1094 Form

What is the 1094?

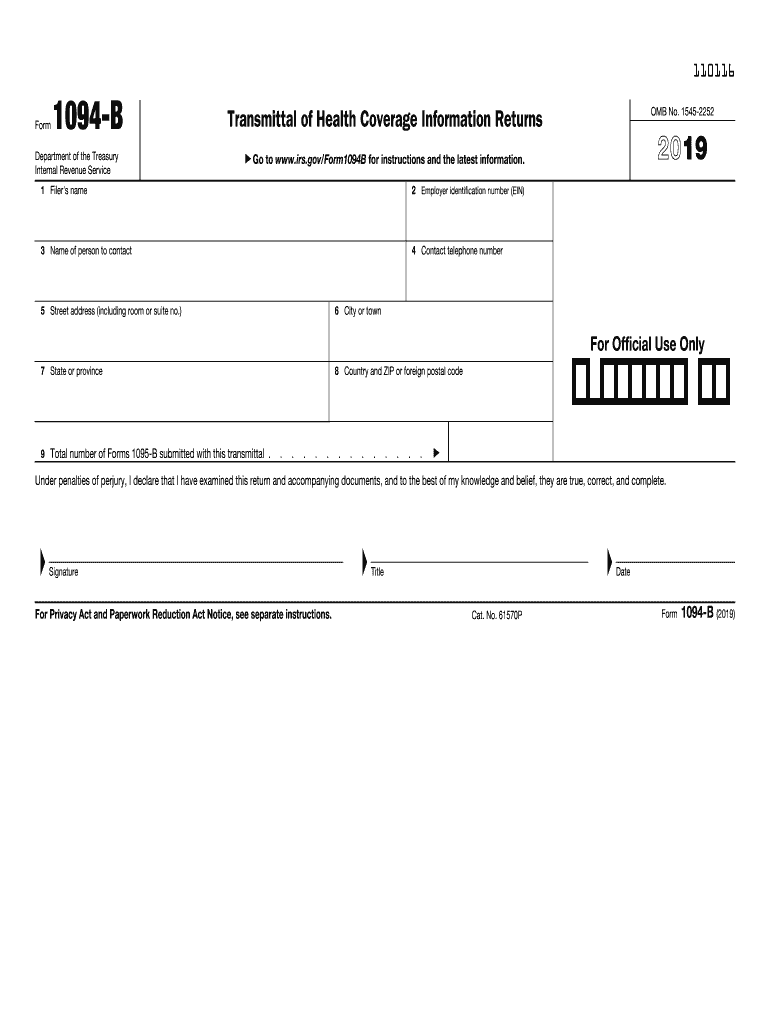

The 2019 Form 1094-B is a transmittal form used by health coverage providers to report information about health insurance coverage offered to individuals. It is part of the Affordable Care Act (ACA) reporting requirements, specifically for those who provide minimum essential coverage. The form helps the IRS track compliance with the ACA's individual mandate, ensuring that individuals have health coverage that meets federal standards.

How to obtain the 1094

To obtain the 2019 Form 1094-B, you can visit the official IRS website where forms are available for download. The form can be printed directly from the website, or you may request a physical copy through the IRS by contacting their office. Ensure you are using the correct version for the tax year you are reporting, as forms are updated annually.

Steps to complete the 1094

Completing the 2019 Form 1094-B involves several key steps:

- Gather necessary information about the health coverage provided, including the name and address of the coverage provider.

- Fill out the form with details such as the number of individuals covered and the months during which coverage was provided.

- Ensure that all information is accurate and complete to avoid penalties.

- Review the form for any errors before submission.

Legal use of the 1094

The legal use of the 2019 Form 1094-B is crucial for compliance with IRS regulations. This form must be filed accurately to demonstrate that health coverage meets the ACA requirements. Failure to file correctly may result in penalties for the coverage provider. It is essential to adhere to all guidelines set forth by the IRS to ensure that the form is legally binding.

Filing Deadlines / Important Dates

For the 2019 tax year, the filing deadlines for Form 1094-B are typically aligned with the tax return deadlines. Forms must be submitted to the IRS by February 28 if filing by paper and by March 31 if filing electronically. It is important to stay updated on any changes to these deadlines, as they may vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Form 1094-B can be submitted in several ways:

- Electronically through the IRS e-file system, which is recommended for faster processing.

- By mail, sending the completed form to the designated IRS address for your location.

- In-person submission is typically not available for this form, as it is primarily processed through electronic or mail methods.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the 2019 Form 1094-B can result in significant penalties. The IRS imposes fines for failing to file, filing late, or providing incorrect information. It is essential for coverage providers to ensure that all submissions are accurate and timely to avoid these financial repercussions.

Quick guide on how to complete f1094b form 1094 b department of the treasury internal

Complete 1094 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage 1094 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign 1094 without hassle

- Locate 1094 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign 1094 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1094b form 1094 b department of the treasury internal

How to make an eSignature for your F1094b Form 1094 B Department Of The Treasury Internal online

How to create an eSignature for your F1094b Form 1094 B Department Of The Treasury Internal in Google Chrome

How to create an eSignature for signing the F1094b Form 1094 B Department Of The Treasury Internal in Gmail

How to create an electronic signature for the F1094b Form 1094 B Department Of The Treasury Internal straight from your mobile device

How to create an electronic signature for the F1094b Form 1094 B Department Of The Treasury Internal on iOS

How to make an eSignature for the F1094b Form 1094 B Department Of The Treasury Internal on Android devices

People also ask

-

What is the 2019 form 1094 B and why is it important?

The 2019 form 1094 B is a transmittal form used by health insurance providers to report health coverage information to the IRS. It plays a crucial role in ensuring compliance with the Affordable Care Act. Accurate completion of this form helps businesses avoid penalties and facilitates a clear overview of coverage offerings.

-

How can airSlate SignNow help with completing the 2019 form 1094 B?

airSlate SignNow offers a streamlined solution to electronically fill out and eSign the 2019 form 1094 B. Our platform allows users to upload necessary documents, edit fields, and get them signed quickly. This simplifies the compliance process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 2019 form 1094 B?

Yes, airSlate SignNow provides various pricing plans designed to accommodate different business needs. Whether you are a small startup or a large corporation, our flexible options ensure you can access the features necessary for managing documents like the 2019 form 1094 B efficiently.

-

What features does airSlate SignNow offer for handling the 2019 form 1094 B?

airSlate SignNow includes features such as document templates, customizable workflows, and secure storage to assist with the 2019 form 1094 B. Additionally, it provides advanced tools for tracking document status and ensuring compliance through eSignature solutions.

-

Can airSlate SignNow integrate with other software for the 2019 form 1094 B?

Absolutely! airSlate SignNow easily integrates with popular accounting and HR software, allowing seamless management of documents like the 2019 form 1094 B. This integration enhances workflow efficiency by eliminating manual data entry and ensures all necessary documents are easily accessible.

-

What benefits can businesses expect from using airSlate SignNow for the 2019 form 1094 B?

Using airSlate SignNow for the 2019 form 1094 B offers several benefits such as improved speed and accuracy when filling out forms. The eSignature feature expedites the approval process while providing a secure method for storing sensitive information. Overall, it enhances operational efficiency and compliance readiness.

-

Is it easy to use airSlate SignNow for the 2019 form 1094 B?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate. With an intuitive interface, users can quickly familiarize themselves with the process of preparing the 2019 form 1094 B, regardless of their technical expertise. Online resources and customer support are also available to assist.

Get more for 1094

Find out other 1094

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT