Irs Form 8805

What is the IRS Form 8805

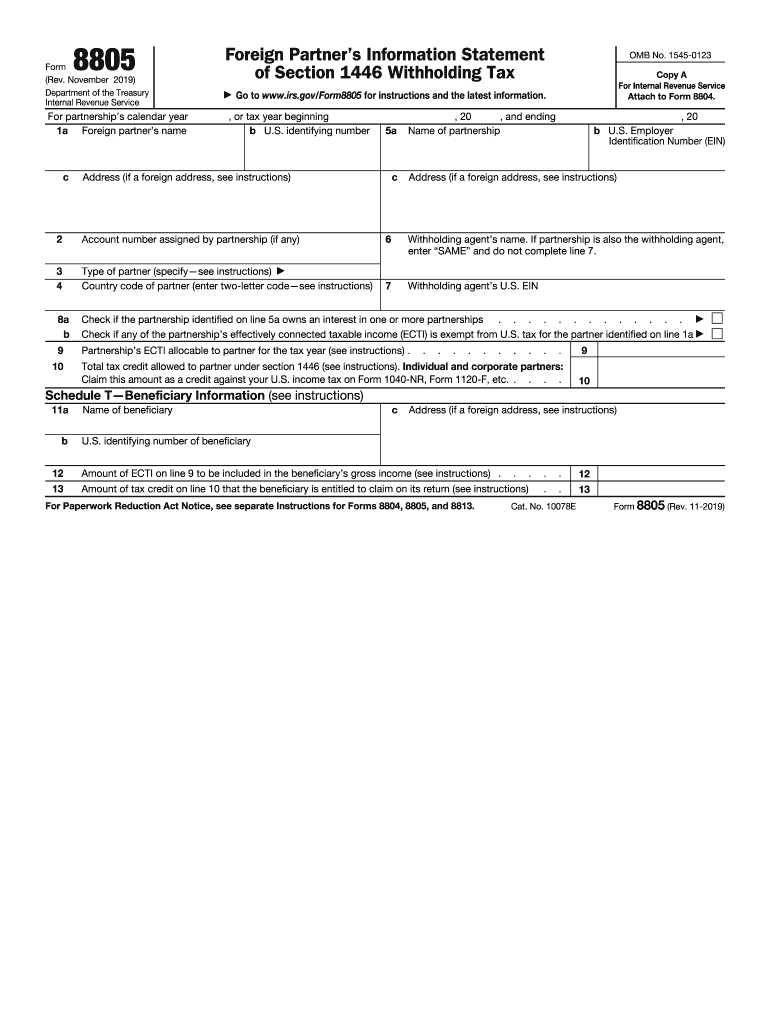

The IRS Form 8805 is a tax document used by partnerships to report the income, deductions, and credits allocated to foreign partners. This form is essential for ensuring that foreign partners meet their U.S. tax obligations. It provides detailed information about the partnership's income and the respective shares of each partner, allowing the IRS to track tax compliance among foreign entities. The form must be filed annually and is crucial for accurate reporting and withholding tax purposes.

How to use the IRS Form 8805

Using the IRS Form 8805 involves several steps to ensure compliance with tax regulations. Partnerships must fill out the form accurately, detailing the income allocated to each foreign partner. This includes specifying the amount of U.S. source income and any applicable deductions. After completing the form, partnerships must provide copies to their foreign partners, who will use this information to file their own tax returns. Additionally, the partnership must submit the form to the IRS by the specified deadline to avoid penalties.

Steps to complete the IRS Form 8805

Completing the IRS Form 8805 requires careful attention to detail. Follow these steps:

- Gather necessary information about the partnership and its foreign partners.

- Fill out the form, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the total income and deductions allocated to each foreign partner.

- Calculate the withholding tax, if applicable, and ensure it is accurately reported.

- Review the completed form for accuracy before submission.

Legal use of the IRS Form 8805

The IRS Form 8805 is legally binding when completed and submitted according to IRS regulations. It serves as an official record of income allocation and tax withholding for foreign partners. To ensure its legal standing, partnerships must comply with the requirements outlined in the IRS instructions for the form. This includes timely filing and accurate reporting of all necessary information. Failure to adhere to these regulations can result in penalties and complications for both the partnership and its foreign partners.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8805 are critical for compliance. Generally, the form must be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically means a deadline of March 15. It is important to be aware of these dates to avoid late filing penalties, which can significantly impact the partnership's financial obligations.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8805 can be submitted through various methods, ensuring flexibility for partnerships. The form can be filed electronically using IRS-approved e-filing software, which is often the preferred method for its efficiency and speed. Alternatively, partnerships may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not applicable for this specific form, as the IRS encourages electronic filing for faster processing.

Quick guide on how to complete form 8805 rev november 2019 foreign partners information statement of section 1446 withholding tax

Complete Irs Form 8805 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an optimal eco-friendly alternative to traditional printed and signed papers, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 8805 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Irs Form 8805 without hassle

- Locate Irs Form 8805 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks on any device you choose. Edit and electronically sign Irs Form 8805 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8805 rev november 2019 foreign partners information statement of section 1446 withholding tax

How to generate an eSignature for the Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax online

How to generate an electronic signature for your Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax in Google Chrome

How to generate an eSignature for putting it on the Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax in Gmail

How to make an electronic signature for the Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax from your smart phone

How to generate an eSignature for the Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax on iOS

How to create an eSignature for the Form 8805 Rev November 2019 Foreign Partners Information Statement Of Section 1446 Withholding Tax on Android OS

People also ask

-

What is airSlate SignNow 8805 and how does it work?

airSlate SignNow 8805 is an intuitive eSigning platform that allows businesses to easily send and sign documents online. It streamlines the document workflow with features for signing, tracking, and managing documents in real time, ensuring a seamless experience for users.

-

What are the key features of airSlate SignNow 8805?

The key features of airSlate SignNow 8805 include document templates, custom branding, advanced security options, and integrations with various tools. These features cater to diverse business needs, making it simple to generate, send, and manage eSignatures efficiently.

-

How much does airSlate SignNow 8805 cost?

airSlate SignNow 8805 offers a competitive pricing model tailored for businesses of all sizes. Plans start at an affordable monthly rate, making it a cost-effective solution for companies looking to enhance their document handling without breaking the bank.

-

Can I integrate airSlate SignNow 8805 with my existing software?

Yes, airSlate SignNow 8805 supports numerous integrations with popular business applications such as Salesforce, Google Workspace, and Microsoft Office. This flexibility allows businesses to incorporate seamless eSigning capabilities into their established workflows.

-

What security measures does airSlate SignNow 8805 have in place?

airSlate SignNow 8805 prioritizes security with features like data encryption and compliance with regulations such as GDPR and HIPAA. These measures ensure that your documents are handled safely, providing peace of mind for businesses and their customers.

-

How can airSlate SignNow 8805 benefit my small business?

For small businesses, airSlate SignNow 8805 simplifies the signing process, saving time and reducing paperwork. With its easy-to-use interface and scalable features, small businesses can enhance efficiency and provide a better customer experience without signNow investment.

-

What types of documents can I eSign with airSlate SignNow 8805?

With airSlate SignNow 8805, you can eSign a variety of document types, including contracts, agreements, and consent forms. This versatility helps streamline operations across different industries, allowing businesses to facilitate transactions quickly and legally.

Get more for Irs Form 8805

Find out other Irs Form 8805

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT