Form it 204 CP New York Corporate Partner S Schedule K 1 Tax Year 2024-2026

Understanding the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

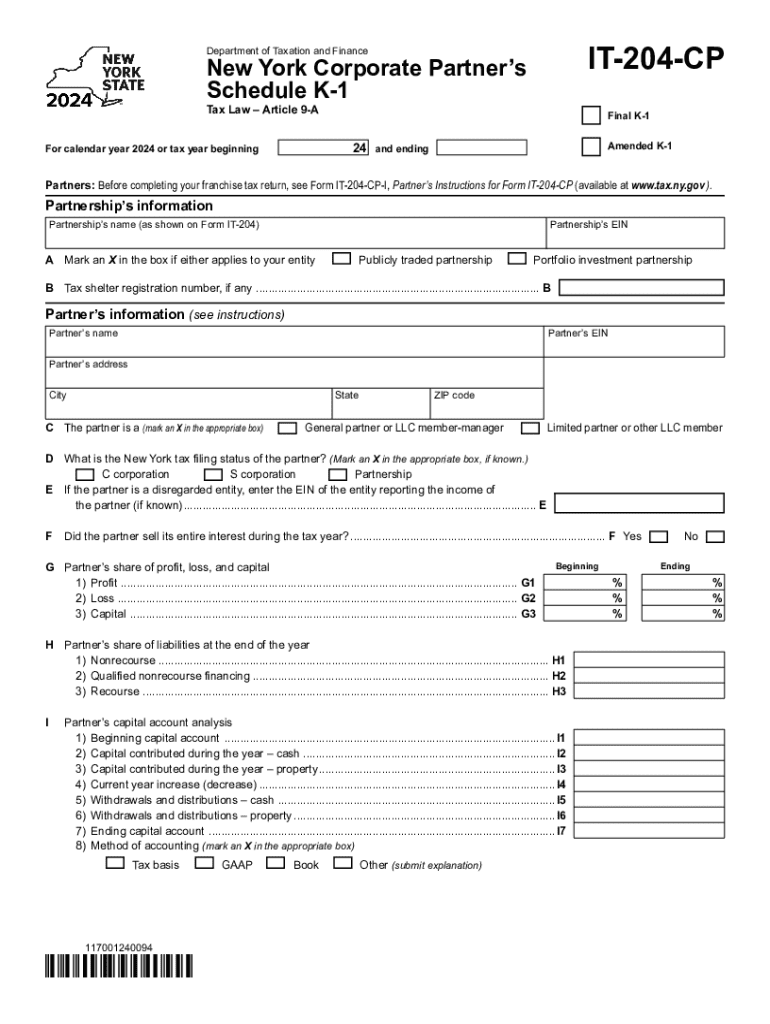

The Form IT 204 CP is a crucial document for corporate partners in New York, specifically designed to report income, deductions, and credits from partnerships. This form is essential for ensuring accurate tax reporting for the tax year. It provides a detailed account of each partner's share of the partnership’s income, which is necessary for individual tax returns. The information on this form is derived from the partnership's tax return and is used by partners to complete their personal tax filings.

Steps to Complete the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

Completing the Form IT 204 CP involves several clear steps:

- Gather all necessary financial documents related to the partnership.

- Review the partnership’s tax return to extract relevant income and deduction information.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Double-check for any errors or omissions before finalizing the form.

- Submit the completed form to the appropriate tax authorities as required.

Key Elements of the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

The Form IT 204 CP includes several key elements that are vital for accurate tax reporting:

- Partner Identification: Includes the name, address, and taxpayer identification number of the partner.

- Partnership Information: Details about the partnership, including its name and identification number.

- Income Allocation: Specifies the partner's share of the partnership's income, losses, and deductions.

- Credits: Lists any tax credits that the partner is entitled to claim based on their share of the partnership.

Legal Use of the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

The Form IT 204 CP serves a legal purpose in tax compliance for corporate partners in New York. It is used to report income accurately and to ensure that partners fulfill their tax obligations. Misreporting or failing to file this form can lead to penalties and interest charges from tax authorities. Therefore, understanding its legal implications is essential for all corporate partners involved in partnerships.

Filing Deadlines for the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

Filing deadlines for the Form IT 204 CP are critical for compliance. Typically, the form must be submitted by the due date of the partnership's tax return, which is generally March 15 for calendar year partnerships. Partners should ensure they receive their K-1 forms in a timely manner to meet their individual tax filing deadlines, which are usually April 15. It is important to stay informed about any changes in deadlines that may occur due to state or federal regulations.

Obtaining the Form IT 204 CP New York Corporate Partner’s Schedule K-1 Tax Year

The Form IT 204 CP can be obtained through the New York State Department of Taxation and Finance website or directly from the partnership that issued the K-1. It is important to ensure that you have the most current version of the form to comply with the latest tax regulations. Keeping a copy of the form for your records is also advisable for future reference and verification.

Create this form in 5 minutes or less

Find and fill out the correct form it 204 cp new york corporate partners schedule k 1 tax year 772089043

Create this form in 5 minutes!

How to create an eSignature for the form it 204 cp new york corporate partners schedule k 1 tax year 772089043

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to new york cp?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For those in New York CP, it offers a streamlined process to manage contracts and agreements efficiently, ensuring compliance with local regulations.

-

How much does airSlate SignNow cost for new york cp users?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses in New York CP. You can select from different tiers that cater to various needs, ensuring you only pay for the features you require.

-

What features does airSlate SignNow offer for new york cp businesses?

airSlate SignNow provides a range of features tailored for new york cp businesses, including customizable templates, real-time tracking, and secure cloud storage. These features enhance document management and streamline the signing process.

-

How can airSlate SignNow benefit my new york cp operations?

By using airSlate SignNow, new york cp businesses can signNowly reduce the time spent on document processing. The platform enhances efficiency, improves collaboration, and ensures that all documents are legally binding and secure.

-

Does airSlate SignNow integrate with other tools for new york cp?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used by new york cp businesses, such as CRM systems and cloud storage solutions. This allows for a more cohesive workflow and better data management.

-

Is airSlate SignNow compliant with regulations in new york cp?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, making it a reliable choice for new york cp businesses. This ensures that your electronic signatures are legally valid and recognized in New York.

-

Can I try airSlate SignNow before committing for new york cp?

Yes, airSlate SignNow offers a free trial for new york cp users, allowing you to explore its features and benefits without any commitment. This is a great way to see how it can fit into your business operations.

Get more for Form IT 204 CP New York Corporate Partner s Schedule K 1 Tax Year

Find out other Form IT 204 CP New York Corporate Partner s Schedule K 1 Tax Year

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form