Form 5329

What is the Form 5329

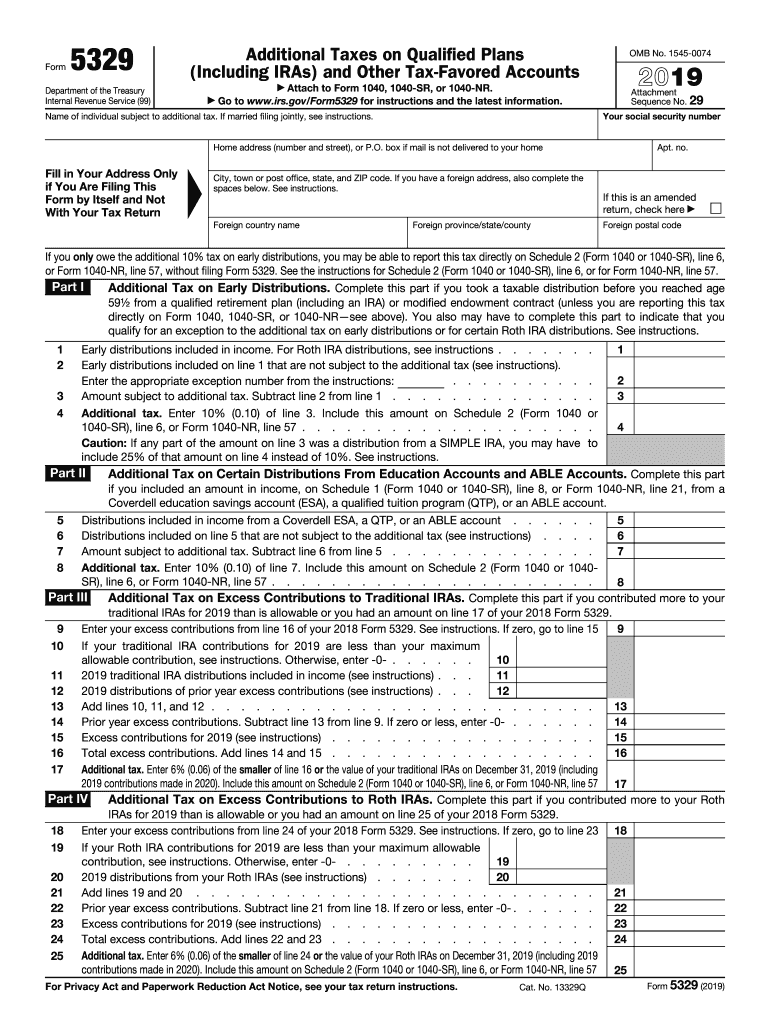

The 2019 tax Form 5329 is a document used by taxpayers to report additional taxes on qualified retirement plans, including IRAs and 401(k)s. This form is essential for those who may have taken early withdrawals or failed to meet required minimum distributions (RMDs). By filing Form 5329, individuals can calculate any penalties associated with these actions, ensuring compliance with IRS regulations.

How to use the Form 5329

To effectively use the 2019 IRS Form 5329, taxpayers must first determine if they have any additional taxes due on their retirement accounts. This includes reviewing any early withdrawals or missed RMDs. After identifying applicable situations, individuals will fill out the form by providing necessary information, such as the type of account, the amount withdrawn, and any applicable exceptions. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties.

Steps to complete the Form 5329

Completing the 2019 Form 5329 involves several key steps:

- Begin by downloading the 5 blank form from the IRS website or a trusted source.

- Fill in your personal information, including your name and Social Security number.

- Report any early distributions from retirement accounts in Part I, detailing the amounts and types of accounts involved.

- In Part II, indicate any exceptions that may apply to your situation, such as disability or medical expenses.

- Calculate any penalties owed and ensure all calculations are accurate.

- Finally, sign and date the form before submitting it with your tax return.

Legal use of the Form 5329

The legal use of the 2019 tax Form 5329 is grounded in its compliance with IRS regulations. Taxpayers must ensure that the information provided is accurate and complete to avoid potential audits or penalties. Filing this form is not optional for those who have taken early withdrawals or failed to meet RMDs; it is a legal requirement to report these transactions properly.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 5329. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on eligibility criteria, exceptions, and filing procedures. Adhering to these guidelines is essential for ensuring that the form is processed correctly and that any penalties are calculated accurately.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing Form 5329 coincides with the standard tax filing deadline, which is typically April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but they must still ensure that any penalties associated with early withdrawals or missed RMDs are addressed by the original deadline to avoid incurring additional fees.

Quick guide on how to complete attach to form 1040 1040 sr or 1040 nr

Accomplish Form 5329 effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the essentials to generate, modify, and electronically sign your documents swiftly without hindrances. Manage Form 5329 on any device via airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The most effective method to modify and eSign Form 5329 with ease

- Obtain Form 5329 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 5329 and guarantee excellent communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the attach to form 1040 1040 sr or 1040 nr

How to generate an electronic signature for the Attach To Form 1040 1040 Sr Or 1040 Nr in the online mode

How to create an eSignature for the Attach To Form 1040 1040 Sr Or 1040 Nr in Google Chrome

How to create an electronic signature for signing the Attach To Form 1040 1040 Sr Or 1040 Nr in Gmail

How to generate an eSignature for the Attach To Form 1040 1040 Sr Or 1040 Nr right from your smartphone

How to make an electronic signature for the Attach To Form 1040 1040 Sr Or 1040 Nr on iOS devices

How to create an electronic signature for the Attach To Form 1040 1040 Sr Or 1040 Nr on Android

People also ask

-

What is IRS Form 5329 for 2019?

IRS Form 5329 for 2019 is used to report additional taxes on qualified retirement plans and IRAs. By filing this form, individuals can address issues like excess contributions, early withdrawals, and more. Understanding this form is crucial for proper tax compliance.

-

Why do I need to submit IRS Form 5329 for 2019?

Submitting IRS Form 5329 for 2019 is necessary if you have made mistakes regarding contributions to your retirement accounts. This may include excess contributions or distributions before age 59½. Properly filing this form helps you avoid hefty penalties and keep your tax records accurate.

-

How can airSlate SignNow help me with IRS Form 5329 for 2019?

airSlate SignNow streamlines the process of signing and sending IRS Form 5329 for 2019 electronically. Our platform allows you to eSign documents quickly, reducing the time and hassle associated with paper forms. This ensures that you meet deadlines and maintain compliance effortlessly.

-

What features does airSlate SignNow offer for handling IRS Form 5329 for 2019?

AirSlate SignNow offers features like customizable templates, secure eSigning, and easy document sharing specifically for IRS Form 5329 for 2019. These tools help ensure that your forms are completed correctly and efficiently. Additionally, our platform includes tracking capabilities to monitor the status of your submissions.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5329 for 2019?

Yes, there are various pricing plans available for using airSlate SignNow, tailored to different business needs. Whether you're an individual or part of a larger organization, you can choose a plan that fits your requirements for managing IRS Form 5329 for 2019. Our cost-effective solutions help you save time and reduce paper waste.

-

Can I integrate airSlate SignNow with my existing tools for IRS Form 5329 for 2019?

Absolutely! airSlate SignNow offers integrations with various tools, enhancing your workflow for handling IRS Form 5329 for 2019. This includes compatibility with popular document management and accounting systems, ensuring seamless processing and storage of your tax forms.

-

How secure is my information when using airSlate SignNow for IRS Form 5329 for 2019?

Security is a top priority at airSlate SignNow, especially for sensitive documents like IRS Form 5329 for 2019. We employ advanced encryption protocols and comply with industry standards to protect your data. This ensures that your personal and financial information remains safe throughout the eSigning process.

Get more for Form 5329

Find out other Form 5329

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking