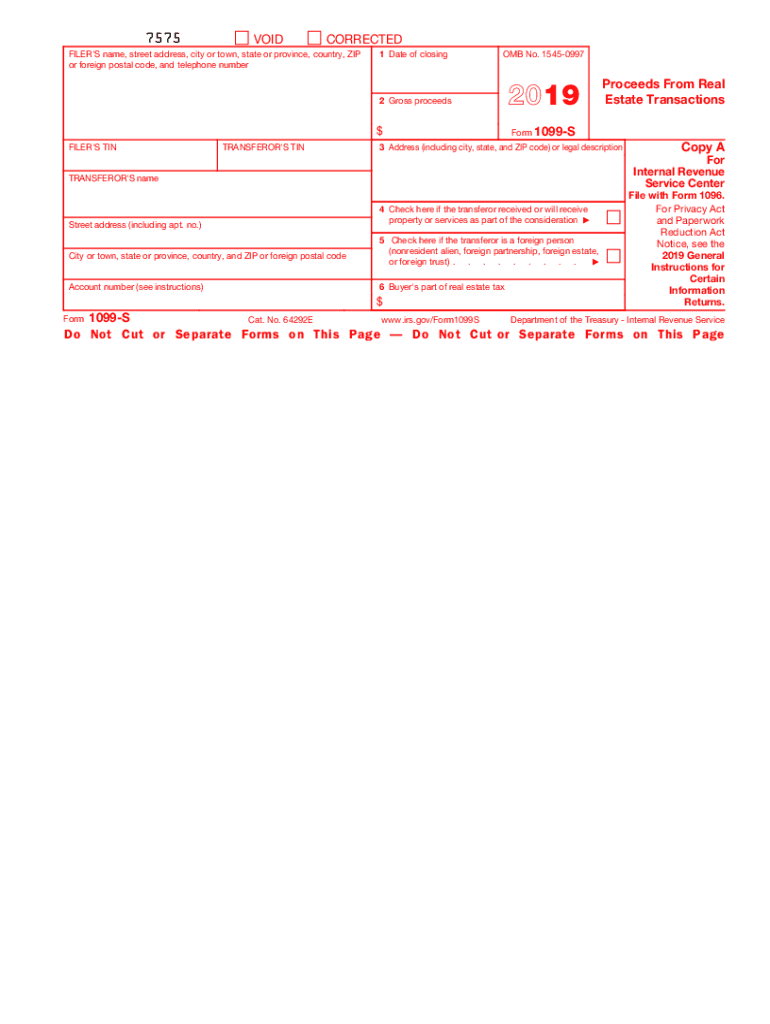

1099 S Form

What is the 1099 S Form

The 1099 S form is a tax document used to report proceeds from real estate transactions. This form is essential for both the seller and the Internal Revenue Service (IRS) to ensure proper reporting of income related to property sales. It captures vital information, including the seller's details, the buyer's information, and the gross proceeds from the sale. Understanding the 1099 S form is crucial for anyone involved in real estate transactions, as it helps maintain compliance with tax regulations.

How to use the 1099 S Form

Using the 1099 S form involves several steps to ensure accurate reporting. First, the seller must complete the form, providing necessary details such as the address of the property sold, the date of sale, and the amount received. Once completed, the form is submitted to the IRS and a copy is provided to the buyer. It is important to keep a record of the submitted form for personal tax records. Utilizing digital tools can simplify this process, allowing for easy completion and submission.

Steps to complete the 1099 S Form

Completing the 1099 S form requires careful attention to detail. Follow these steps:

- Gather necessary information, including seller and buyer details, property address, and sale amount.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Submit the form to the IRS by the designated deadline, typically by the end of February for paper submissions.

- Provide a copy of the completed form to the buyer for their records.

Using electronic filing options can streamline this process, making it easier to manage deadlines and submissions.

IRS Guidelines

The IRS provides specific guidelines for the 1099 S form to ensure compliance and accuracy. These guidelines include who must file the form, the information required, and the deadlines for submission. It is essential to familiarize oneself with these guidelines to avoid penalties. The IRS mandates that the 1099 S form be filed whenever there are gross proceeds of $600 or more from a real estate transaction. Understanding these requirements helps ensure that all parties meet their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 S form are crucial for compliance. Typically, the form must be submitted to the IRS by the end of February if filed on paper, or by March 31 if filed electronically. Additionally, a copy must be provided to the buyer by the same deadlines. Marking these dates on your calendar can help avoid late submissions and potential penalties. Staying informed about any changes in deadlines is also important, as the IRS may adjust dates from year to year.

Penalties for Non-Compliance

Failure to file the 1099 S form correctly or on time can result in significant penalties. The IRS imposes fines based on how late the form is filed, with amounts increasing the longer the delay. Additionally, incorrect information on the form can lead to further complications, including audits or additional fines. It is vital to ensure accuracy and timeliness when dealing with the 1099 S form to avoid these consequences.

Quick guide on how to complete httpswwwirsgovpubirs pdff1099spdf pdf irs form pinterest

Prepare 1099 S Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without obstacles. Handle 1099 S Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign 1099 S Form with ease

- Find 1099 S Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 1099 S Form and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the httpswwwirsgovpubirs pdff1099spdf pdf irs form pinterest

How to generate an electronic signature for your Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest in the online mode

How to create an eSignature for the Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest in Google Chrome

How to generate an eSignature for signing the Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest in Gmail

How to make an eSignature for the Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest straight from your smart phone

How to make an electronic signature for the Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest on iOS

How to generate an eSignature for the Httpswwwirsgovpubirs Pdff1099spdf Pdf Irs Form Pinterest on Android OS

People also ask

-

What is a 1099 fillable form 2019 and why is it important?

The 1099 fillable form 2019 is a tax document used to report various types of income received outside of regular employment. It's important for both businesses and independent contractors to accurately fill out this form to avoid any tax issues and ensure compliance with IRS regulations.

-

How can I fill out a 1099 fillable form 2019 using airSlate SignNow?

With airSlate SignNow, you can easily fill out a 1099 fillable form 2019 online. Our user-friendly interface allows you to input your information directly into the form, and you can save, print, or eSign it once completed.

-

Are there any costs associated with using airSlate SignNow for the 1099 fillable form 2019?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you're sending a few documents or managing multiple 1099 fillable forms 2019, our cost-effective solutions ensure you can handle your paperwork efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing 1099 fillable forms 2019?

Yes, airSlate SignNow integrates seamlessly with various software applications. This means you can incorporate tools you already use for bookkeeping or accounting, facilitating a smooth workflow for managing your 1099 fillable form 2019 and other documents.

-

What are the benefits of using airSlate SignNow for eSigning my 1099 fillable form 2019?

Using airSlate SignNow for eSigning your 1099 fillable form 2019 provides a fast, secure, and legally binding method to sign your documents. You can sign anytime, anywhere, which streamlines the process and helps you meet important tax deadlines.

-

Is it secure to use airSlate SignNow for submitting 1099 fillable forms 2019?

Absolutely! airSlate SignNow employs robust security measures, including encryption and authentication protocols, ensuring that your 1099 fillable form 2019 is protected. You can trust that your sensitive information remains confidential and secure.

-

Can I track the status of my submitted 1099 fillable form 2019 on airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your 1099 fillable form 2019. You’ll receive notifications when your form is viewed and signed, giving you peace of mind throughout the process.

Get more for 1099 S Form

Find out other 1099 S Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors