Form 1120

What is Form 1120?

Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. It applies to C corporations, which are separate legal entities from their owners, and must be filed annually with the Internal Revenue Service (IRS).

How to use Form 1120

To use Form 1120, corporations must gather financial information for the tax year, including total income, deductions, and credits. The form requires detailed reporting of various income sources, such as sales, dividends, and capital gains. Additionally, corporations must report expenses related to business operations, which can reduce taxable income. After completing the form, corporations must file it with the IRS by the due date, typically the fifteenth day of the fourth month after the end of their tax year.

Steps to complete Form 1120

Completing Form 1120 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Enter total income on the form, including gross receipts and dividends.

- List allowable deductions, such as operating expenses, salaries, and interest.

- Calculate taxable income by subtracting deductions from total income.

- Determine the tax liability using the applicable corporate tax rate.

- Complete any additional schedules required based on the corporation's activities.

- Review the form for accuracy before submission.

Legal use of Form 1120

Form 1120 is legally binding when completed accurately and submitted on time. Corporations must ensure that all information is truthful and complies with IRS regulations. Any discrepancies or false information can lead to penalties, including fines and interest on unpaid taxes. Corporations should maintain records supporting the information reported on the form for at least three years.

Filing Deadlines / Important Dates

The deadline for filing Form 1120 is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may file for an automatic six-month extension using Form 7004, but this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance

Failure to file Form 1120 on time can result in penalties. The IRS imposes a penalty for late filing, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, if a corporation fails to pay the tax owed by the due date, interest will accrue on the unpaid balance. It is crucial for corporations to comply with filing requirements to avoid these penalties.

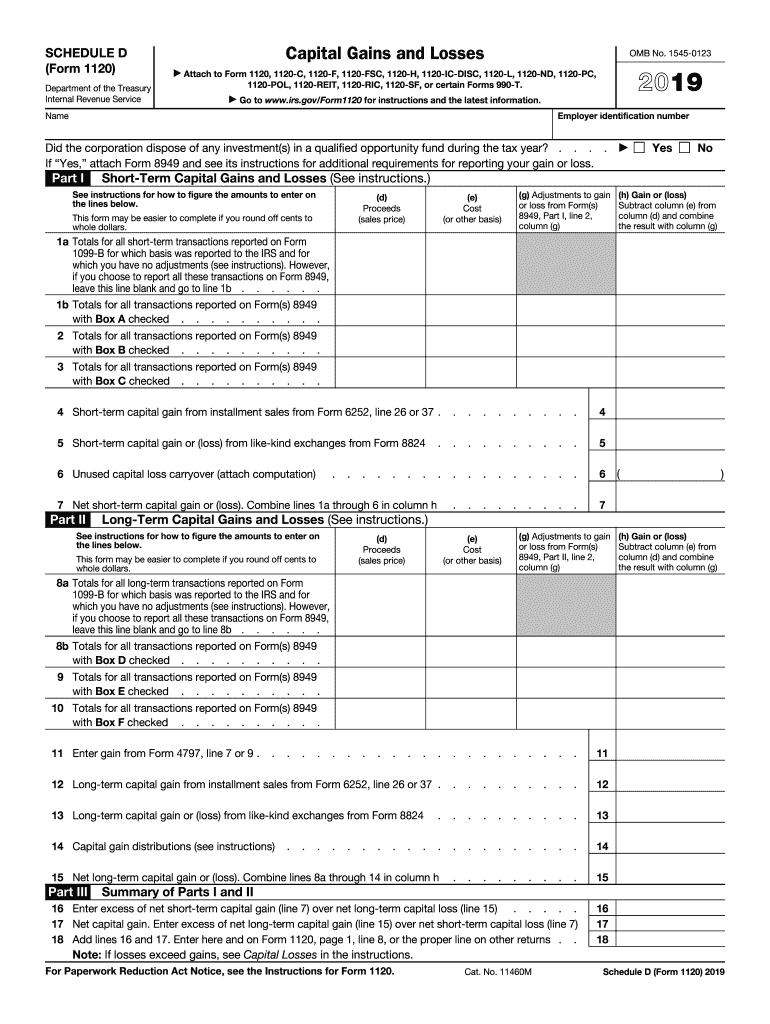

Quick guide on how to complete 2019 schedule d form 1120 capital gains and losses

Complete Form 1120 effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 1120 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 1120 with ease

- Find Form 1120 and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that necessitate new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1120 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule d form 1120 capital gains and losses

How to make an eSignature for your 2019 Schedule D Form 1120 Capital Gains And Losses online

How to make an eSignature for the 2019 Schedule D Form 1120 Capital Gains And Losses in Chrome

How to make an eSignature for signing the 2019 Schedule D Form 1120 Capital Gains And Losses in Gmail

How to make an eSignature for the 2019 Schedule D Form 1120 Capital Gains And Losses straight from your smartphone

How to make an eSignature for the 2019 Schedule D Form 1120 Capital Gains And Losses on iOS

How to make an electronic signature for the 2019 Schedule D Form 1120 Capital Gains And Losses on Android devices

People also ask

-

What is Schedule D in relation to airSlate SignNow?

Schedule D refers to a specific document used for reporting capital gains and losses when filing taxes. In the context of airSlate SignNow, knowing 'what is Schedule D' can help users understand how to efficiently manage and sign important tax-related documents online.

-

How does airSlate SignNow help with Schedule D documentation?

airSlate SignNow streamlines the process of creating and signing Schedule D documents by providing templates and easy eSignature capabilities. This means that users can quickly fill out, sign, and send their Schedule D forms securely, avoiding paper waste and enhancing productivity.

-

Is airSlate SignNow cost-effective for managing Schedule D forms?

Yes, airSlate SignNow is a cost-effective solution for managing Schedule D forms, offering flexible pricing plans tailored to business needs. By using this platform, users can save both time and money while efficiently handling their tax documents electronically.

-

Can I integrate airSlate SignNow with other software for Schedule D filings?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, making it easier to manage your Schedule D filings. By connecting the platforms, users can streamline data transfer and minimize errors, consolidating their document handling process.

-

What features does airSlate SignNow offer for completing Schedule D?

airSlate SignNow offers features such as customizable templates, eSigning, and document tracking specifically tailored for Schedule D forms. These features enhance the user experience, making it simple to generate, edit, and manage critical tax documents from any device.

-

What are the benefits of using airSlate SignNow for Schedule D submissions?

The primary benefits of using airSlate SignNow for Schedule D submissions include increased efficiency, reduced errors, and improved document security. With airSlate SignNow, users can focus on their business while enhancing their tax management processes seamlessly.

-

Is airSlate SignNow user-friendly for first-time Schedule D users?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with Schedule D forms. The platform provides guided steps and intuitive interfaces, ensuring that first-time users can navigate their tax documentation without difficulty.

Get more for Form 1120

Find out other Form 1120

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation