F11185 Request for a Charitable Distribution from an Individual Retirement Account IRA F11185 2022-2026

Understanding the TIAA QCD Form

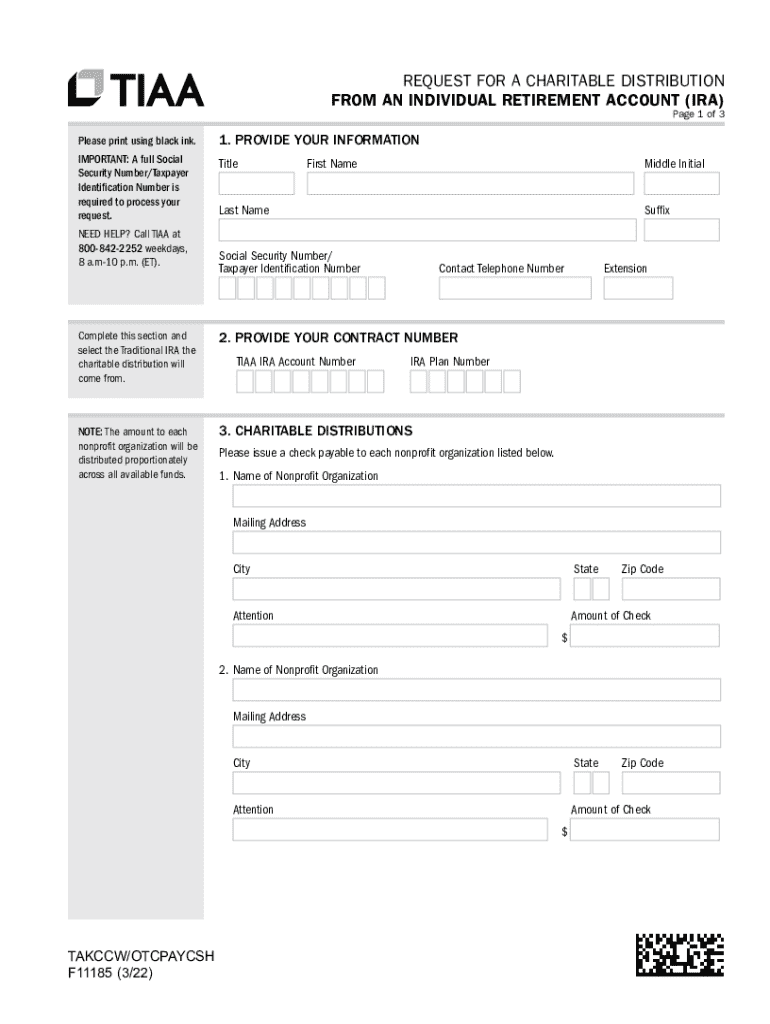

The TIAA QCD form, officially known as the F11185 Request for a Charitable Distribution from an Individual Retirement Account (IRA), allows individuals to request a direct transfer of funds from their IRA to a qualified charitable organization. This process is often utilized for tax benefits, as distributions made directly to charities can be excluded from taxable income, provided certain conditions are met. Understanding this form is essential for those looking to support charitable causes while managing their tax obligations effectively.

Steps to Complete the TIAA QCD Form

Completing the TIAA QCD form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your IRA account details and the charity's information. Next, fill out the form by providing your personal information, the amount you wish to donate, and the charity's name and address. Ensure that all details are accurate to avoid delays. Finally, review the completed form for any errors before submitting it to TIAA for processing.

Eligibility Criteria for the TIAA QCD Form

To utilize the TIAA QCD form, certain eligibility criteria must be met. The individual must be at least seventy and a half years old at the time of the distribution. The distribution must be made directly to a qualified charitable organization, as defined by the IRS. Additionally, the total amount of QCDs cannot exceed one hundred thousand dollars per year for each individual. Meeting these criteria is crucial to benefit from the tax advantages associated with charitable distributions.

Legal Use of the TIAA QCD Form

The legal use of the TIAA QCD form is governed by IRS regulations regarding charitable distributions from IRAs. When properly executed, these distributions can help individuals meet their required minimum distributions (RMDs) while also providing financial support to charities. It is important to ensure that the receiving organization qualifies under IRS rules to avoid potential tax liabilities. Consulting with a tax professional can provide additional clarity on legal implications.

IRS Guidelines for Charitable Distributions

The IRS has established specific guidelines for charitable distributions from IRAs, including the use of the TIAA QCD form. According to IRS regulations, the distribution must be made directly to a qualifying charity, and the donor must not receive any goods or services in exchange for the donation. Additionally, individuals should keep records of their charitable contributions for tax reporting purposes. Familiarizing oneself with these guidelines can help ensure compliance and maximize tax benefits.

Form Submission Methods

The TIAA QCD form can be submitted through various methods, depending on individual preference and the requirements of TIAA. Common submission methods include mailing the completed form to TIAA’s designated address or submitting it electronically through their online platform. It is advisable to confirm the preferred submission method with TIAA to ensure timely processing of the request.

Quick guide on how to complete f11185 request for a charitable distribution from an individual retirement account ira f11185

Easily Prepare F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185 on Any Device

Managing documents online has become a favored approach for businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed forms, allowing you to access the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without unnecessary delays. Handle F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185 Effortlessly

- Obtain F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185 and facilitate exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f11185 request for a charitable distribution from an individual retirement account ira f11185

Create this form in 5 minutes!

How to create an eSignature for the f11185 request for a charitable distribution from an individual retirement account ira f11185

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TIAA QCD form and why is it important?

The TIAA QCD form is a Qualified Charitable Distribution form that allows individuals to donate directly from their retirement accounts to eligible charities. This form is important because it helps donors avoid income tax on the distribution while supporting their favorite causes.

-

How can airSlate SignNow help with the TIAA QCD form?

airSlate SignNow streamlines the process of completing and signing the TIAA QCD form electronically. With our easy-to-use platform, you can fill out, eSign, and send the form securely, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the TIAA QCD form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solution ensures that you can manage your TIAA QCD form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the TIAA QCD form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the TIAA QCD form. These features enhance efficiency and ensure that your charitable contributions are processed smoothly.

-

Can I integrate airSlate SignNow with other applications for the TIAA QCD form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your TIAA QCD form alongside other financial tools. This integration helps streamline your workflow and keeps everything organized.

-

What are the benefits of using airSlate SignNow for the TIAA QCD form?

Using airSlate SignNow for the TIAA QCD form offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your charitable distributions are handled efficiently and securely.

-

How secure is the airSlate SignNow platform for handling the TIAA QCD form?

The airSlate SignNow platform employs advanced security measures, including encryption and secure cloud storage, to protect your TIAA QCD form and personal information. You can trust us to keep your documents safe.

Get more for F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185

- Minnesota request 497312313 form

- Salary verification form for potential lease minnesota

- Minnesota landlord tenant 497312315 form

- Mn questionnaire form

- Minnesota amended form

- Notice of prehearing efforts to reach settlement minnesota form

- Notice of default on residential lease minnesota form

- Model affidavit requesting unspecified relief template minnesota form

Find out other F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA F11185

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation