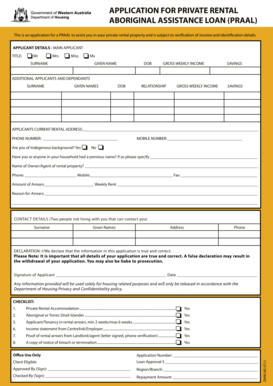

APPLICATION for PRIVATE RENTAL ABORIGINAL ASSISTANCE Form

Understanding the Private Rental Aboriginal Assistance Loan

The Private Rental Aboriginal Assistance Loan is designed to support Aboriginal individuals and families in securing private rental housing. This financial assistance aims to alleviate the burden of rental costs, making it easier for eligible applicants to obtain stable housing. The loan can cover various expenses, including rental deposits and initial rent payments, helping to create a more secure living situation.

Eligibility Criteria for the Loan

To qualify for the Private Rental Aboriginal Assistance Loan, applicants typically need to meet specific criteria. These may include:

- Being an Aboriginal or Torres Strait Islander individual or family.

- Demonstrating a need for financial assistance for private rental housing.

- Meeting income thresholds set by the program.

- Providing proof of a rental agreement or lease.

It is essential to review the detailed eligibility requirements specific to your state or region, as they may vary.

Steps to Complete the Application

Completing the application for the Private Rental Aboriginal Assistance Loan involves several key steps:

- Gather necessary documents, such as identification, proof of income, and rental agreements.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application through the designated method, whether online, by mail, or in person.

- Await confirmation of your application status and any further instructions from the issuing authority.

Required Documents for Application

When applying for the Private Rental Aboriginal Assistance Loan, you will need to provide several documents to support your application. Commonly required documents include:

- Proof of Aboriginal or Torres Strait Islander status.

- Identification documents, such as a driver’s license or passport.

- Recent payslips or other evidence of income.

- A copy of the rental agreement or lease for the property you intend to rent.

Ensuring that all documents are current and accurately reflect your situation will facilitate a smoother application process.

Application Process and Approval Time

The application process for the Private Rental Aboriginal Assistance Loan generally involves submitting your completed application along with the required documents. After submission, the approval time can vary based on several factors, including:

- The volume of applications being processed.

- The completeness and accuracy of your submitted information.

- Specific state or regional processing times.

Typically, applicants can expect to receive a decision within a few weeks, but it is advisable to check with the local authority for more precise timelines.

Legal Use of the Loan

The Private Rental Aboriginal Assistance Loan is intended for specific uses related to securing private rental housing. Legal uses include:

- Covering initial rental payments.

- Paying for rental bonds or deposits.

- Supporting ongoing rental costs as stipulated in the loan agreement.

It is crucial to adhere to the terms of the loan to avoid potential penalties or issues with repayment.

Quick guide on how to complete application for private rental aboriginal assistance

Complete APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE with ease

- Locate APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for private rental aboriginal assistance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a private rental aboriginal assistance loan?

A private rental aboriginal assistance loan is a financial product designed to help Aboriginal individuals secure rental properties. This loan provides the necessary funds to cover rental costs, making it easier for Aboriginal families to find stable housing. It aims to support the community by facilitating access to private rental markets.

-

How can I apply for a private rental aboriginal assistance loan?

To apply for a private rental aboriginal assistance loan, you typically need to fill out an application form through a participating lender. You'll need to provide personal information, proof of income, and details about the rental property. The process is straightforward and designed to assist Aboriginal applicants efficiently.

-

What are the eligibility requirements for a private rental aboriginal assistance loan?

Eligibility for a private rental aboriginal assistance loan usually includes being an Aboriginal or Torres Strait Islander individual or family. Additionally, applicants may need to demonstrate a stable income and a good rental history. Specific requirements can vary by lender, so it's essential to check with your chosen financial institution.

-

What are the benefits of a private rental aboriginal assistance loan?

The primary benefit of a private rental aboriginal assistance loan is that it provides financial support to secure rental housing. This loan can help reduce the financial burden of upfront costs, enabling Aboriginal families to focus on settling into their new homes. Additionally, it promotes stability and community growth.

-

Are there any fees associated with a private rental aboriginal assistance loan?

Yes, there may be fees associated with a private rental aboriginal assistance loan, such as application fees or processing charges. It's important to review the loan agreement carefully to understand all potential costs. Many lenders strive to keep fees low to support Aboriginal applicants effectively.

-

Can I use a private rental aboriginal assistance loan for any rental property?

Generally, a private rental aboriginal assistance loan can be used for most rental properties, provided they meet the lender's criteria. However, some lenders may have restrictions on certain types of properties or locations. Always confirm with your lender to ensure your chosen property qualifies.

-

How does a private rental aboriginal assistance loan impact my credit score?

Taking out a private rental aboriginal assistance loan can impact your credit score, similar to any other loan. Timely repayments can positively affect your credit history, while missed payments may harm it. It's crucial to manage your loan responsibly to maintain a healthy credit profile.

Get more for APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE

Find out other APPLICATION FOR PRIVATE RENTAL ABORIGINAL ASSISTANCE

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online