Form it 221 Disability Income Exclusion Tax Year 2024-2026

What is the Form IT 221 Disability Income Exclusion Tax Year

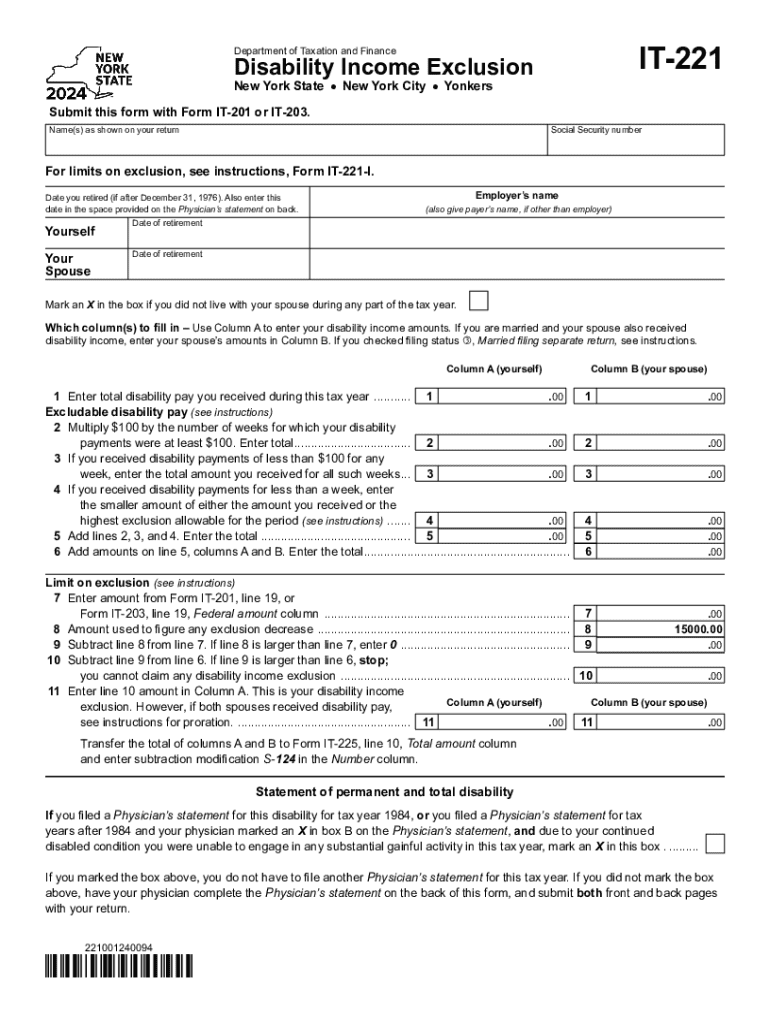

The Form IT 221 is a tax form used in the United States to claim a disability income exclusion for specific tax years. This form allows eligible taxpayers to exclude a portion of their disability income from their taxable income, thereby potentially reducing their overall tax liability. The exclusion applies to individuals who receive disability benefits and meet certain criteria set forth by state and federal tax regulations.

How to use the Form IT 221 Disability Income Exclusion Tax Year

To effectively use the Form IT 221, taxpayers must first determine their eligibility for the disability income exclusion. Once eligibility is confirmed, the form should be filled out with accurate information regarding the taxpayer's disability income. It is essential to follow the instructions provided on the form carefully to ensure that all necessary details are included. After completing the form, it should be submitted along with the taxpayer's annual tax return.

Steps to complete the Form IT 221 Disability Income Exclusion Tax Year

Completing the Form IT 221 involves several key steps:

- Gather all relevant documentation regarding disability income.

- Review the eligibility criteria to ensure compliance.

- Fill out the form with accurate personal and financial information.

- Double-check the completed form for any errors or omissions.

- Submit the form with the tax return by the designated filing deadline.

Key elements of the Form IT 221 Disability Income Exclusion Tax Year

Key elements of the Form IT 221 include the taxpayer's identification information, details about the disability benefits received, and the specific amount being claimed for exclusion. Additionally, the form may require information about the provider of the disability income and any relevant state-specific guidelines that apply. Understanding these elements is crucial for accurately completing the form and maximizing potential tax benefits.

Eligibility Criteria

Eligibility for the disability income exclusion on Form IT 221 typically requires that the taxpayer has received disability benefits from a recognized source, such as Social Security or a private insurance policy. The taxpayer must also meet specific income thresholds and other criteria as determined by tax laws. It is advisable for individuals to review these criteria closely to ensure they qualify before filing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 221 coincide with the general tax return deadlines. Typically, individual tax returns must be filed by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to be aware of these dates to avoid penalties and ensure timely processing of their tax returns.

Create this form in 5 minutes or less

Find and fill out the correct form it 221 disability income exclusion tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 221 disability income exclusion tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 221 Disability Income Exclusion Tax Year?

Form IT 221 Disability Income Exclusion Tax Year is a tax form used by individuals to claim an exclusion for disability income on their state tax returns. This form helps taxpayers reduce their taxable income, providing financial relief for those with disabilities. Understanding how to properly fill out this form can signNowly impact your tax obligations.

-

How can airSlate SignNow help with Form IT 221 Disability Income Exclusion Tax Year?

airSlate SignNow offers a streamlined process for electronically signing and sending Form IT 221 Disability Income Exclusion Tax Year. Our platform ensures that your documents are securely signed and stored, making it easier to manage your tax-related paperwork. With our user-friendly interface, you can complete your forms quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form IT 221 Disability Income Exclusion Tax Year?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring that you can manage your Form IT 221 Disability Income Exclusion Tax Year without breaking the bank. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow provide for managing Form IT 221 Disability Income Exclusion Tax Year?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Form IT 221 Disability Income Exclusion Tax Year. These features enhance your workflow by allowing you to prepare, send, and sign documents all in one place. Additionally, our platform supports collaboration, making it easy to work with tax professionals.

-

Can I integrate airSlate SignNow with other software for Form IT 221 Disability Income Exclusion Tax Year?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form IT 221 Disability Income Exclusion Tax Year alongside your other tools. Whether you use accounting software or document management systems, our integrations enhance your productivity and streamline your processes.

-

What are the benefits of using airSlate SignNow for Form IT 221 Disability Income Exclusion Tax Year?

Using airSlate SignNow for Form IT 221 Disability Income Exclusion Tax Year provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform simplifies the signing process, allowing you to focus on what matters most—your financial well-being. Additionally, our secure storage ensures that your sensitive information is protected.

-

How do I get started with airSlate SignNow for Form IT 221 Disability Income Exclusion Tax Year?

Getting started with airSlate SignNow for Form IT 221 Disability Income Exclusion Tax Year is easy! Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating or uploading your documents. Our intuitive platform guides you through the process, ensuring you can quickly manage your tax forms.

Get more for Form IT 221 Disability Income Exclusion Tax Year

Find out other Form IT 221 Disability Income Exclusion Tax Year

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later