Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 Xlsx Form

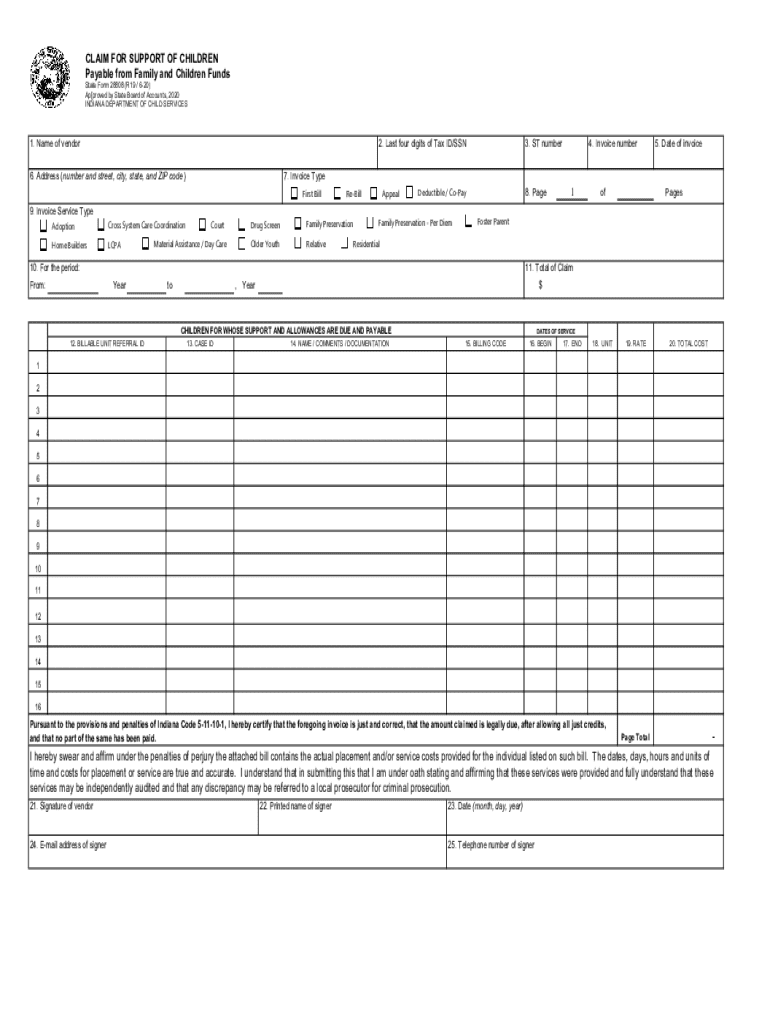

Understanding the Indiana Invoice Form

The Indiana invoice form serves as an essential document for businesses and individuals to request payment for goods or services provided. It typically includes details such as the seller's and buyer's information, a description of the services or products, pricing, and payment terms. This form is crucial for maintaining clear financial records and ensuring compliance with state regulations.

How to Complete the Indiana Invoice Form

Filling out the Indiana invoice form requires careful attention to detail. Start by entering your business name and contact information at the top of the form. Next, include the buyer's details, ensuring accuracy in spelling and address. Clearly describe each item or service provided, including quantity and unit price. Finally, calculate the total amount due, taking into account any applicable taxes or discounts. Ensure all sections are filled out completely to avoid delays in payment.

Key Elements of the Indiana Invoice Form

Several key elements must be present on the Indiana invoice form for it to be effective. These include:

- Invoice Number: A unique identifier for tracking purposes.

- Invoice Date: The date the invoice is issued.

- Payment Terms: Specify when payment is due, such as "Net 30" or "Due on receipt."

- Itemized List: A detailed breakdown of products or services provided.

- Total Amount: The final amount due, including taxes and discounts.

Legal Considerations for Using the Indiana Invoice Form

When using the Indiana invoice form, it is important to adhere to state regulations regarding invoicing. This includes maintaining accurate records for tax purposes and ensuring compliance with the Indiana Department of Revenue guidelines. Businesses should also be aware of any specific requirements related to the information that must be included on the invoice to avoid penalties or disputes.

Submission Methods for the Indiana Invoice Form

The Indiana invoice form can be submitted through various methods, depending on the preferences of the parties involved. Common submission methods include:

- Email: Sending a digital copy of the invoice directly to the client.

- Mail: Printing and sending a physical copy through postal services.

- In-Person: Delivering the invoice directly to the client during a meeting or transaction.

Common Scenarios for Using the Indiana Invoice Form

Different scenarios may require the use of the Indiana invoice form. For instance, freelancers providing services to clients often utilize this form to request payment. Small businesses selling products also rely on invoices for tracking sales and managing accounts receivable. Understanding these scenarios can help ensure that the invoice is used effectively to facilitate transactions.

Quick guide on how to complete db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx

Complete Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx smoothly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx effortlessly

- Locate Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs effortlessly from any device of your choice. Modify and eSign Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to invoice Indiana?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For those dealing with invoice Indiana, it streamlines the invoicing process, ensuring that your invoices are signed and returned quickly, enhancing overall efficiency.

-

How can airSlate SignNow help with managing invoice Indiana?

With airSlate SignNow, managing invoice Indiana becomes seamless. You can create, send, and track invoices in real-time, ensuring that your billing process is organized and that you receive payments faster.

-

What are the pricing options for airSlate SignNow for invoice Indiana users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling invoice Indiana. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for invoice Indiana?

airSlate SignNow provides a range of features specifically designed for invoice Indiana, including customizable templates, automated reminders, and secure cloud storage. These features help ensure that your invoicing process is efficient and compliant with local regulations.

-

Can airSlate SignNow integrate with other tools for invoice Indiana?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management tools, making it ideal for invoice Indiana. This integration allows you to sync your invoicing data, reducing manual entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for invoice Indiana?

Using airSlate SignNow for invoice Indiana offers numerous benefits, including faster turnaround times for signed documents and improved cash flow. Additionally, it enhances the professionalism of your invoicing process, which can lead to better client relationships.

-

Is airSlate SignNow secure for handling invoice Indiana?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including those related to invoice Indiana. With features like encryption and secure access controls, you can trust that your sensitive information is safe.

Get more for Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx

Find out other Db4b2147875b1047d473b95459df9487afc9a497e3a1122b07fceeea58cbf945 xlsx

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free