Federal 8916 Form

What is the Federal 8916

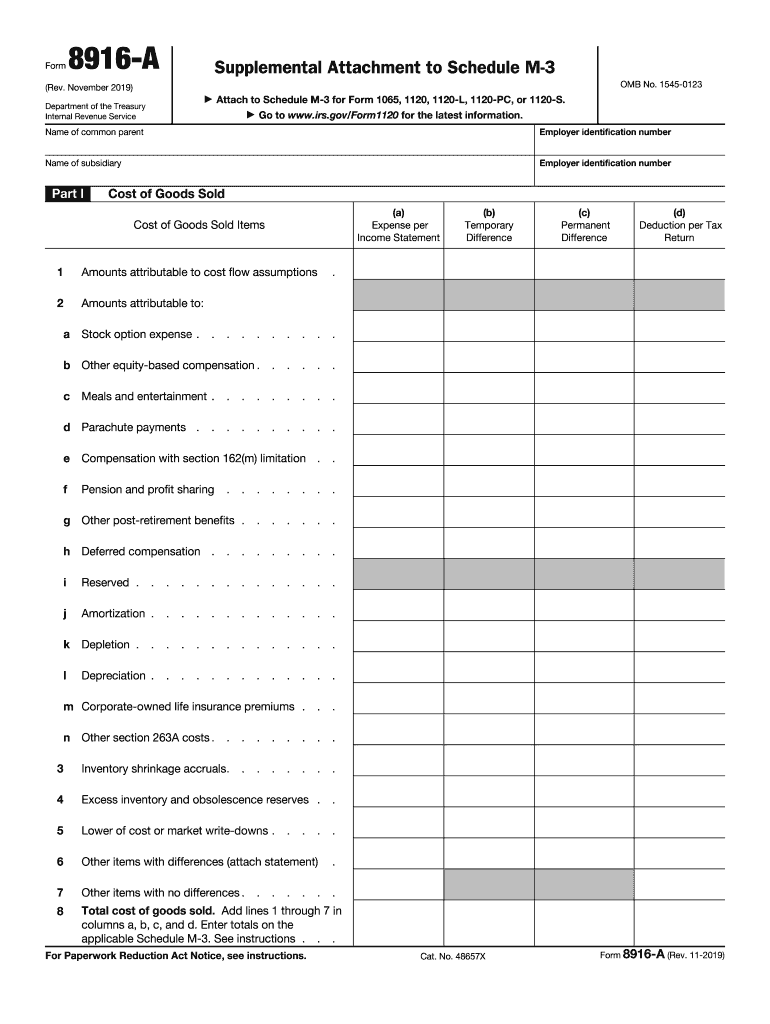

The IRS Form 8916 is a tax form used by partnerships and S corporations to report information related to the income and deductions of the entity. Specifically, it is designed to accompany Form 1065 or Form 1120S, providing additional details required by the IRS. This form helps ensure that the partnership or S corporation accurately reflects its financial activities and complies with federal tax regulations.

How to use the Federal 8916

To use the IRS Form 8916, businesses must first determine if they are required to file it based on their entity type and the nature of their income. Once it is established that the form is necessary, the entity should gather relevant financial information, including income, deductions, and other pertinent data. The completed form is then submitted alongside the primary tax return, such as Form 1065 or Form 1120S, ensuring that all information is accurate and complete.

Steps to complete the Federal 8916

Completing the IRS Form 8916 involves several key steps:

- Gather necessary financial documents, including income statements and deduction records.

- Fill out the basic information section, including the entity's name, address, and Employer Identification Number (EIN).

- Provide detailed information regarding income and deductions as required by the form.

- Review the completed form for accuracy and ensure that all necessary signatures are included.

- Submit the form along with the corresponding tax return by the established deadline.

Legal use of the Federal 8916

The IRS Form 8916 must be used in accordance with federal tax laws to ensure its legal validity. This includes providing truthful and accurate information, as any discrepancies could lead to penalties or audits. When filed correctly, the form serves as a legal document that supports the financial claims made by the partnership or S corporation on their tax returns.

Filing Deadlines / Important Dates

The filing deadline for IRS Form 8916 typically aligns with the due date for Form 1065 or Form 1120S, which is usually March 15 for calendar year filers. If an extension is filed, the deadline may be extended to September 15. It is crucial for businesses to adhere to these deadlines to avoid late filing penalties and ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 8916 can be submitted through various methods. Businesses may file it electronically as part of their tax return using compatible tax software. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency and accuracy.

Quick guide on how to complete 2290 heavy highway vehicle use tax return

Effortlessly Prepare Federal 8916 on Any Device

Digital document management has gained traction among businesses and individuals. It offers a great eco-friendly substitute to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without any holdups. Manage Federal 8916 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Federal 8916 effortlessly

- Locate Federal 8916 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Identify important parts of the document or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Federal 8916 to ensure smooth communication at every phase of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2290 heavy highway vehicle use tax return

How to create an eSignature for your 2290 Heavy Highway Vehicle Use Tax Return in the online mode

How to generate an eSignature for the 2290 Heavy Highway Vehicle Use Tax Return in Chrome

How to make an electronic signature for signing the 2290 Heavy Highway Vehicle Use Tax Return in Gmail

How to make an electronic signature for the 2290 Heavy Highway Vehicle Use Tax Return from your mobile device

How to generate an eSignature for the 2290 Heavy Highway Vehicle Use Tax Return on iOS

How to make an electronic signature for the 2290 Heavy Highway Vehicle Use Tax Return on Android

People also ask

-

What is IRS Form 8916 and how is it used?

IRS Form 8916 is used to report the tax credit for increasing research activities. Businesses can utilize this form to claim the Qualified Research Expenses (QREs) they incur. Accurate completion of IRS Form 8916 is crucial to ensure that you receive the appropriate tax benefits.

-

How can airSlate SignNow help with IRS Form 8916?

airSlate SignNow allows you to easily create, send, and eSign documents like IRS Form 8916 securely. With its user-friendly interface, you can prepare essential tax documents seamlessly, ensuring timely submission. The platform enhances compliance and reduces the risk of errors when filing IRS Form 8916.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8916?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling documents like IRS Form 8916. The plans include features like document templates and eSignature capabilities. You'll find that the cost-effectiveness of airSlate SignNow makes it an ideal choice for preparing IRS Form 8916.

-

What features does airSlate SignNow offer for IRS Form 8916 processing?

airSlate SignNow provides features such as easy document creation, customizable templates, and secure eSigning for IRS Form 8916. You can also track document status and manage workflows efficiently. These features help streamline the completion of IRS Form 8916, making tax season less stressful.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 8916?

Yes, airSlate SignNow offers integrations with popular accounting software to facilitate the handling of IRS Form 8916. By connecting your tools, you can simplify the process of compiling necessary data. This integration ensures that your IRS Form 8916 is completed accurately and efficiently.

-

What are the benefits of using airSlate SignNow for IRS Form 8916?

Using airSlate SignNow for IRS Form 8916 allows for increased efficiency and reduced errors in document processing. The platform provides secure storage and organized access to your forms. Additionally, the convenience of eSigning ensures that your IRS Form 8916 can be signed and submitted promptly.

-

Is airSlate SignNow compliant with IRS standards for form submissions, including IRS Form 8916?

Yes, airSlate SignNow is designed to comply with IRS standards for electronic submissions, including IRS Form 8916. The platform prioritizes data security and confidentiality, ensuring that your sensitive information is protected. This compliance reinforces the reliability of using airSlate SignNow for your IRS Form 8916 needs.

Get more for Federal 8916

- Home inventory checklist state farm form

- Blank state farm letterhead form

- Roofing installation information and certification for reduction in residential insurance premiums

- State farm steer clear discount form

- State farm power of attorney form

- Project narrative example form

- Partners research proposal coversheet partners research resadmin partners form

- Missouri report manual form

Find out other Federal 8916

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later