PTE100EXT Form PTE1002021Extension of Time to File 2021

What is the PTE100EXT Form PTE1002021Extension Of Time To File

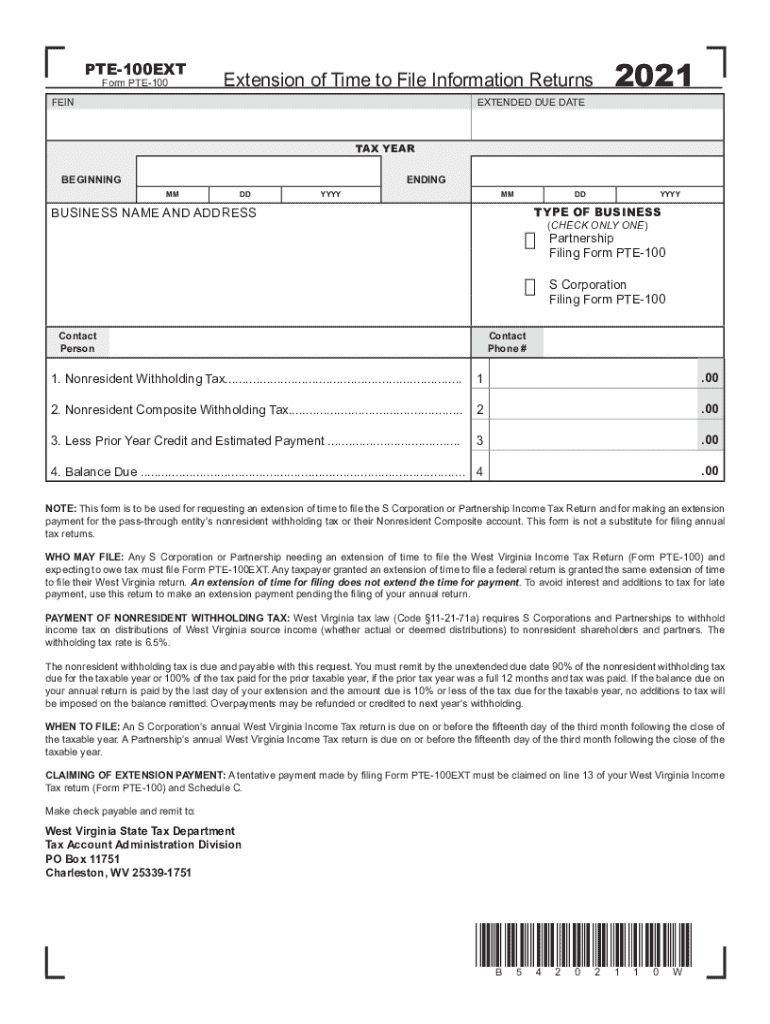

The PTE100EXT Form PTE1002021 is a request for an extension of time to file a pass-through entity tax return in the United States. This form is typically used by partnerships, S corporations, and limited liability companies that are classified as pass-through entities for tax purposes. By submitting this form, entities can secure additional time to complete their tax filings, ensuring compliance with federal and state tax regulations.

How to use the PTE100EXT Form PTE1002021Extension Of Time To File

To effectively use the PTE100EXT Form PTE1002021, begin by gathering all necessary information about your entity, including its name, address, and Employer Identification Number (EIN). Fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, submit it to the appropriate tax authority, either electronically or via mail, depending on state requirements. It is crucial to file this form before the original due date of your tax return to avoid penalties.

Steps to complete the PTE100EXT Form PTE1002021Extension Of Time To File

Completing the PTE100EXT Form PTE1002021 involves several key steps:

- Gather your entity's information, including name, address, and EIN.

- Access the form from the relevant tax authority's website or obtain a physical copy.

- Fill in the entity details, ensuring accuracy in all fields.

- Indicate the reason for requesting an extension, if applicable.

- Review the form for completeness and accuracy.

- Submit the form by the original due date of the tax return.

Filing Deadlines / Important Dates

Filing deadlines for the PTE100EXT Form PTE1002021 typically align with the original due date of the pass-through entity's tax return. It is essential to submit the form before this date to avoid penalties and ensure compliance. Generally, the deadline falls on the fifteenth day of the third month following the end of the entity's tax year. For entities operating on a calendar year, this means the deadline is March 15. Be aware of any state-specific deadlines that may apply.

Required Documents

When completing the PTE100EXT Form PTE1002021, certain documents may be required to support your request for an extension. These typically include:

- Your entity's tax identification number (EIN).

- Previous year's tax return, if available.

- Any documentation supporting the reason for the extension request.

Having these documents ready can facilitate a smoother filing process and ensure that your form is complete.

Penalties for Non-Compliance

Failing to file the PTE100EXT Form PTE1002021 by the deadline may result in penalties imposed by the IRS or state tax authorities. These penalties can include fines and interest on any unpaid taxes. It is important to adhere to filing deadlines to avoid these consequences and maintain good standing with tax authorities.

Quick guide on how to complete pte100ext form pte1002021extension of time to file

Effortlessly Prepare PTE100EXT Form PTE1002021Extension Of Time To File on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle PTE100EXT Form PTE1002021Extension Of Time To File on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign PTE100EXT Form PTE1002021Extension Of Time To File with Ease

- Obtain PTE100EXT Form PTE1002021Extension Of Time To File and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign PTE100EXT Form PTE1002021Extension Of Time To File to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pte100ext form pte1002021extension of time to file

Create this form in 5 minutes!

How to create an eSignature for the pte100ext form pte1002021extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTE100EXT Form PTE1002021Extension Of Time To File?

The PTE100EXT Form PTE1002021Extension Of Time To File is a document that allows taxpayers to request an extension for filing their tax returns. This form is essential for individuals and businesses needing additional time to prepare their filings without incurring penalties. Utilizing airSlate SignNow can streamline the process of completing and submitting this form.

-

How can airSlate SignNow help with the PTE100EXT Form PTE1002021Extension Of Time To File?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the PTE100EXT Form PTE1002021Extension Of Time To File. Our solution simplifies document management, allowing users to fill out forms quickly and securely. With our service, you can ensure timely submission and compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for the PTE100EXT Form PTE1002021Extension Of Time To File?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, whether individuals or businesses. Our cost-effective solutions ensure that you can manage your documents, including the PTE100EXT Form PTE1002021Extension Of Time To File, without breaking the bank. Visit our pricing page for detailed information on available plans.

-

Are there any features specifically designed for the PTE100EXT Form PTE1002021Extension Of Time To File?

Yes, airSlate SignNow includes features that enhance the experience of completing the PTE100EXT Form PTE1002021Extension Of Time To File. These features include customizable templates, secure eSigning, and real-time tracking of document status. This ensures that your extension request is handled efficiently and securely.

-

What benefits does airSlate SignNow offer for filing the PTE100EXT Form PTE1002021Extension Of Time To File?

Using airSlate SignNow for the PTE100EXT Form PTE1002021Extension Of Time To File provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick edits and easy sharing, ensuring that you can focus on your business while we handle the documentation. Additionally, our secure environment protects your sensitive information.

-

Can I integrate airSlate SignNow with other software for the PTE100EXT Form PTE1002021Extension Of Time To File?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the PTE100EXT Form PTE1002021Extension Of Time To File alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, our platform can enhance your workflow and document management.

-

Is it easy to eSign the PTE100EXT Form PTE1002021Extension Of Time To File with airSlate SignNow?

Yes, eSigning the PTE100EXT Form PTE1002021Extension Of Time To File with airSlate SignNow is straightforward and user-friendly. Our platform allows you to sign documents electronically in just a few clicks, ensuring a quick and efficient process. This feature is designed to save you time and eliminate the hassle of printing and scanning.

Get more for PTE100EXT Form PTE1002021Extension Of Time To File

Find out other PTE100EXT Form PTE1002021Extension Of Time To File

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free