Form 8938

What is the Form 8938

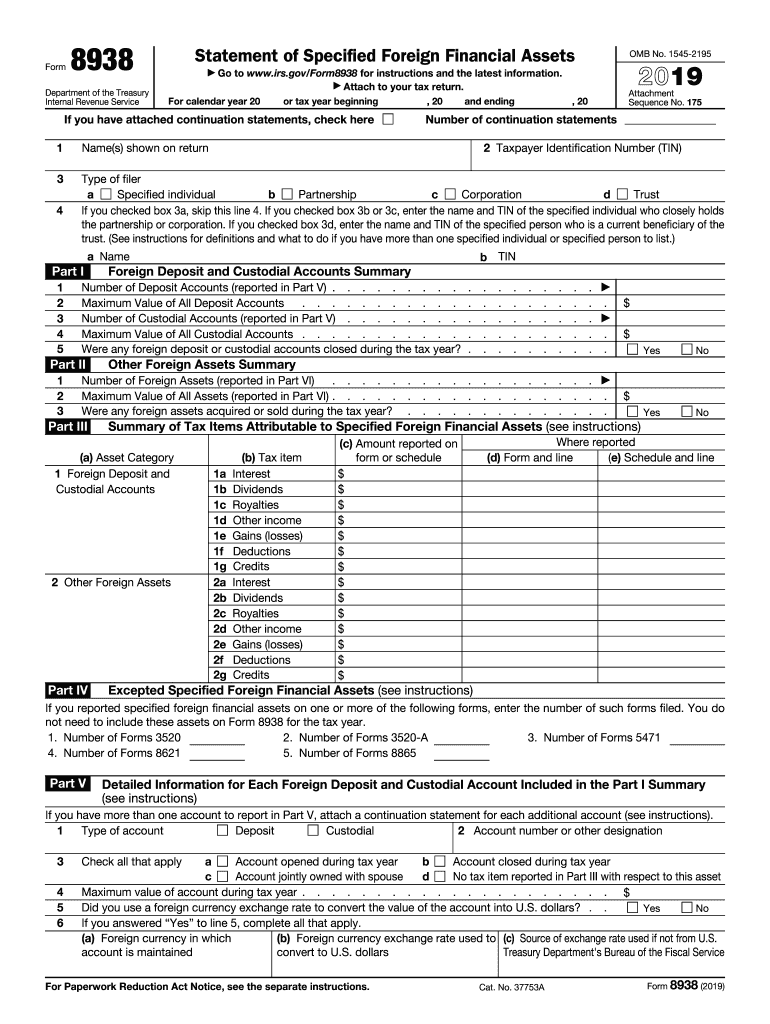

The 2019 Form 8938 is a tax form used by specified individuals to report their foreign financial assets to the Internal Revenue Service (IRS). This form is part of the Foreign Account Tax Compliance Act (FATCA) and is required for U.S. taxpayers who have an interest in specified foreign financial assets and meet certain thresholds. The form helps the IRS monitor compliance with U.S. tax laws regarding foreign income and assets.

How to use the Form 8938

To effectively use the 2019 Form 8938, taxpayers must first determine if they meet the filing requirements based on their foreign financial assets. Once determined, they will need to accurately complete the form by providing detailed information about each asset, including the type, value, and income generated. It is essential to ensure that all information is accurate and complete to avoid penalties. The form must be submitted with the taxpayer's annual income tax return.

Steps to complete the Form 8938

Completing the 2019 Form 8938 involves several steps. First, gather all necessary information about your foreign financial assets, including bank accounts, stocks, and other investments. Next, determine the total value of these assets as of the end of the tax year. Then, fill out the form by entering the required information in the appropriate sections, including your personal details and specifics about each asset. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 8938

The legal use of the 2019 Form 8938 is governed by IRS regulations under FATCA. It is crucial for taxpayers to understand that failing to file this form when required can result in significant penalties. The form serves as a declaration of foreign assets and must be filed in compliance with U.S. tax laws. Using a reliable digital platform for e-signatures can enhance the legal validity of the submission, ensuring compliance with the necessary legal frameworks.

Filing Deadlines / Important Dates

The filing deadline for the 2019 Form 8938 coincides with the due date for your federal income tax return, typically April 15 of the following year. If you are unable to meet this deadline, you may request an extension, but it is important to note that the extension does not apply to the Form 8938 specifically. Ensure that you keep track of any changes in deadlines or requirements from the IRS to avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the 2019 Form 8938 when required can result in severe penalties. The IRS imposes a penalty of $10,000 for not filing the form, with additional penalties for continued failure to file after notification. Moreover, if the IRS determines that the failure to report was willful, the penalties can increase significantly. It is essential for taxpayers to understand their obligations to avoid these financial repercussions.

Quick guide on how to complete f8938 form 8938 department of the treasury internal revenue

Effortlessly Prepare Form 8938 on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 8938 on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-based workflow today.

The Simplest Way to Modify and eSign Form 8938 with Ease

- Obtain Form 8938 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 8938 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8938 form 8938 department of the treasury internal revenue

How to make an electronic signature for the F8938 Form 8938 Department Of The Treasury Internal Revenue in the online mode

How to generate an electronic signature for the F8938 Form 8938 Department Of The Treasury Internal Revenue in Chrome

How to generate an electronic signature for putting it on the F8938 Form 8938 Department Of The Treasury Internal Revenue in Gmail

How to make an electronic signature for the F8938 Form 8938 Department Of The Treasury Internal Revenue straight from your smartphone

How to generate an eSignature for the F8938 Form 8938 Department Of The Treasury Internal Revenue on iOS devices

How to create an eSignature for the F8938 Form 8938 Department Of The Treasury Internal Revenue on Android devices

People also ask

-

What is the 2019 Form 8938 and who needs to file it?

The 2019 Form 8938 is a tax form used by specified individuals to report foreign financial assets. If you have assets exceeding certain thresholds, you are required to file this form with your tax return. Understanding how to accurately file this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help in filing the 2019 Form 8938?

airSlate SignNow streamlines the process of signing and submitting documents like the 2019 Form 8938. With our user-friendly interface, users can easily upload, edit, and eSign necessary tax forms, ensuring a quick and secure filing process. Our solution saves time and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 2019 Form 8938?

airSlate SignNow offers various pricing plans to fit different business needs, making it a cost-effective solution for managing tax documents, including the 2019 Form 8938. Our competitive pricing allows businesses of all sizes to access essential features without breaking the bank. Be sure to check our website for current promotions or discounts.

-

What features does airSlate SignNow offer for managing the 2019 Form 8938?

airSlate SignNow provides several features that are beneficial for managing the 2019 Form 8938. These include customizable templates, secure eSigning, and cloud storage for easy access and collaboration with your tax advisor. Our platform ensures that all your documents are organized and readily available whenever you need them.

-

Can I integrate airSlate SignNow with other platforms for filing the 2019 Form 8938?

Yes, airSlate SignNow easily integrates with various popular applications, making it simple to file your 2019 Form 8938 alongside other business processes. You can connect it with platforms like Google Drive and Dropbox, allowing for seamless document management. These integrations enhance efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for tax forms like the 2019 Form 8938?

Using airSlate SignNow for tax forms such as the 2019 Form 8938 provides numerous benefits, including increased efficiency and enhanced security. Our platform allows for rapid document preparation and eSigning, which speeds up the overall filing process. Additionally, our secure environment ensures that sensitive information is protected.

-

How user-friendly is airSlate SignNow for preparing the 2019 Form 8938?

airSlate SignNow is designed with usability in mind, making it incredibly user-friendly for preparing documents like the 2019 Form 8938. Our interface features intuitive navigation and straightforward tools that guide users through each step of the process. This simplicity is beneficial for both tech-savvy and non-technical users.

Get more for Form 8938

- Retainer agreement new york personal injury form

- Credit agreement employee form

- Forms financial analysis

- Fire chief employment contract jeff johnson form

- Commercial construction subcontractor contracts download form

- Courier driver contract template form

- Coo real estate contract samples form

- Online aappm form

Find out other Form 8938

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney