and helps ensure your agreements are processed smoothly.

-

What are the benefits of using airSlate SignNow for my Income Tax Closing Agreements?

Using airSlate SignNow for your Income Tax Closing Agreements offers numerous benefits, including enhanced security, faster turnaround times, and easy document management. Our platform allows you to access your agreements anytime, anywhere, ensuring you can respond promptly to IRS inquiries. Plus, our user-friendly interface makes the signing process straightforward for all parties involved.

-

Is airSlate SignNow compliant with IRS regulations for Income Tax Closing Agreements?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures and document management, including Income Tax Closing Agreements. Our platform adheres to stringent security protocols to protect sensitive information, ensuring that your agreements meet legal standards. This compliance helps you maintain trust and integrity in your tax-related dealings.

-

What pricing plans does airSlate SignNow offer for managing Income Tax Closing Agreements?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Income Tax Closing Agreements. Our plans range from cost-effective options for small businesses to advanced features for larger organizations, ensuring you find a solution that fits your budget. Additionally, we provide a free trial so you can experience our platform before committing.

-

Can I integrate airSlate SignNow with my existing accounting software for Income Tax Closing Agreements?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easy to manage your Income Tax Closing Agreements. This integration allows for better workflow efficiency, as you can synchronize documents and data without manual entry. Check our integrations page to see a full list of compatible applications.

-

How secure is airSlate SignNow when handling Income Tax Closing Agreements?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like Income Tax Closing Agreements. Our platform uses advanced encryption methods, secure servers, and regular security audits to protect your information. You can trust that your agreements are handled with the utmost confidentiality and integrity.

Get more for Income Tax Closing Agreement

Find out other Income Tax Closing Agreement

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word