Pa Rct 101 Form

What is the PA RCT 101?

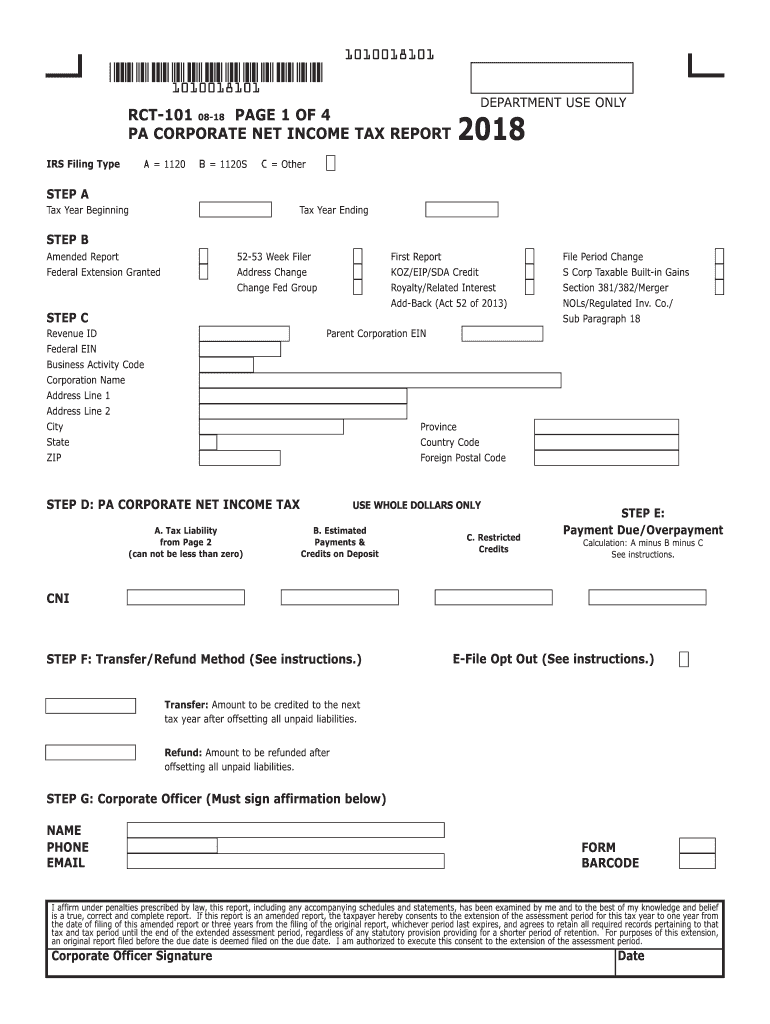

The PA RCT 101, also known as the 2018 Form RCT 101, is a tax form used by businesses in Pennsylvania to report their corporate net income and other related taxes. This form is essential for corporations operating within the state, as it helps determine their tax liabilities based on income earned. The PA RCT 101 is a critical document for compliance with Pennsylvania tax regulations and is typically required to be filed annually.

Steps to Complete the PA RCT 101

Completing the PA RCT 101 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, follow these steps:

- Fill out the basic information section, including your business name, address, and federal employer identification number (EIN).

- Report your total income and deductions, ensuring all figures are accurate and reflect your financial records.

- Calculate your taxable income by subtracting allowable deductions from your total income.

- Determine your tax liability based on the applicable corporate tax rate.

- Review the form for completeness and accuracy before submission.

Legal Use of the PA RCT 101

The PA RCT 101 is legally binding when completed and filed correctly. To ensure its legal validity, businesses must adhere to Pennsylvania's tax laws and regulations. This includes providing accurate information and timely filing. Electronic signatures can be used for submissions, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes eSignatures as legally valid.

Form Submission Methods

The PA RCT 101 can be submitted through various methods, ensuring flexibility for businesses. The available submission methods include:

- Online: Many businesses opt to file electronically through the Pennsylvania Department of Revenue's online portal, which streamlines the process and provides immediate confirmation of submission.

- Mail: Businesses may also choose to print the completed form and mail it to the appropriate state office. It is important to use certified mail to track the submission.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local Pennsylvania Department of Revenue office is an option.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the PA RCT 101 is crucial for avoiding penalties. The standard deadline for submitting this form is the fifteenth day of the fourth month following the end of the tax year. For corporations with a calendar year-end, this typically falls on April 15. It is advisable to mark your calendar and prepare your documents well in advance to ensure timely submission.

Required Documents

To complete the PA RCT 101, several documents are necessary to provide accurate information. Key documents include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and deductions.

- Prior year tax returns for reference and consistency.

- Any supporting documentation for specific deductions claimed.

Eligibility Criteria

Eligibility to file the PA RCT 101 primarily depends on the business structure. Corporations operating in Pennsylvania, including C-Corps and S-Corps, are required to file this form. Additionally, businesses must have a physical presence in Pennsylvania or generate income from Pennsylvania sources to meet the eligibility criteria for this tax form.

Quick guide on how to complete about form 1120internal revenue service irsgov

Effortlessly Prepare Pa Rct 101 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Pa Rct 101 on any device using the airSlate SignNow Android or iOS applications, and enhance any document-centric process today.

How to Modify and eSign Pa Rct 101 with Ease

- Find Pa Rct 101 and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive data using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Pa Rct 101 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1120internal revenue service irsgov

How to generate an electronic signature for the About Form 1120internal Revenue Service Irsgov in the online mode

How to make an electronic signature for your About Form 1120internal Revenue Service Irsgov in Chrome

How to create an electronic signature for signing the About Form 1120internal Revenue Service Irsgov in Gmail

How to create an electronic signature for the About Form 1120internal Revenue Service Irsgov straight from your smartphone

How to make an eSignature for the About Form 1120internal Revenue Service Irsgov on iOS

How to make an electronic signature for the About Form 1120internal Revenue Service Irsgov on Android

People also ask

-

What is the PA Form RCT 101 for 2018?

The PA Form RCT 101 is a tax return form for corporate net income and franchise taxes in Pennsylvania. Understanding the PA Form RCT 101 instructions for 2018 can help businesses accurately report their earnings and comply with state tax laws.

-

How can I use airSlate SignNow to handle PA Form RCT 101 instructions 2018?

airSlate SignNow allows users to easily eSign and manage documents, including tax forms like the PA Form RCT 101 for 2018. You can upload the completed form, add eSignatures, and securely send it to relevant parties, streamlining your filing process.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as eSigning, document templates, and workflow automation, which are valuable for managing forms like the PA Form RCT 101 instructions 2018. These features enhance efficiency and ensure consistent compliance with tax requirements.

-

Is there a cost involved in using airSlate SignNow for PA Form RCT 101?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including those looking to manage PA Form RCT 101 instructions 2018. Pricing is competitive and designed to provide cost-effective solutions for eSigning and document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates with various accounting and tax preparation software, making it convenient to manage PA Form RCT 101 instructions 2018 alongside your other financial documents. This integration helps ensure a seamless workflow and accurate filing.

-

What are the benefits of using airSlate SignNow for signing the PA Form RCT 101?

Using airSlate SignNow to sign the PA Form RCT 101 provides several benefits, including improved efficiency and security. The platform ensures that your signed documents are stored securely and are easily accessible, enhancing your tax filing experience for 2018.

-

How does airSlate SignNow ensure the security of my PA Form RCT 101?

airSlate SignNow prioritizes the security of your documents, including the PA Form RCT 101 instructions 2018. It employs encryption protocols and compliance measures to ensure that your sensitive tax information is protected throughout the signing process.

Get more for Pa Rct 101

Find out other Pa Rct 101

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free