8804 Form

What is the 8804

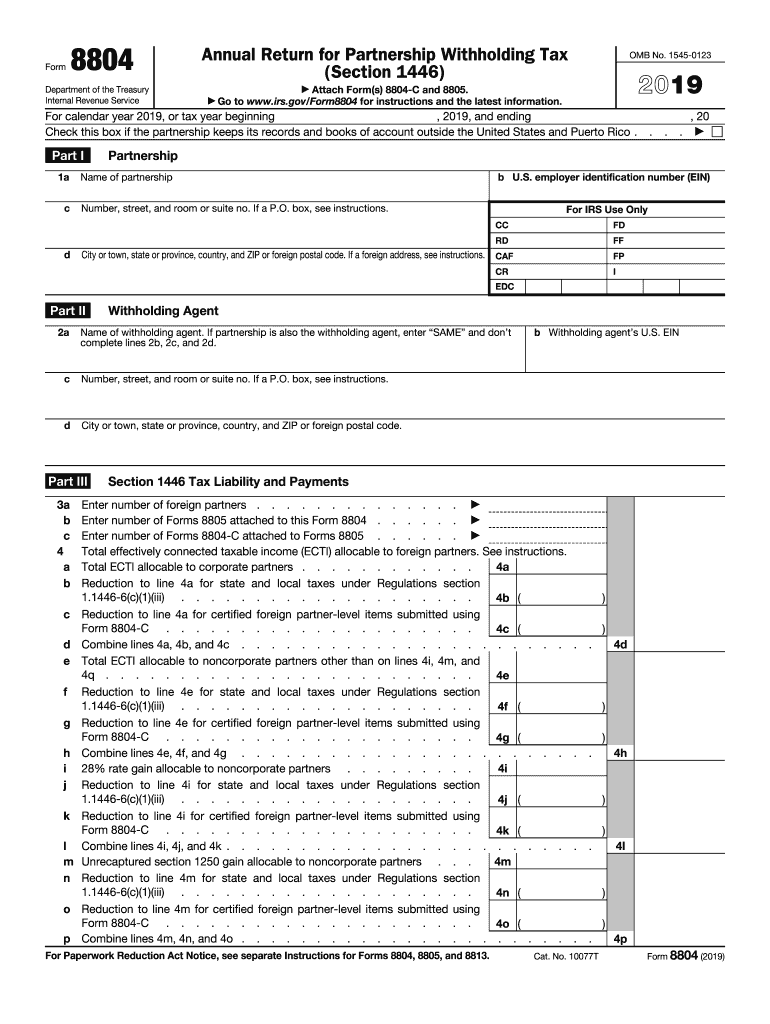

The 8804 form, officially known as the 8804 Annual Return for Partnership Withholding Tax, is a tax document used by partnerships in the United States to report and pay withholding tax on income allocated to foreign partners. This form is essential for ensuring compliance with U.S. tax laws, particularly for partnerships that have non-resident alien partners who receive income from U.S. sources. The form provides the IRS with information about the partnership's income, deductions, and the amount withheld for each foreign partner.

How to use the 8804

Using the 8804 form involves several steps to ensure accurate reporting and compliance. First, partnerships must determine if they have foreign partners who require withholding. If so, they need to calculate the total income allocated to these partners and the corresponding withholding tax amount. The completed form must then be submitted to the IRS along with any required payments. It is crucial for partnerships to maintain accurate records of income and withholding to support the information reported on the 8804.

Steps to complete the 8804

Completing the 8804 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the partnership and its foreign partners.

- Calculate the total income allocated to each foreign partner.

- Determine the appropriate withholding tax rate based on the income type and partner status.

- Complete the form by entering the calculated amounts and any other required information.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the 8804

The legal use of the 8804 form is governed by IRS regulations, which mandate that partnerships with foreign partners comply with U.S. withholding tax laws. Properly filing the 8804 ensures that the partnership meets its tax obligations and avoids potential penalties. It is important for partnerships to understand the legal implications of failing to withhold or report correctly, as this can lead to significant financial consequences.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the 8804 form to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is essential to stay informed about any changes to IRS deadlines that may occur, especially in light of evolving tax laws.

Required Documents

To complete the 8804 form accurately, partnerships need to gather several key documents:

- Partnership tax return (Form 1065) for the relevant tax year.

- Information on foreign partners, including their tax identification numbers.

- Records of income allocated to each foreign partner.

- Documentation of any withholding tax payments made during the year.

Penalties for Non-Compliance

Failure to comply with the requirements of the 8804 form can result in significant penalties. The IRS may impose fines for late filings, underreporting income, or failing to withhold the appropriate taxes. These penalties can accumulate quickly, making it crucial for partnerships to adhere to all filing requirements and deadlines. Understanding the potential consequences of non-compliance can help partnerships prioritize their tax obligations effectively.

Quick guide on how to complete about form 8804 annual return for partnership withholding

Complete 8804 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and store it securely online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any holdups. Manage 8804 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign 8804 without any hassle

- Locate 8804 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your chosen device. Modify and eSign 8804 and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8804 annual return for partnership withholding

How to create an eSignature for the About Form 8804 Annual Return For Partnership Withholding online

How to create an eSignature for your About Form 8804 Annual Return For Partnership Withholding in Chrome

How to generate an electronic signature for putting it on the About Form 8804 Annual Return For Partnership Withholding in Gmail

How to make an eSignature for the About Form 8804 Annual Return For Partnership Withholding straight from your mobile device

How to make an eSignature for the About Form 8804 Annual Return For Partnership Withholding on iOS devices

How to create an electronic signature for the About Form 8804 Annual Return For Partnership Withholding on Android devices

People also ask

-

What is Form 8804 and why is it important?

Form 8804 is a crucial document used by partnerships to report the tax owed on effectively connected taxable income. Understanding Form 8804 is essential for compliance with IRS regulations, ensuring that businesses avoid penalties and maintain good standing.

-

How does airSlate SignNow simplify the signing process for Form 8804?

airSlate SignNow streamlines the signing process for Form 8804 by providing a user-friendly interface. Users can easily send, receive, and eSign documents securely, saving time while ensuring accurate completion of the Form 8804.

-

Can I integrate airSlate SignNow with my tax software for Form 8804?

Yes, airSlate SignNow offers seamless integrations with various popular tax software. This allows users to easily import data and manage their Form 8804 directly from their tax applications, enhancing efficiency and reducing manual errors.

-

Is there a specific pricing model for using airSlate SignNow for Form 8804?

airSlate SignNow provides flexible pricing plans that cater to different business needs. You can choose a plan that best fits your requirements, whether you need occasional access to Form 8804 or frequent document handling for multiple partners.

-

What are the key features of airSlate SignNow for handling Form 8804?

Key features of airSlate SignNow for Form 8804 include document templates, in-person signing options, and advanced security measures. These features enhance user experience and ensure compliance, making the process of managing Form 8804 comprehensive and secure.

-

How does airSlate SignNow ensure the security of Form 8804?

airSlate SignNow employs state-of-the-art encryption and secure access controls to protect sensitive documents like Form 8804. Users can trust that their data will remain confidential and secure throughout the signing and submission process.

-

Can I track the status of my Form 8804 with airSlate SignNow?

Yes, airSlate SignNow includes a tracking feature that allows users to monitor the status of their Form 8804. This transparency ensures that you are always informed about who has signed the document and when, streamlining the overall process.

Get more for 8804

- Fluid intake and output record form

- Timberland warranty claim form fill online printable

- Transcript request form east clinton local schools

- Mortgage contract template form

- Monthly subscription contract template form

- Mortgage loan contract template form

- Mother agency contract template form

- Mortgage sale contract template form

Find out other 8804

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online