Form 8815

What is the Form 8815

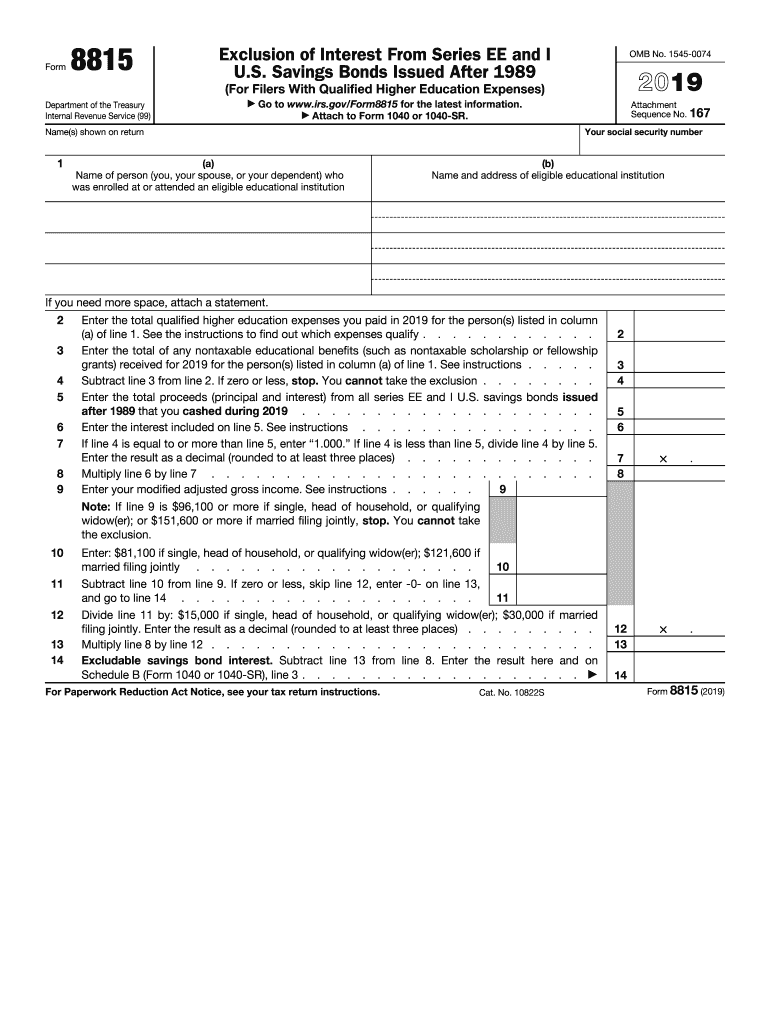

The Form 8815 is a tax document used by individuals to report the exclusion of interest from qualified U.S. savings bonds. This form is particularly relevant for taxpayers who have received interest from matured savings bonds and wish to exclude that interest from their taxable income. Understanding the purpose and requirements of Form 8815 is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8815

To use the Form 8815, taxpayers must first determine their eligibility for the exclusion of interest from savings bonds. This involves reviewing the specific criteria set by the IRS, such as income limits and the purpose of the bonds. Once eligibility is confirmed, individuals can complete the form by providing necessary information, including the amount of interest earned and any applicable exemptions. Proper completion of this form ensures that taxpayers can take advantage of potential tax savings.

Steps to complete the Form 8815

Completing the Form 8815 involves several steps:

- Gather all relevant financial documents, including the 1098 form, which details the mortgage principal balance.

- Review the IRS guidelines to confirm eligibility for the interest exclusion.

- Fill out the form with accurate information, including personal details and the amount of interest from savings bonds.

- Double-check all entries for accuracy before submission to avoid delays or penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use and completion of Form 8815. Taxpayers should familiarize themselves with these guidelines to ensure compliance. Key points include understanding the income thresholds for exclusion, the types of bonds that qualify, and the necessary documentation required to support the claims made on the form. Adhering to these guidelines is crucial for a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for Form 8815 typically align with the annual tax return deadlines. Taxpayers must ensure that they submit the form by the due date to avoid potential penalties. It is advisable to keep track of important dates, such as the start of the tax filing season and the final submission date, to ensure timely compliance with IRS requirements.

Required Documents

When completing Form 8815, several documents are required to substantiate the claims made. These include:

- The 1098 form, which outlines the mortgage principal balance.

- Documentation of the savings bonds, including purchase dates and interest earned.

- Any additional financial statements that may support the exclusion claim.

Eligibility Criteria

Eligibility for using Form 8815 is based on specific criteria set forth by the IRS. Taxpayers must meet income limits and must have used the proceeds from the savings bonds for qualified expenses, such as education. Understanding these criteria is essential for determining whether one can file the form and benefit from the interest exclusion.

Quick guide on how to complete 2018 form 8815 internal revenue service

Prepare Form 8815 effortlessly on any device

Digital document management has become widespread among corporations and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the proper form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form 8815 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and electronically sign Form 8815 without any hassle

- Find Form 8815 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click the Done button to save your edits.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8815 and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 8815 internal revenue service

How to make an eSignature for your 2018 Form 8815 Internal Revenue Service online

How to make an electronic signature for the 2018 Form 8815 Internal Revenue Service in Google Chrome

How to create an eSignature for signing the 2018 Form 8815 Internal Revenue Service in Gmail

How to create an electronic signature for the 2018 Form 8815 Internal Revenue Service from your smartphone

How to generate an eSignature for the 2018 Form 8815 Internal Revenue Service on iOS devices

How to generate an eSignature for the 2018 Form 8815 Internal Revenue Service on Android

People also ask

-

What is the 2019 IRS 8815 form and who needs it?

The 2019 IRS 8815 form is used to report the exclusion of income from U.S. territories for certain tax filers. Typically, individuals who have earned income in designated U.S. territories need to complete this form when filing their taxes. Understanding the 2019 IRS 8815 form is crucial for proper tax compliance and to ensure you are taking advantage of applicable benefits.

-

How can airSlate SignNow help me with my 2019 IRS 8815 form?

AirSlate SignNow offers a user-friendly platform that allows you to create, sign, and send your 2019 IRS 8815 form electronically. This streamlined process ensures that your document is compliant and submitted efficiently. By using airSlate SignNow, you can minimize the risk of errors and save time during tax season.

-

Is there a cost associated with using airSlate SignNow for the 2019 IRS 8815?

AirSlate SignNow offers various pricing plans that cater to different business needs. For the 2019 IRS 8815 form, you can choose a plan based on your frequency of use and user requirements. Overall, the platform provides a cost-effective solution to streamline your document management processes.

-

What features does airSlate SignNow provide for handling tax forms like the 2019 IRS 8815?

AirSlate SignNow provides multiple features suited for filling out tax forms like the 2019 IRS 8815, including document templates, electronic signatures, and advanced collaboration options. You can seamlessly track changes and manage approvals, ensuring your form is completed accurately and on time. This enhances your productivity during tax season.

-

Can I integrate airSlate SignNow with other software for my 2019 IRS 8815?

Yes, airSlate SignNow allows integrations with various software applications that can help you manage your 2019 IRS 8815 form more effectively. Whether you use accounting software or document management systems, integration options are available to streamline your workflow. This flexibility simplifies the entire document handling process.

-

How secure is the information I collect using the 2019 IRS 8815 on airSlate SignNow?

AirSlate SignNow prioritizes user security, employing advanced encryption methods to safeguard your sensitive information, including details related to the 2019 IRS 8815 form. With comprehensive security measures in place, you can trust that your documents and personal data remain protected. Security compliance helps ensure peace of mind throughout the document handling process.

-

How do I get started with airSlate SignNow for my 2019 IRS 8815?

Getting started with airSlate SignNow for your 2019 IRS 8815 is simple. You can sign up for an account, select a suitable pricing plan, and access templates specifically designed for tax forms. Once you're set up, you can quickly create, sign, and send your documents without hassle.

Get more for Form 8815

- Chandler nguyen form

- Donation request application guidelines putters fill and form

- Www boardmantwp com zoning filespool permit application form

- Nevada state firefighters association form

- Get in gear program form

- Cr 200 dill temporary order 9 15 criminal forms

- Music artist performance contract template

- Music band contract template form

Find out other Form 8815

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors