Mortgage Form

What is the Mortgage Form

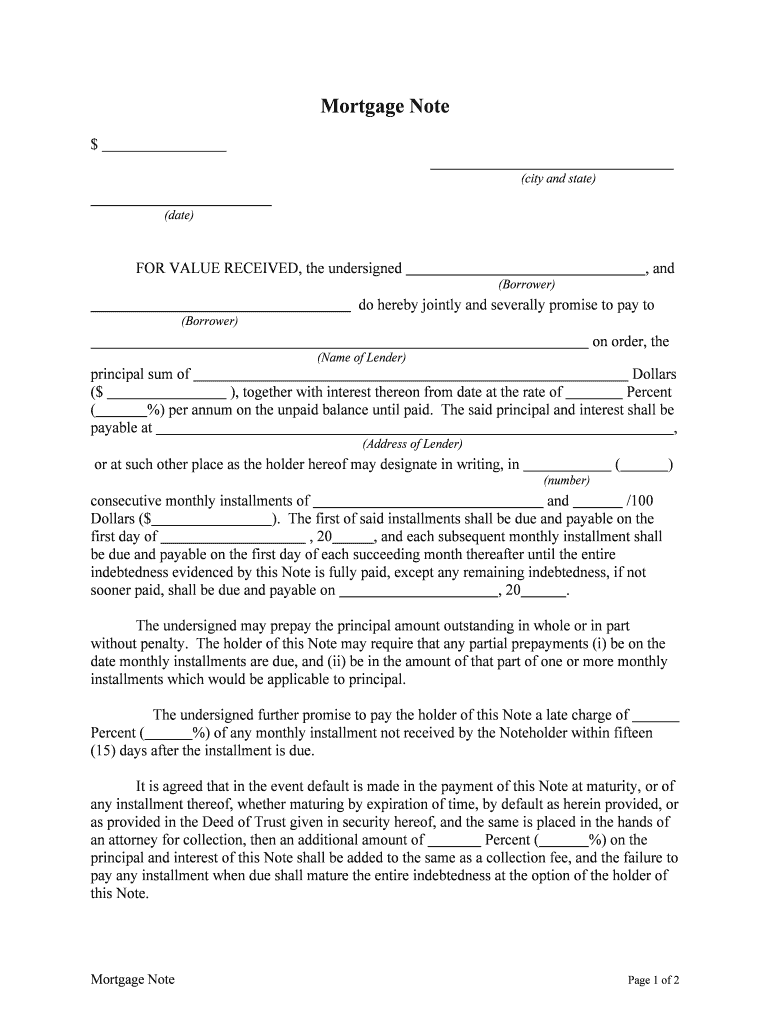

The mortgage form is a legal document used in the United States to outline the terms and conditions of a mortgage loan. It serves as a binding agreement between the borrower and the lender, detailing the amount borrowed, interest rates, repayment schedules, and other essential terms. This form is crucial in securing financing for purchasing property, whether residential or commercial. Understanding the mortgage form is vital for borrowers to ensure they are aware of their obligations and rights under the loan agreement.

How to Use the Mortgage Form

To effectively use the mortgage form, borrowers should first gather all necessary information, including personal identification, financial details, and property information. The form typically requires details such as the loan amount, property address, and borrower’s financial history. Once completed, the mortgage form must be signed by both parties, often in the presence of a notary public, to ensure its legal validity. After signing, the lender retains a copy, while the borrower should keep a copy for their records.

Steps to Complete the Mortgage Form

Completing the mortgage form involves several key steps:

- Gather necessary documents, including proof of income, credit history, and property details.

- Fill out personal information accurately, including names, addresses, and Social Security numbers.

- Specify the loan amount and terms, including interest rates and repayment periods.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of a notary public to ensure legal compliance.

Key Elements of the Mortgage Form

Several key elements are essential in a mortgage form. These include:

- Loan Amount: The total amount borrowed from the lender.

- Interest Rate: The percentage charged on the loan, which can be fixed or variable.

- Repayment Terms: The schedule for repaying the loan, including monthly payment amounts.

- Property Description: Details about the property being financed, including its address and legal description.

- Borrower Information: Personal and financial information about the borrower.

Legal Use of the Mortgage Form

The mortgage form is legally binding once signed by both the borrower and the lender. It is essential for borrowers to understand that this document grants the lender a lien on the property, meaning they have the right to take possession if the borrower defaults on the loan. Legal compliance with state and federal regulations is necessary to ensure the mortgage form is enforceable. Borrowers should consult legal professionals if they have questions about their rights and responsibilities outlined in the form.

Form Submission Methods

The mortgage form can typically be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow borrowers to complete and submit the mortgage form electronically through their websites.

- Mail: Borrowers can print the completed form and send it via postal mail to the lender.

- In-Person Submission: Some borrowers may prefer to submit the form in person at the lender's office, where they can also ask questions and receive immediate assistance.

Quick guide on how to complete mortgage form

Complete Mortgage Form effortlessly on any gadget

Online document handling has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage Mortgage Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Mortgage Form with minimal effort

- Locate Mortgage Form and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes just moments and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Mortgage Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage form and why is it important?

A mortgage form is a legal document that outlines the terms of a mortgage agreement between a borrower and a lender. It is crucial because it protects both parties by clearly defining the obligations and rights involved in the mortgage process.

-

How can airSlate SignNow help with mortgage forms?

airSlate SignNow streamlines the process of creating, sending, and eSigning mortgage forms. Our platform allows users to easily customize templates, ensuring that all necessary information is included and that the forms are legally compliant.

-

What features does airSlate SignNow offer for managing mortgage forms?

airSlate SignNow offers features such as document templates, real-time tracking, and secure eSigning for mortgage forms. These tools enhance efficiency and ensure that all parties can access and sign documents quickly and securely.

-

Is airSlate SignNow cost-effective for handling mortgage forms?

Yes, airSlate SignNow provides a cost-effective solution for managing mortgage forms. With flexible pricing plans, businesses can choose the option that best fits their needs without compromising on features or security.

-

Can I integrate airSlate SignNow with other software for mortgage forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage mortgage forms alongside your existing tools. This integration capability enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for mortgage forms?

Using airSlate SignNow for mortgage forms provides numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. Our platform also enhances collaboration among stakeholders, making the mortgage process smoother.

-

How secure is airSlate SignNow when handling mortgage forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that all mortgage forms and sensitive information are protected against unauthorized access and bsignNowes.

Get more for Mortgage Form

Find out other Mortgage Form

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy