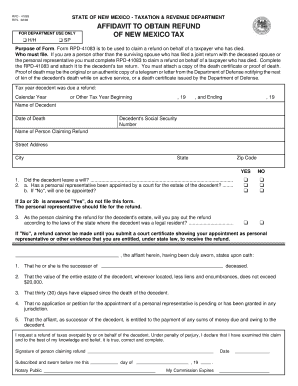

Form Rpd 41083 2012

What is the Form RPD 41083

The Form RPD 41083 is a specific document used for various administrative purposes in the United States. It is essential for individuals or businesses that need to submit specific information to state or federal agencies. Understanding the purpose of this form is crucial for ensuring compliance with legal and regulatory requirements.

How to Use the Form RPD 41083

Using the Form RPD 41083 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant documentation that supports the information you will submit. Next, carefully fill out the form, ensuring that each section is completed according to the guidelines. Finally, review the form for accuracy before submission to avoid any potential delays or issues.

Steps to Complete the Form RPD 41083

Completing the Form RPD 41083 requires a systematic approach:

- Obtain the latest version of the form from the appropriate agency.

- Read the instructions carefully to understand the requirements.

- Fill in your personal or business information as required.

- Provide any necessary supporting documents.

- Review the completed form for accuracy and completeness.

- Submit the form via the designated method.

Legal Use of the Form RPD 41083

The Form RPD 41083 serves a legal purpose, making it essential for compliance with various regulations. It is often required for reporting, applications, or other official processes. Proper use of this form ensures that individuals and businesses adhere to legal standards, thereby avoiding potential penalties or complications.

Key Elements of the Form RPD 41083

Several key elements are integral to the Form RPD 41083. These include:

- Identification information of the individual or entity submitting the form.

- Specific details related to the purpose of the form.

- Signature and date fields to validate the submission.

- Any additional documentation required to support the information provided.

Who Issues the Form RPD 41083

The Form RPD 41083 is typically issued by a relevant governmental agency or department. This agency is responsible for the oversight and regulation of the specific area the form pertains to, ensuring that all submissions are processed according to established guidelines.

Quick guide on how to complete form rpd 41083

Manage Form Rpd 41083 effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Handle Form Rpd 41083 on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form Rpd 41083 with ease

- Locate Form Rpd 41083 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form Rpd 41083 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rpd 41083

Create this form in 5 minutes!

How to create an eSignature for the form rpd 41083

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rpd 41083 and how does it relate to airSlate SignNow?

RPD 41083 refers to a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to send, sign, and store documents like rpd 41083 securely and conveniently. By utilizing airSlate SignNow, businesses can streamline their document workflows and enhance productivity.

-

What are the pricing options for using airSlate SignNow with rpd 41083?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those that require handling rpd 41083 documents. Pricing typically varies based on the number of users and features required. It's best to visit the airSlate SignNow website for the most current pricing details.

-

What features does airSlate SignNow offer for managing rpd 41083 documents?

airSlate SignNow provides a range of features for managing rpd 41083 documents, including eSignature capabilities, document templates, and real-time tracking. These features ensure that users can efficiently handle their documents while maintaining compliance and security. The platform is designed to simplify the signing process for all types of documents.

-

How can airSlate SignNow benefit my business when dealing with rpd 41083?

Using airSlate SignNow for rpd 41083 can signNowly enhance your business's efficiency by reducing the time spent on document management. The platform's user-friendly interface allows for quick document preparation and signing, which can lead to faster transaction times. Additionally, it helps in maintaining a clear audit trail for compliance purposes.

-

Can I integrate airSlate SignNow with other tools for managing rpd 41083?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easy to manage rpd 41083 alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, airSlate SignNow can seamlessly connect to enhance your workflow. This integration capability ensures that you can work efficiently without disrupting your current processes.

-

Is airSlate SignNow secure for handling sensitive rpd 41083 documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive rpd 41083 documents. The platform employs advanced encryption and security protocols to protect your data. Additionally, it complies with industry standards to ensure that your documents remain confidential and secure.

-

What support options are available for airSlate SignNow users dealing with rpd 41083?

airSlate SignNow provides comprehensive support options for users managing rpd 41083 documents. This includes access to a knowledge base, tutorials, and customer support representatives who can assist with any questions or issues. Whether you're a new user or need help with advanced features, support is readily available.

Get more for Form Rpd 41083

- Dhfc guidelines manual pdf scdhec form

- Hip 2020 guidelines for single form

- Immunization information form dhec 1103v pdf department of scdhec

- South carolina medicaid program annual review form www1 scdhhs

- Wkr001 form

- Paperwork to sign over parental rights in tennessee form

- Voluntary termination of parental rights form tennessee

- Tn form sports

Find out other Form Rpd 41083

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors