Distribution Request Form READ the ATTACHED IRS SP 2016-2026

Understanding the Distribution Request Form

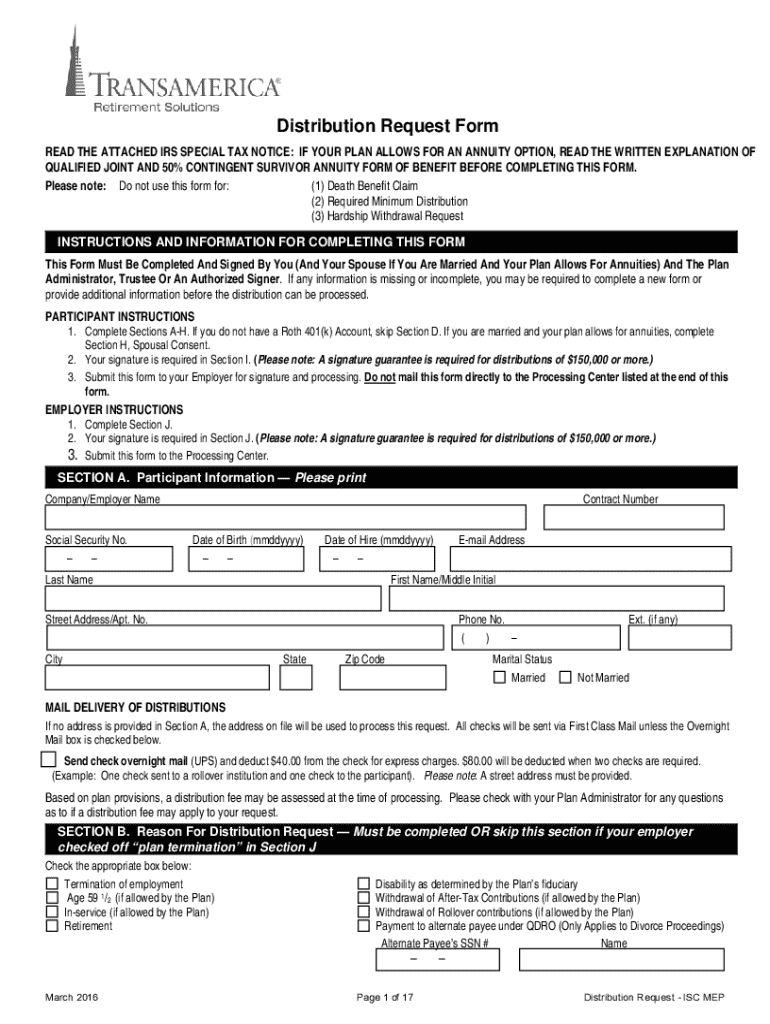

The Transamerica disbursement request form is a crucial document for individuals seeking to withdraw funds from their retirement accounts. This form is specifically designed to facilitate the process of requesting distributions from various types of accounts, such as 401(k) plans. Understanding its purpose and function is essential for ensuring compliance with IRS regulations and making informed financial decisions.

Steps to Complete the Distribution Request Form

Filling out the Transamerica distribution request form involves several key steps to ensure accuracy and completeness. Begin by providing your personal information, including your name, address, and Social Security number. Next, specify the type of distribution you are requesting, such as a hardship withdrawal or an early withdrawal. Be sure to include the amount you wish to withdraw and any relevant account numbers. Finally, review the form for any errors and sign it to authorize the transaction.

Required Documents for Submission

To successfully submit the Transamerica disbursement request form, certain documents may be required. Typically, you will need to provide proof of identity, such as a government-issued ID, and any supporting documentation related to your withdrawal request. For instance, if you are applying for a hardship withdrawal, you may need to submit evidence of financial need. Ensuring that all necessary documents are included will help expedite the processing of your request.

Eligibility Criteria for Withdrawals

Eligibility for withdrawals from your Transamerica retirement account is governed by specific criteria set forth by the IRS and your plan. Generally, you may be eligible for a distribution if you have reached the age of fifty-nine and a half, if you are facing financial hardship, or if you have separated from service with your employer. It is important to review these criteria carefully to determine your eligibility before submitting the distribution request form.

Submission Methods for the Form

The Transamerica disbursement request form can be submitted through various methods, depending on your preference. You may choose to complete the form online via the Transamerica portal, ensuring a quick and efficient process. Alternatively, you can print the completed form and submit it by mail or in person at a designated Transamerica office. Each submission method has its own processing times, so consider your needs when choosing how to send your request.

IRS Guidelines for Disbursement Requests

When submitting the Transamerica distribution request form, it is essential to adhere to IRS guidelines regarding retirement account withdrawals. The IRS outlines specific rules about the timing of distributions, tax implications, and penalties for early withdrawals. Familiarizing yourself with these guidelines will help you navigate the process more effectively and avoid potential tax liabilities.

Common Scenarios for Using the Distribution Request Form

There are various scenarios in which individuals may need to utilize the Transamerica disbursement request form. Common situations include retirement, financial hardship, or unexpected medical expenses. Each scenario may have different implications for the type of withdrawal requested and the associated tax consequences. Understanding these scenarios can help you make informed decisions about your retirement funds.

Handy tips for filling out Distribution Request Form READ THE ATTACHED IRS SP online

Quick steps to complete and e-sign Distribution Request Form READ THE ATTACHED IRS SP online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant solution for maximum straightforwardness. Use signNow to electronically sign and send out Distribution Request Form READ THE ATTACHED IRS SP for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct distribution request form read the attached irs sp

Create this form in 5 minutes!

How to create an eSignature for the distribution request form read the attached irs sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the transamerica disbursement request form?

The transamerica disbursement request form is a document used to request the disbursement of funds from Transamerica accounts. It streamlines the process of accessing your funds, ensuring that all necessary information is captured efficiently. Using airSlate SignNow, you can easily fill out and eSign this form, making it a hassle-free experience.

-

How can I access the transamerica disbursement request form?

You can access the transamerica disbursement request form through the Transamerica website or by using airSlate SignNow. Our platform allows you to quickly locate and complete the form online, ensuring that you have all the necessary details at your fingertips. Once completed, you can eSign it directly within the application.

-

What features does airSlate SignNow offer for the transamerica disbursement request form?

airSlate SignNow offers a variety of features for the transamerica disbursement request form, including easy document editing, eSigning capabilities, and secure storage. You can also track the status of your form and receive notifications when it has been signed. These features enhance the efficiency of managing your disbursement requests.

-

Is there a cost associated with using the transamerica disbursement request form on airSlate SignNow?

While the transamerica disbursement request form itself is free to access, using airSlate SignNow may involve subscription fees depending on the plan you choose. Our pricing is competitive and designed to provide value for businesses looking to streamline their document management processes. You can explore different plans to find one that fits your needs.

-

What are the benefits of using airSlate SignNow for the transamerica disbursement request form?

Using airSlate SignNow for the transamerica disbursement request form offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick eSigning and document sharing, which speeds up the disbursement process. Additionally, it enhances security and compliance, ensuring your sensitive information is protected.

-

Can I integrate airSlate SignNow with other applications for the transamerica disbursement request form?

Yes, airSlate SignNow offers integrations with various applications that can enhance your experience with the transamerica disbursement request form. You can connect it with CRM systems, cloud storage services, and other tools to streamline your workflow. This flexibility allows you to manage your documents more effectively.

-

How secure is the transamerica disbursement request form when using airSlate SignNow?

The transamerica disbursement request form is highly secure when processed through airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your information is safe while you eSign and manage your disbursement requests.

Get more for Distribution Request Form READ THE ATTACHED IRS SP

Find out other Distribution Request Form READ THE ATTACHED IRS SP

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer