ServicesWashington County, Nebraska 2022-2026

What is the ServicesWashington County, Nebraska

The ServicesWashington County, Nebraska, encompass a range of essential resources provided by local government and community organizations. These services are designed to support residents in various aspects of daily life, including health, education, transportation, and public safety. Understanding these services is crucial for residents seeking assistance or information related to their needs.

How to use the ServicesWashington County, Nebraska

Utilizing the ServicesWashington County, Nebraska, involves accessing the appropriate resources based on specific needs. Residents can visit local government offices, community centers, or official websites to gather information about available services. Many services may require residents to fill out forms or applications, which can often be completed online or in person.

Steps to complete the ServicesWashington County, Nebraska

Completing the ServicesWashington County, Nebraska, typically includes the following steps:

- Identify the specific service needed, such as health care or housing assistance.

- Gather necessary documentation, which may include identification and proof of residency.

- Complete any required forms, ensuring all information is accurate and up to date.

- Submit the forms either online, by mail, or in person at designated locations.

- Follow up with the relevant agency to confirm receipt and inquire about the status of the application.

Legal use of the ServicesWashington County, Nebraska

The legal use of the ServicesWashington County, Nebraska, is governed by local, state, and federal regulations. Residents must comply with eligibility criteria and application processes to ensure they receive services lawfully. Understanding these legal frameworks is essential for avoiding potential issues or delays in accessing needed services.

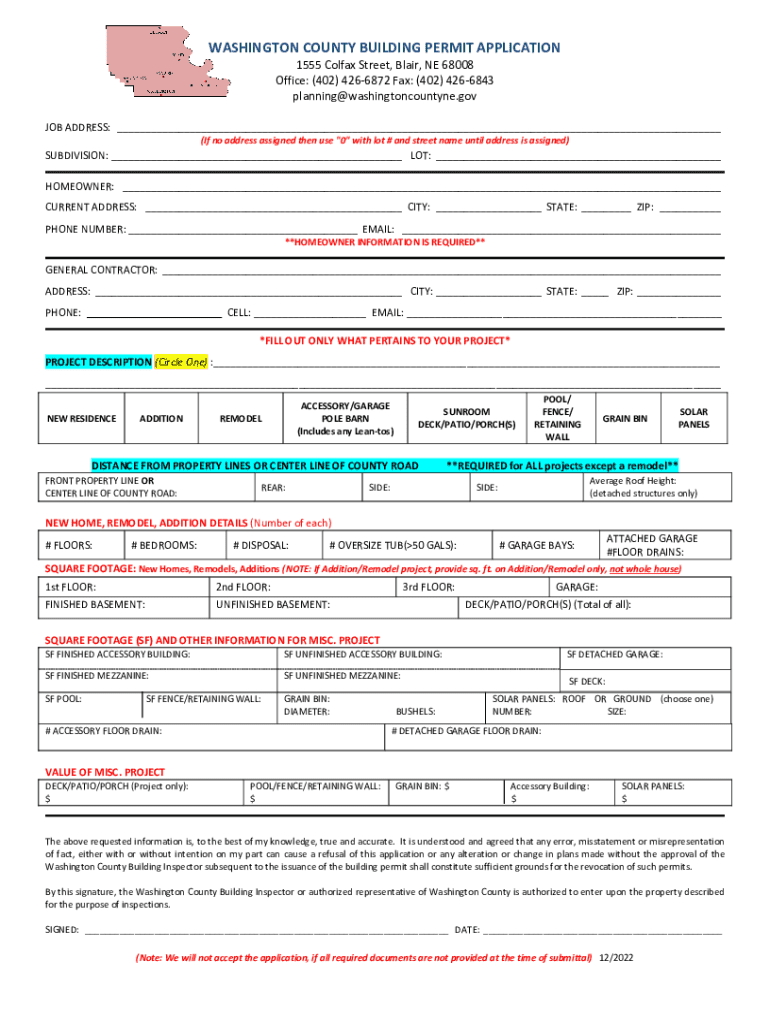

Required Documents

When applying for ServicesWashington County, Nebraska, residents may need to provide various documents. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Proof of residency, such as a utility bill or lease agreement.

- Income verification documents, such as pay stubs or tax returns.

- Any specific forms related to the service being requested.

Form Submission Methods (Online / Mail / In-Person)

Residents can submit forms for ServicesWashington County, Nebraska, through several methods:

- Online: Many services offer online submission through official websites, allowing for quick and efficient processing.

- Mail: Forms can often be printed and mailed to the appropriate agency, ensuring all required documents are included.

- In-Person: Residents may also visit local offices to submit forms directly, which can provide immediate assistance and clarification on any questions.

Quick guide on how to complete serviceswashington county nebraska

Complete ServicesWashington County, Nebraska seamlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without any holdups. Manage ServicesWashington County, Nebraska across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign ServicesWashington County, Nebraska effortlessly

- Find ServicesWashington County, Nebraska and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides explicitly for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign ServicesWashington County, Nebraska and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct serviceswashington county nebraska

Create this form in 5 minutes!

How to create an eSignature for the serviceswashington county nebraska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of services are offered in ServicesWashington County, Nebraska?

ServicesWashington County, Nebraska, includes a range of document management solutions such as eSigning, document sharing, and workflow automation. These services are designed to streamline business processes and enhance productivity. With airSlate SignNow, you can easily manage your documents from anywhere.

-

How much do the services cost in ServicesWashington County, Nebraska?

The pricing for ServicesWashington County, Nebraska, varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can select a plan that fits your budget while still accessing powerful eSigning features.

-

What are the key features of airSlate SignNow in ServicesWashington County, Nebraska?

Key features of airSlate SignNow in ServicesWashington County, Nebraska, include customizable templates, real-time tracking, and secure cloud storage. These features help businesses efficiently manage their documents and ensure compliance. Additionally, the platform is user-friendly, making it accessible for all team members.

-

How can airSlate SignNow benefit my business in ServicesWashington County, Nebraska?

Using airSlate SignNow in ServicesWashington County, Nebraska, can signNowly reduce the time spent on document management. By automating the eSigning process, businesses can improve efficiency and reduce errors. This leads to faster transactions and enhanced customer satisfaction.

-

Is airSlate SignNow easy to integrate with other tools in ServicesWashington County, Nebraska?

Yes, airSlate SignNow offers seamless integrations with various business tools commonly used in ServicesWashington County, Nebraska. Whether you use CRM systems, cloud storage solutions, or project management tools, integration is straightforward. This ensures that your workflow remains uninterrupted and efficient.

-

What security measures does airSlate SignNow implement for ServicesWashington County, Nebraska?

airSlate SignNow prioritizes security for its users in ServicesWashington County, Nebraska, by implementing advanced encryption and secure access controls. All documents are stored securely in the cloud, ensuring that sensitive information is protected. Compliance with industry standards further enhances the security of your documents.

-

Can I access airSlate SignNow on mobile devices in ServicesWashington County, Nebraska?

Absolutely! airSlate SignNow is fully accessible on mobile devices, allowing users in ServicesWashington County, Nebraska, to manage their documents on the go. The mobile app provides all the essential features, ensuring that you can eSign and send documents anytime, anywhere.

Get more for ServicesWashington County, Nebraska

- Baylor class schedule worksheet form

- Residential profile sheet nabor com form

- Hcuc 150 point inspection checklist uc012 clickmotive form

- Ps form 3295 daily record of stamps stamped nalc branch 78 nalc branch78

- Problem solving plan plan b flowchart form

- Ujjivan loan application form

- Marie d berry scholarship renewal a form

- Solicitation permit application moon township police department form

Find out other ServicesWashington County, Nebraska

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online