83B Form Instructions 83B Form Instructions 2022-2026

What is the IRS Form 83-B?

The IRS Form 83-B, also known as the 83-B election form, is a tax document that allows employees or service providers to elect to include the value of property received in connection with the performance of services in their taxable income at the time of transfer, rather than at the time of vesting. This form is particularly relevant for those receiving restricted stock or options, as it can significantly affect the tax implications of the transaction. By filing the 83-B election, individuals can potentially minimize their tax burden if the value of the property increases over time.

Steps to Complete the IRS Form 83-B

Filling out the IRS Form 83-B involves several key steps to ensure accuracy and compliance. Here’s a concise guide to help you navigate the process:

- Begin by downloading the fillable IRS Form 83-B from the IRS website or obtaining a physical copy.

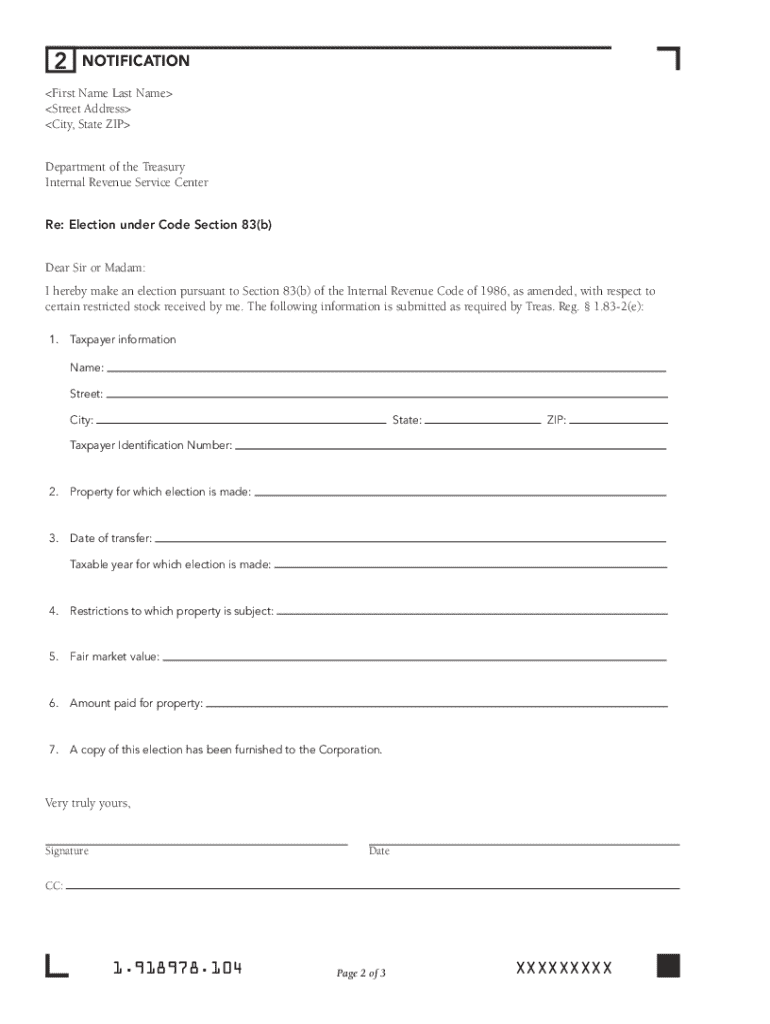

- Provide your name, address, and taxpayer identification number (TIN) at the top of the form.

- Detail the property received, including the date of transfer and the fair market value at that time.

- Indicate whether the property is subject to a risk of forfeiture and the vesting schedule.

- Sign and date the form to certify the information is accurate.

Filing Deadlines for the IRS Form 83-B

The IRS Form 83-B must be filed within thirty days of the property transfer date. Missing this deadline can result in the loss of the election, which may lead to unfavorable tax consequences. It is crucial to keep track of the transfer date and ensure that the form is submitted on time to the appropriate IRS office.

How to Submit the IRS Form 83-B

Once the IRS Form 83-B is completed, it can be submitted in two primary ways:

- By mailing the form to the IRS address specified in the instructions that accompany the form.

- By including a copy of the completed form with your income tax return for the year in which the property was transferred.

It is advisable to keep a copy of the filed form for your records, as it may be needed for future reference or in case of an audit.

Key Elements of the IRS Form 83-B

Understanding the key elements of the IRS Form 83-B is essential for proper completion. The form requires specific information, including:

- Your personal details, such as name and TIN.

- A description of the property received, including its fair market value at the time of transfer.

- Details regarding any restrictions on the property, including vesting conditions.

- Your signature and the date of signing, which certifies the information provided is accurate.

Legal Use of the IRS Form 83-B

The IRS Form 83-B is legally recognized and provides a mechanism for taxpayers to elect how they report income related to property received for services. By making this election, taxpayers can establish their tax basis in the property at the time of transfer, which can be beneficial if the property appreciates in value. It is important to consult with a tax professional to ensure compliance with IRS regulations and to understand the implications of filing the form.

Handy tips for filling out 83B Form Instructions 83B Form Instructions online

Quick steps to complete and e-sign 83B Form Instructions 83B Form Instructions online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to e-sign and send 83B Form Instructions 83B Form Instructions for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct 83b form instructions 83b form instructions

Create this form in 5 minutes!

How to create an eSignature for the 83b form instructions 83b form instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Form 83 B filing instructions?

The IRS Form 83 B filing instructions provide guidance on how to report the receipt of property in connection with the performance of services. This form must be filed within 30 days of receiving the property to avoid adverse tax consequences. Understanding these instructions is crucial for ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with IRS Form 83 B filing?

airSlate SignNow simplifies the process of preparing and signing IRS Form 83 B by providing an intuitive platform for document management. Users can easily create, edit, and eSign the form, ensuring that all necessary information is accurately captured. This streamlines the filing process and helps avoid delays.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the efficiency of managing IRS Form 83 B filing instructions and other important documents. Users can also integrate with various applications to further streamline their workflow.

-

Is there a cost associated with using airSlate SignNow for IRS Form 83 B filing?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing documents, including IRS Form 83 B filing instructions. Users can choose a plan that best fits their budget and requirements.

-

Can I integrate airSlate SignNow with other software for IRS Form 83 B filing?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing users to connect their existing tools for a seamless experience. This means you can easily incorporate IRS Form 83 B filing instructions into your current workflow without any hassle.

-

What are the benefits of using airSlate SignNow for IRS Form 83 B filing?

Using airSlate SignNow for IRS Form 83 B filing offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are stored securely and can be accessed anytime, making it easier to manage your filing obligations. Additionally, the eSigning feature speeds up the approval process.

-

How does airSlate SignNow ensure the security of my IRS Form 83 B filings?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for all documents, including IRS Form 83 B filings. This ensures that your sensitive information remains protected from unauthorized access. Regular security audits and compliance with industry standards further enhance the safety of your data.

Get more for 83B Form Instructions 83B Form Instructions

- First marriage certificate pdf download form

- Birth certificate gujarat pdf download in english form

- Adarsha vidyalaya application form pdf

- Drivers license renewal dl1 form south africa

- Form 706 checklist

- Hometeamns passion card replacement form

- Glaze ka all pdf class hindi download form

- College receipt number form

Find out other 83B Form Instructions 83B Form Instructions

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien