F11185 Request for a Charitable Distribution from an Individual Retirement Account IRA 2018

What is the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

The F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA is a specialized form used by individuals who wish to make charitable donations directly from their IRA accounts. This process allows account holders to transfer funds to eligible charitable organizations without incurring immediate tax liabilities. By utilizing this form, individuals can support their chosen charities while also benefiting from potential tax advantages associated with charitable contributions.

Steps to complete the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

Completing the F11185 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your IRA account details and the recipient charity's information. Next, fill out the form with precise details, ensuring that you specify the amount you wish to donate. It's important to review the form for any errors before submission. Finally, submit the completed form to your IRA custodian, who will process the distribution directly to the charity.

Legal use of the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

This form is legally binding when completed correctly and submitted according to IRS regulations. It is essential to ensure that the charitable organization is qualified under IRS guidelines to receive tax-deductible contributions. By following the proper procedures, individuals can utilize this form to facilitate tax-efficient charitable giving, thereby supporting their philanthropic goals while adhering to legal requirements.

Key elements of the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

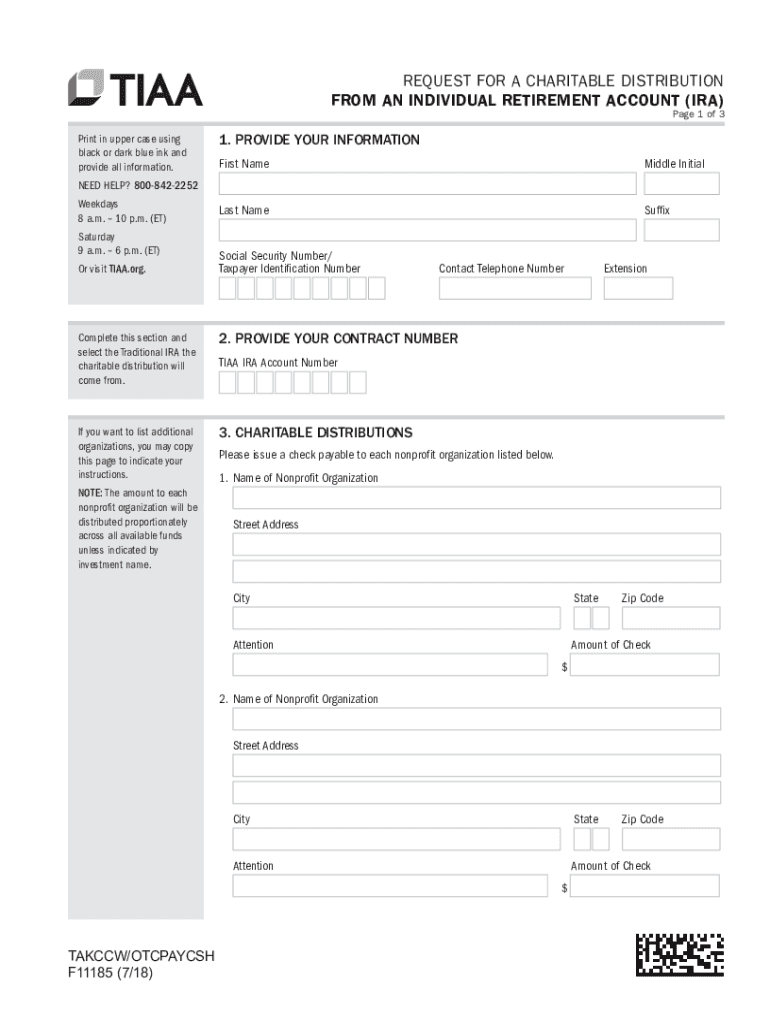

Several key elements must be included in the F11185 form to ensure it is valid. These elements include the account holder's name, IRA account number, the name and address of the charitable organization, and the specific amount to be distributed. Additionally, the form may require the account holder's signature and date to confirm the request. Ensuring all these details are accurate is crucial for the successful processing of the distribution.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the F11185 form for charitable distributions. To qualify, the donation must go to a recognized 501(c)(3) organization, and the distribution must be made directly from the IRA to the charity. Furthermore, individuals must adhere to annual contribution limits and other tax regulations to maintain compliance. Familiarizing oneself with these guidelines is essential for maximizing the benefits of charitable contributions from an IRA.

Eligibility Criteria

To use the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA, individuals must meet certain eligibility criteria. Primarily, the account holder must be at least seventy and a half years old to make tax-free distributions to charity. Additionally, the total amount distributed cannot exceed the annual limit set by the IRS, which varies each year. Understanding these criteria helps individuals plan their charitable giving effectively.

Quick guide on how to complete f11185 request for a charitable distribution from an individual retirement account ira

Effortlessly Prepare F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and eSign F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA Effortlessly

- Obtain F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f11185 request for a charitable distribution from an individual retirement account ira

Create this form in 5 minutes!

How to create an eSignature for the f11185 request for a charitable distribution from an individual retirement account ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA?

The F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA is a specific form that allows individuals to request distributions from their IRAs directly to a charitable organization. This form is essential for clients looking to manage their charitable contributions while optimizing their tax benefits. By using this form, you can streamline the process of making charitable donations directly from your retirement account.

-

How much does it cost to use the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA form through airSlate SignNow?

Using airSlate SignNow to manage your F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA is highly cost-effective. The pricing plans vary based on the number of users and features included. Overall, airSlate SignNow offers competitive pricing that ensures you can handle your IRA distributions without breaking the bank.

-

What features does airSlate SignNow offer for managing the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA?

airSlate SignNow provides a variety of features for managing your F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA, including eSigning, document templates, and workflows. These features enhance efficiency by allowing users to complete their charitable distribution requests seamlessly and securely. Additionally, real-time tracking ensures you stay updated on document status.

-

Can I integrate airSlate SignNow with other applications for the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA process?

Yes, airSlate SignNow offers integrations with a multitude of applications to streamline your F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA process. Whether you need CRM or accounting software integrations, airSlate SignNow ensures your workflow remains efficient and interconnected. This helps in managing your documents with ease across different platforms.

-

What are the benefits of using airSlate SignNow for the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA?

Utilizing airSlate SignNow for the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA offers numerous benefits, including improved efficiency, security, and ease of use. You can easily handle your requests, ensure compliance with IRS regulations, and track documents effortlessly. Overall, it simplifies the entire process of managing charitable distributions from your retirement accounts.

-

Is airSlate SignNow legally compliant for the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA?

Absolutely, airSlate SignNow ensures that all forms, including the F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA, are legally compliant with relevant regulations. The platform follows stringent security and compliance protocols to safeguard your data. This makes airSlate SignNow a reliable solution for managing sensitive documents like charitable distribution requests.

-

How do I start using airSlate SignNow for my F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA?

To start using airSlate SignNow for your F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA, all you need to do is sign up on our platform. After signing up, you can easily access templates, fill out necessary information, and start eSigning your requests. The user-friendly interface guides you through the process step by step.

Get more for F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

- Advisory 93 10 texas department of insurance texasgov form

- 765514 statutes ampamp constitution view statutes online form

- 72 17 201 making amending revoking and refusing to make form

- Az pllc 1 form

- How to form a professional llc in arizonanolo

- Az pllc pub form

- Rhode island general laws title 34 property34 11 12 form

- Is the promissory note in your buy sell agreement fair to all form

Find out other F11185 Request For A Charitable Distribution From An Individual Retirement Account IRA

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online